Happy Tuesday. It does not look like today will be a Turnaround Tuesday as the market futures are at the lowest levels I have seen in some weeks. The market got some fresh fearful news from a number of places in the global space. First, China’s markets dropped over 2% as the country did not respond well to a new deal with Taiwan and Japanese news that the country had a major slow down in May. Then, Greek workers walked out today on their jobs fearing wage cuts and debt worries. It has gotten Americans scared, and on a slow day of our economic data and earnings, this appears to be king.

We have three open positions moving into the session today. First off, our position in Micron (MU) looked all but great in after hours even though the company reported record profits, margins, and revenues. Accounting charges and one-time charges confused investors due to an acquisition, and the price is moving southwards. We sold 1/2 our position at 10.04, and I am going to be exiting the other 1/2 this morning before it gets any worse. Most likely this will help us break close to even. Our Play of the Week in Schnitzer Steel (SCHN) is a bit underwater for us. We got involved yesterday at 42.50. The stock is definitely not going to get a big gain today, but we have a stop loss set at 40.90. Finally, we held over our Short Sale of the Day from yesterday, which I think was a good decision. We got involved with a short sale of News Corp. at 14.68, and we are looking to exit 14.39 – 14.25. The stock closed yesterday at 14.65.

confused investors due to an acquisition, and the price is moving southwards. We sold 1/2 our position at 10.04, and I am going to be exiting the other 1/2 this morning before it gets any worse. Most likely this will help us break close to even. Our Play of the Week in Schnitzer Steel (SCHN) is a bit underwater for us. We got involved yesterday at 42.50. The stock is definitely not going to get a big gain today, but we have a stop loss set at 40.90. Finally, we held over our Short Sale of the Day from yesterday, which I think was a good decision. We got involved with a short sale of News Corp. at 14.68, and we are looking to exit 14.39 – 14.25. The stock closed yesterday at 14.65.

Let’s get into today’s play of the day. The chart on the right helps our SCHN position and a new one for today.

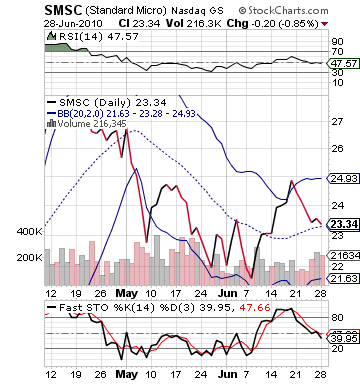

Short Sale of the Day: Standard Microsystems Corp. (SMSC)

Analysis: Recommending a Buy Pick out of the gate seemed a little too risky this morning, so I decided to wait for our Buy Pick towards the afternoon for a late day breakout. So, we will start with a Short Sale of the Day instead. The market is looking to pretty beaten up this morning. Futures on the Dow were down 112 points at 8:00 AM, 116 at 8:15, and 111 at  8:40 AM. The market does not have a lot of catalysts to get it going, and it may be a pretty weak day. So, any stock that is moving upwards at 5 or 6% in pre-market sends up a red flag to fall a bit.

8:40 AM. The market does not have a lot of catalysts to get it going, and it may be a pretty weak day. So, any stock that is moving upwards at 5 or 6% in pre-market sends up a red flag to fall a bit.

One such company is Standard Microsystems Corp. (SMSC), which is a silicon-based integrated circuit maker. As we have noted time and again, the circuit market is on fire for demand, and companies are doing exceptional in this side of the tech sector. SMSC reported some great quarterly earnings this morning. The company hit an EPS of 0.33 vs. the expected 0.27, and they gave an upbeat outlook on things. Their Q2 estimates were well above the street Q2 estimates as revenue in Q1 rose more than 55%. It was a good morning, but unfortunately, the stock was already fair valued in a narrow trading range. The stock’s upper band is at 24.80, and the stock is only 1% below this in pre-market. This is why the stock appears very technically toppy along with the poor market conditions.

I have placed my entry into SMSC a bit higher to give it some room to bounce upwards 1-2% before falling. The stock will have a lot of trouble maintaining buyers and traders because of the jittery and scared market, which will help to reduce the price of the stock as their is significant profit taking. Further, the stock will most likely be hurt by the Micron (MU) downward movement that is the big news in the tech sector today that has been unfortunate for us.

The stock has pretty low volume, so if you cannot pick up shares to short this morning take a look at the puts for 22.50 and 20.00.

We want to get into this one early on today but make sure to watch it as it hits our range as it may get a much larger bounce than I expect as that tends to happen sometimes.

Entry: We are looking to short sale 24.65 – 24.90.

Exit: We are looking to cover for a 2-3% gain.

Stop Buy: 3% on top.

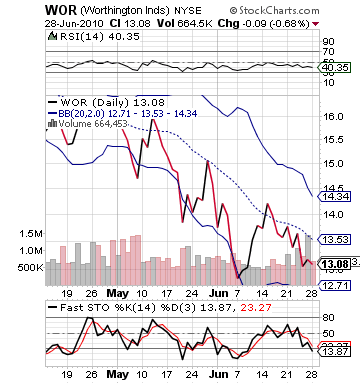

Buy Pick of the Day: Worthington Industries Inc. (WOR)

Analysis: Well, well, we can throw our original assessment about playing Worthington out the window. The company, which was supposed to report earnings in after hours, made some big news by reporting their earnings this morning. The company did exceptional swinging to a profit and beating estimates, which is great news for the steel industry and Schnitzer. Worthington’s revenue was over $600 million while analysts were expecting revenue to be round $550 million. The company hit an EPS of 0.42 vs. the expected 0.27.

Schnitzer. Worthington’s revenue was over $600 million while analysts were expecting revenue to be round $550 million. The company hit an EPS of 0.42 vs. the expected 0.27.

The stock actually has not gotten much movement since the announcement, but it should. These are Worthington’s best results since 2008, and the company is bullish on its future outlook. The stock has gained very little in pre-market. In fact, it has gained just a penny. I think this one could get a big boost right off the bat, and we actually want to buy right at the open.

Worthington is near that lower bollinger band, and it has tons of room to the upside. It has been declining the past two weeks for a total of about 8%, and this is the first big steel news in awhile. Worthington is setting up the even larger Schnitzer for tomorrow, and it could set up the whole steel industry for a great Q2 of 2010. Worthington obviously made well over the rise in steel prices.

Get in right away.

Entry: We are looking to enter this stock right as the market opens.

Exit: We are looking to exit for a 2-4% gain from our entry at the open.

Stop Loss: 3% on bottom of entry.

Good Investing,

David Ristau