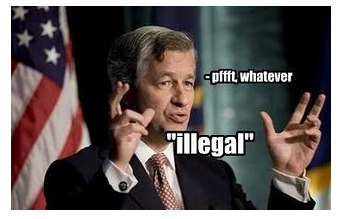

Become a Big Bank, Ignore The Law

Courtesy of Karl Denninger at The Market Ticker

Courtesy of Karl Denninger at The Market Ticker

When the government began rescuing it from collapse in the fall of 2008 with what has become a $182 billion lifeline, A.I.G. was required to forfeit its right to sue several banks — including Goldman, Société Générale, Deutsche Bank and Merrill Lynch — over any irregularities with most of the mortgage securities it insured in the precrisis years.

But after the Securities and Exchange Commission’s civil fraud suit filed in April against Goldman for possibly misrepresenting a mortgage deal to investors, A.I.G. executives and shareholders are asking whether A.I.G. may have been misled by Goldman into insuring mortgage deals that the bank and others may have known were flawed.

Absolutely correct.

If you’re a big bank, when things go south the government will force those who dealt with you to give up their right to sue you for your misrepresentations!

“This really suggests they had myopia and they were looking at it entirely through the perspective of the banks,” Mr. Skeel said.

No, it says in plain English that if you’re a bank there are no laws.

No, it says in plain English that if you’re a bank there are no laws.

There are no laws about money-laundering that will be enforced.

There are no laws about bribery that will be enforced.

There are no laws about bid-rigging that will be enforced.

There are no laws about emitting fraudulent securities that will be enforced.

And there are no laws about intentionally screwing counterparties that will be enforced.

Everyone else has to follow these laws.

But if you’re a big bank, you can do all these things and more, and there is absolutely no criminal or civil enforcement available to anyone to do anything about it.

May I ask, quite politely, why the American public peacefully accepts this state of affairs?

****

Picture credits: Jr. Deputy Accountant