Hey all. Its the last day of June, and it has been a pretty great month for The Oxen Report. Yesterday, we had some good and bad moments. We were very successful with our Short Sale of the Day in Standard Microsystems (SMSC). We got .png) involved out of the gates at 24.75 (per my Oxen Alert – Entry/Exit), and we sold just minutes later at 23.46. It was a super gain of nearly 5% for our short. We also finished our position in our Short Sale from Monday in News Corp. (NWS). We entered on Monday at 14.68, and we exited at 14.25 on Tuesday for a 3% gain. Our Midterm Trade from last week with Micron Technologies (MU) was looking great on Monday, but the market did not react well to earnings. We got involved at 9.66, and we sold 1/2 our position at 10.04 on Monday and the other half at 9.24 on Tuesday. We averaged our exit at 9.64 for a slight loss.

involved out of the gates at 24.75 (per my Oxen Alert – Entry/Exit), and we sold just minutes later at 23.46. It was a super gain of nearly 5% for our short. We also finished our position in our Short Sale from Monday in News Corp. (NWS). We entered on Monday at 14.68, and we exited at 14.25 on Tuesday for a 3% gain. Our Midterm Trade from last week with Micron Technologies (MU) was looking great on Monday, but the market did not react well to earnings. We got involved at 9.66, and we sold 1/2 our position at 10.04 on Monday and the other half at 9.24 on Tuesday. We averaged our exit at 9.64 for a slight loss.

Finally, we opened a position, yesterday, in Worthington Industries (WOR) as our Buy Pick of the Day at 13.40. The stock has done barely any movement up or down since, and we are just waiting. I am not holding past today, however. We also have our open position in Schnitzer Steel Inc. (SCHN). Yesterday, SCHN dropped significantly on the down day, and we were looking at a 5% loss. I DD on my position (42.50) with a buy at 40.10 for an average entry at 41.30. The company reports earnings in after hours, and it is up a bit from yesterday’s close. I am hoping for a nice rise this afternoon to get close to break even.

Let’s get into today’s Overnight Trade of the Day…

Overnight Trade: Christopher & Banks Corp. (CBK)

Analysis: The retail sector has been churning out phenomenally great profits over the past two months as the first few months of 2010 saw a great rise in retail spending. The first four months all saw sequential growth from month-to-month in retail sales. Since the beginning of May 2010, 33 apparel stores have reported quarterly earnings. 31 of those stores  have reported better than expected earnings. Many of these beats were quite significant as well. The companies saw great retail store sales in February – April, the typical Q1 for retail. Yet, one company is reporting its Q1 2010 earnings tonight – Christopher & Banks Corp. (CBK) from its March – May earnings season.

have reported better than expected earnings. Many of these beats were quite significant as well. The companies saw great retail store sales in February – April, the typical Q1 for retail. Yet, one company is reporting its Q1 2010 earnings tonight – Christopher & Banks Corp. (CBK) from its March – May earnings season.

CBK operates as a woman’s apparel store with over 450 locations in 46 states throughout the USA. The company is a smaller retail operation with only about $225 million in market capitalization, but the company still competes with larger companies like Talbots, Limited, Ann Taylor, and Lane Bryant. This area of women’s apparel tends to be for 30+. The company is projected to report earnings per share at 0.12, which is a 140% increase from last year’s Q1. Further, it is a sequential swing to profit from the Q4 of 2009. I think the company can some great movement from even a slight beat on this number, and it is not hard to suspect the company will beat earnings.

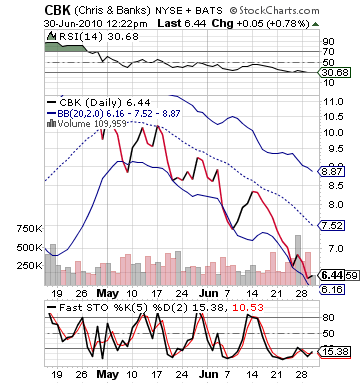

CBK’s competitors all have had outstanding results over the past few months. Earnings-wise, Talbots reported a 137% earnings surprise on its Q1 report. Ann Taylor saw an 8% surprise in EPS. All competitors improved significantly in their Q1 from one year prior and sequentially. All of our retail trades throughout this retail high were great, but retail has been hit hard with the market’s downturn as of recent. Christopher & Banks is no different. The company has dropped nearly 25% in the past two weeks alone. The stock is heavily oversold and undervalued. Therefore, if the company can report some strong earnings, it will have a great impact on the stock. It is almost as if CBK rose with other retailers but never contributed. Now, it has fallen, and it is its turn finally to report a similar success story.

past two weeks alone. The stock is heavily oversold and undervalued. Therefore, if the company can report some strong earnings, it will have a great impact on the stock. It is almost as if CBK rose with other retailers but never contributed. Now, it has fallen, and it is its turn finally to report a similar success story.

There is lots of reason to believe it will be strong from the company. Women’s clothing stores rose 4.2% in March as a whole. Similar company Limited saw rises of 15% in March and still even over 6% in May. Ann Taylor in April rose its forecasting for its Q1, which made the surprise gains not as high because the company expected to far exceed early forecasting since sales were so high. This is a vibrant industry right now, and we have a company very undervalued.

I did a quick run through the CBK website as well and found that many items for sale on the online store are not in inventory. Most items do not have all the sizes available. This is a great sign for the company, and it was on their top items.

The company has over 30% growth to its upside on bollinger bands right now. The stock is in a wide band and at the bottom of it. There is a lot of short interest on the stock, and fast stochastics show it heavily oversold over a long period of time. Therefore, this means that we are getting this stock at dirt cheap prices, and if it does not do wonderfully, it does not have significant room to decline. If it does what every other apparel store has done and kill earnings, then it will be a big winner.

Good luck!

Entry: We want to get involved from 6.38 – 6.45.

Exit: We are looking to exit tomorrow morning after earnings are reported.

Good Investing,

David Ristau