Let’s review first, how we got into this mess:

Not only is a bust cycle the inevitable result of a Capitalistic boom but the way we keep shoveling crises under the rug (to avoid pain and the ensuing political fallout) only exacerbates the problem once the rug becomes too small to mask the problem. Then things begin unraveling at the fringes and then – horror of horrors – someone actually lifts up the rug and says: "OH MY GOD – IT’S TERRIBLE!" Well DUH! Of course it’s terrible. Hayek (Freidrich, not Selma) told us this would happen 60 years ago and it’s happened dozens of times already and it will happen dozens of times again because it’s the nature of a system where there can be winners and losers – sometimes you win and sometimes you lose.

It is no surprise then, that the Europeans are choosing to follow Hayek’s path to austerity, while the Americans cling to the Keynesian delusion that we, if we just buy a bigger rug, we can fit a lot more problems under it and maybe no one will notice until we move out. David Leonhardt has a great article in The Times presenting the Keynsian side of the eqation. Paul Krugman points out that the "bond vigilantes" are behind this massive attack on the markets as they work very hard to drive current rates down and keep them there BECAUSE THAT INCREASES THE VALUE OF THE BONDS THEY OWN.

It is no surprise then, that the Europeans are choosing to follow Hayek’s path to austerity, while the Americans cling to the Keynesian delusion that we, if we just buy a bigger rug, we can fit a lot more problems under it and maybe no one will notice until we move out. David Leonhardt has a great article in The Times presenting the Keynsian side of the eqation. Paul Krugman points out that the "bond vigilantes" are behind this massive attack on the markets as they work very hard to drive current rates down and keep them there BECAUSE THAT INCREASES THE VALUE OF THE BONDS THEY OWN.

Come on people, grow up! First Pimpco and company drove rates sky high telling you the World was going to default and there was a "ring of fire" in Europe and that sent swap rates and note rates flying so these evill jackasses were able to buy tens of Billions in sovereign debt at sky-high interest rates. Now those same crooks push for a bailout, using other people’s money to insure their high-yield bonds and then they begin a PR campaign to crack the whip on austerity to make sure that making the bondholders whole is every country’s top priority, no matter what the cost to the population.

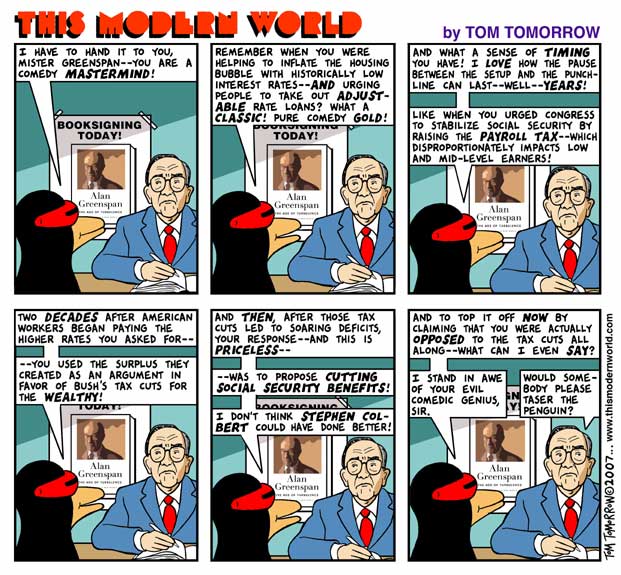

How much is at stake here? Pimpco alone has over $1Tn in bonds that get much, much more valuable if they can engineer a low-rate Japan-style deflationary environment. I pointed out that this was happening on June 15th, when Mohamed El-Erian teamed up with Doctor Doom Roubini to tell us how dire things were (and Krugman had plenty to say about that as well). Since then we have heard from El-Erian’s partner, Bill Gross but today we got the grand denouement as Pimpco released the Greenspan on CNBC this morning, right on Europe’s lunch hour in order to quell the stirrings of a rally as we got some pretty positive economic data early today.

Greenspan’s nonsense is more effective in Europe these days as most Americans realize his policies did nothing more during his 20-year tenure (’87-2006) than debase the dollar and transfer the wealth of this nation from the middle class the the economic elite in one of the greatest cons in human history. “This recent decline is more international than it is a domestic affair,” said Greenspan, adding that “there is an inherent instability in the euro system.”

The current recovery has been different than others, Greenspan said, because it has been “dominated by large banks, higher income individuals and bigger business,” when in past recoveries small businesses do most of the hiring and pull the economy out of a recession. One of the reasons that small business are not hiring, Greenspan said, is because smaller banks are loaded up with commercial loans and aren’t lending. “Small business is in real serious trouble.” Interestingly, I totally agree with this statement but, like I said, all Greenspan is doing is pulling up the rug he laid out 20 years ago and shouting "Look, look – Icky stuff!"

The current recovery has been different than others, Greenspan said, because it has been “dominated by large banks, higher income individuals and bigger business,” when in past recoveries small businesses do most of the hiring and pull the economy out of a recession. One of the reasons that small business are not hiring, Greenspan said, is because smaller banks are loaded up with commercial loans and aren’t lending. “Small business is in real serious trouble.” Interestingly, I totally agree with this statement but, like I said, all Greenspan is doing is pulling up the rug he laid out 20 years ago and shouting "Look, look – Icky stuff!"

So on a day when the markets MUST be kept down (or Pimpco loses Billions), Alan Greenspan comes on CNBC with an hour’s worth of soundbites (in what Barry Rhithotz aptly calls his "Reputation Legacy Destrusction Tour") that they can chop up and play all day long to make sure that any retail buyer who is considering a purchase keeps his finger off the trigger or at least wavers long enough to miss an opportunity to get in while Pimpco covers up their bets and the hedge funds BUYBUYBUY ahead of the Jobs number that is terrifying the "home gamers" who have been chased out of their positions all week in a coordinated attack led by Cramer/CNBC and our friends at Goldman Sachs and Co, who are likely to continue their 2010 string of not losing money on a single trading day, no matter which way it goes. Imagine how powerful that statement is when compared to the very poor end of quarter performance that was just forced on many funds in this week’s dive – just perfect marketing if perhaps FinReg makes them spin off their own fund operations.

How ridiculously low have prices gotten? C, for example, is as much as 20% of the trades in the market on some days and they have traded down to $3.75 yesterday, where we were BUYBUYBUYing it. Today the Treasury announced they have sold $10.5Bn worth of C at an average of $4.03 per share and, that they are done selling for a while now after pocketing a $2Bn profit on 1/3 of their position (stock was granted at $3.25). We’ll see how the financials perform today but let’s not expect much until we see tomorrow’s jobs numbers.

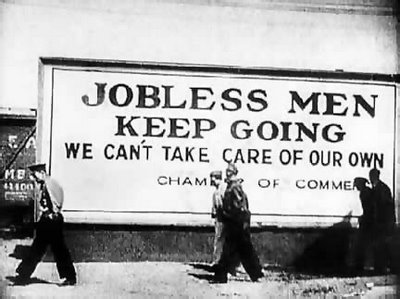

Unemployment came in with 472,000 jobs lost last week, 12,000 worse than expected. Construction Sprending, ISM and Pending Home Sales are at 10 and Auto Sales come throughout the day but nothing matters until tomorrow’s Non-Farm Payroll (8:30), which is now whispered to be -145K after being + 431K last month.

Unemployment came in with 472,000 jobs lost last week, 12,000 worse than expected. Construction Sprending, ISM and Pending Home Sales are at 10 and Auto Sales come throughout the day but nothing matters until tomorrow’s Non-Farm Payroll (8:30), which is now whispered to be -145K after being + 431K last month.

Of course, at this point, even -100K would rally us and we now have the exact opposite situation from last time, when Obama said the Jobs Report would be good and that made 431,000 additions (mostly census) a disappointment. Now we have expectations that are so low, that +1,000 will probably cause a crazy rally. We are in technical hell but I maintain that we are overreacting, although it’s getting very lonely on my side of the fence. Unfortunately, we’ll probably have to wait and see for tomorrow’s Jobs data.

If we are at all red today, we can layer our protection. The TZA hedge is up 300% already and should be stopped out if we are not going lower and the other downside hedges are hugely in the money and may need to be stopped out. A new cover (rolling 1/3 of the profits, which is 100% of the original insurance bet) is DXD July $31/32 bull call spread at .25 and you can stop right there as it has another 300% upside built in (DXD is already $30.95) or you can pair it with the sale of the Aug $26 puts at .40 for a .15 credit on the $1 spread.

The logic to this is, if you put $5,000 into the TZA spread, it’s now $20,000 and it might make another $15,000 if we stay down but it also might get wiped out. If you cash that and put $5,000 into the DXD play with a stop at $2,500, you are taking, effectively, $17,500 off the table (which you can use to roll and DD longs) and you still have another $15,000 of upside if we head lower from the new play. If we DON’T head lower, then it’s good that you improved your longs!

As I said we had good news out of both Asia and Europe this morning (see early morning Member Alert) and even Greenspan and his pimp patrol couldn’t stop the EU from turning around from a 2% dip to down just half a point ahead of the US open. We’re still in bargain-hunting mode until proven wrong – most likely one way or the other tomorrow morning!