Well, I am totally disappointed with Friday’s close.

Well, I am totally disappointed with Friday’s close.

I was going to be pleased but then we had a very sharp, last minute sell-off on heavy volume that pretty much ruined the day. I have been bullish and we have been buying at what we thought was a bottom, moving up to 35% invested in long-term, hedged positions but what if the 20% built-in protection (see "How to Buy a Stock for a 15-20% Discount") isn’t going to be enough?

You know I am a big fan of taking cash off the table in either direction, and we were not greedy and took most of our short-term bearish hedges out in the last two days. We had a couple of new hedges already in this week’s Member Chat but let’s look at some other trade ideas that can bullet-proof our virtual portfolios, all the way back to the March, 2009 lows. Our usual Mattress Strategy is not going to be enough to save us if we have another "flash crash" – especially one that sticks! Keep in mind that this is the biggest market decline we’ve had since February ’09 so adding a layer of protection here doubles our returns if this is the first leg of a major sell-off, or it gives us a smaller hedge that we can roll up later while we take our bigger hedges off the table. As I have to say WAY too often to members – It’s not a profit until you cash it in!

Hedging for disaster is a concept I advocated during another "recovery," in October of 2008, where we made our cover plays to carry us through a worrisome holiday season and into Q1 earnings – "just in case." That "just in case" saved a lot of virtual portfolios! The idea of disaster hedges high return ETFs that will give you 3-5x returns in a major downturn. That way, 5% allocated of your virtual portfolio to protection can turn into 15-25% on a dip, giving you some much-needed cash right when there is a good buying opportunity. At the time, I advocated SKF Jan $100s at $19. SKF hit $300 around Thanksgiving and those calls made a profit of over $280 (1,400%), so putting even just 5% of your virtual portfolio into that financial hedge would give you back 75% of your virtual portfolio when you cash out.

Keep in mind these are INSURANCE plays – you expect to LOSE, not win but, if you need to ride out a lot of bullish positions through an uncertain period, this is a pretty good way to go. We wisely began cashing out our old Buy List on March 18th, and we were all out when we took our last round of disaster hedges on April 28th, which are up an AVERAGE of 500% already! Now we are back on the bull side, with a new Buy List from June 7th and, sadly, we are back testing that bottom again. This is a great opportunity if you missed the last round of buys but very scary for those of us who are now 35% invested! As we had cashed out our long-term holdings (and 75% of your invested virtual portfolio should always be in sensible, well-hedged long-term plays, right?) that left us with our smaller short-term virtual portfolio and our disaster hedges. Since the disaster hedges were designed to protect 75% of our virtual portfolio that’s now back to cash – that left us pretty bearish overall – which is why we have been BUYBUYBUYing on this dip, hoping the market stops falling heare BUT (and it’s a BIG BUT) that does not mean we don’t prepare for the worst – just in case.

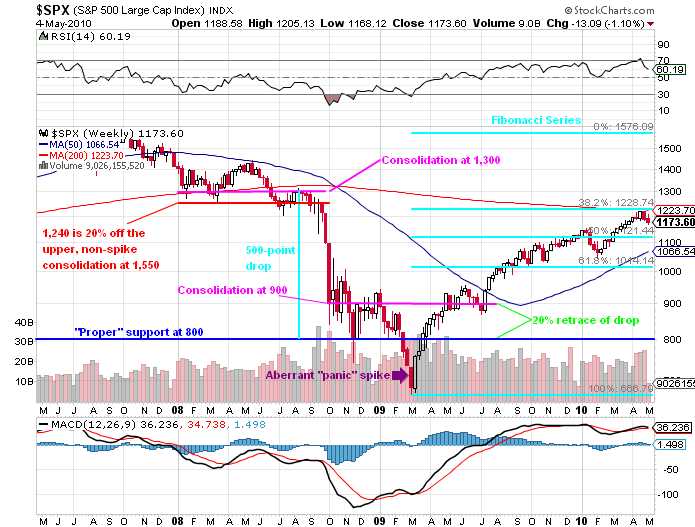

Looking at the above chart, we are HOPEFULLY at the Panic/Capitulation area. That is how we’ve been playing the game, as the "flash crash" came right after our cash out on April 28th. At that time, I felt that we were clearly in Euphoria (and you may be interested to check the archives for what we said at the time about each day) and ready to fall. I saw the Flash crash the next week as, obviously, the Fear stage and the EU’s Trillion Dollar bailout was clearly Desperation. That’s why, in the 2 awful weeks since, we’ve been ramping up our purchases as this is only, in the long run, is nothing more than the Fibonacci retrace of the S&P to 1,014 that we predicted on May 5th if the S&P was to fail at the 1,070 line. Here’s the chart from May 5th:

Oh gee, TA is so complicated – how DO you do it? LOL – the nice thing about TA though is there are so many sheeple that follow it that we get to design our trades to take all their money as they all stampede one way or the other. People who think TA doesn’t control the markets in the short-term are delusional. Do you think they are programing fundamentals into HFT algorithms? Of course not, it’s ALL TA, 90% of the trading in the markets these days is computers selling to other computers that were programmed by guys who only hold stock because it was part of the company’s compensation package. Sadly, this kind of thinking is prevelant now that most investors confuse a stock’s price with a stock’s value – but that’s an article for another day…

Let’s not kid ourselves, failing 1,014 would SUCK! I said on April 15th that we had to make a significant breakout on the Nasdaq or we would be in "technical Hell" and we made a nice stab of it but it was too weak with too little volume and that’s why we cashed out on April 28th – for technical, and not fundamental reasons. Perhaps that’s why I feel more bullish than most people – I’ve been bearish longer than most people and I’m ready to move on now… We are likely to be at the point of "maximum financial risk" and these hedges will help us transition to the next stage, where we can confidently commit more capital, knowing that we have a backstop in case things go wrong. Cash is still king and we are already committed to moving up to as much as 55% invested if the market drops 20% so it makes a lot of sense to put 5% into insurance that will mitigate a good portion of any drop.

Don’t take these plays out of context – they are there to protect our bottom fishing and we hope they all expire worthless! I would urge you to read the original Disaster Hedge post to get an idea of our mindset at the time, where I said:

Don’t take these plays out of context – they are there to protect our bottom fishing and we hope they all expire worthless! I would urge you to read the original Disaster Hedge post to get an idea of our mindset at the time, where I said:

As far as hedging goes, if you are 50% invested and 50% in cash and you are worried about losing 20% on the stock side in a major sell-off, then the logic of these hedges is to take 40% of your cash (20% of your total) and put it on something that may double while the other positions lose. If things go down, your gains on the hedge offset some of the losses on your longer positions. If things go up, you can stop out with a 25% loss, which will "only" be a 5% hit on your total virtual portfolio but it means we are breaking through resistance and your upside bets are safe and doing well. That is not a bad trade-off for insurance in this crazy market. Also, be aware that these are thinly traded contracts with wide bid/ask spreads and you need to use caution establishing and exiting positions.

As we are now, we were very keyed on watching our February levels for support, which were at the time: Dow at 9,835, S&P 1,044, Nasdaq at 2,100, NYSE 6,631 and Russell 580. As of yesterday ONLY the Russell (598) is over the February lows, which is why we’ve been keying on them with our TZA hedges. If we are heading down next week, that 1,014 line on the S&P is life and death and we already tested it this week and the S&P futures closed right on that line on Friday’s sell-off.

We had a very happy Thanksgiving in 2008 BECAUSE we were prepared for a nice correction and I want people to be able to enjoy Summer 2010 the same way so that is the goal of our new protectors. Here’s a few ideas to help ride out a larger downturn as well as to protect our eventual buys:

- DXD Oct $30 calls at $4.20, selling Oct $38 calls for $2.20 and selling Jan $26 puts for $1.90. This is a net .10 entry on a $8 spread so your upside is 7,900% at $38 (DXD is now $31.49 so you are 1,390% in the money to start!). I like this play because you are starting out $1.39 in the money on your spread. If the Dow ends up holding 9,650 and moves back up, there’s a good chance you can kill this cover with a small loss as a $3 move on DXD is 10% and that would be about a 5% move up in the Dow to 10,200 before the put you sold becomes a problem. Under 9,800 you stand an excellent chance of at least getting your money back, which makes this very cheap insurance ($1,000 has a $79,000 upside)!

- FAZ Oct $13 calls at $6.35, selling Oct $18 calls for $4.15 and selling Jan $11 puts for $1.50 puts for net .70 on the $5 spread (614% upside at $18, which is the current price). This one is risky as you can end up owning FAZ for net $11.70 but it’s currently trading at $18.31 so that’s a 36% discount off the current price (a 12% rise in financials) and FAZ is always a good hedge against your financial longs and we love C, JPM and XLF right now on the long side.

When you are entering a trade like this, assume you will have FAZ put to you at $10.75 and allocate how much you are willing to own. Say that’s $11,000, which would be 1,000 shares and that means you can make this trade with 10 contracts at a net outlay of $700 in cash plus (according to TOS) $2,000 in margin. This play returns $5,000 if FAZ STAYS FLAT and holds $18 through Oct expiration. On the risk side, imagine FAZ falls 36% to $11 (12% rise in financials) then you are assigned at $11.70 and have a $.70 loss x 1,000 shares = $700. You will lose another $1,000 for each 10% FAZ falls, which is a 3.3% rise in XLF (plus there is always decay with ultra ETFs). As long as you are fairly confident that your bullish financials will make at least $700 a month if the Financials finish flat to higher for the next 3 months (which is easy for our buy/writes) – then this is a very cheap hedge as you can protect $20,000 worth of longs from a 25% loss for $700 (3.5%) plus some margin you’d better have laying around anyway!

- SDS Sept $36 calls at $5, selling Sept $42 calls for $2.80 and selling Jan $26 puts for $1.10. Here we are in a $6 spread for net $1.10 with the possibility of making $4.90 (455%) if SDS hits $42 (up $3.67 or 9.5% or down 4.75% on the S&P to 986) and we have the ETF put to us at net $27.10 if the S&P rises 16% to 1,187. Of course, we can roll the puts down to 2012 and spend another $2 after losing the .90 this year which would make the net cost of a similar spread for 2012 $2.90 with, perhaps, 100% upside if the S&P doesn’t climb another 10% so figure your "insurance cost," unless the S&P really runs away, is about .25 per month to buy $6 of protection. Keep in mind though that these are time-targeted speads so you don’t make $7 unless we pretty much get all the way to September expiration on target.

One way around that is to simply buy a long call, like the Sept $38s for $3.90 and selling the Jan $32 puts for $3.35. That puts you in the $29s for net .55 with SDS currently at $38.33 so you capture every penny (less .22) of an upward move at expiration. In fact, your upside delta is the .53 from the $29 calls plus .26 from the Jan puts so you make .79 for every $1 SDS goes up, all off a .55 outlay! Of course the downside here is harsh so this play is simply about your faith in the rolling process as the SDS heads higher. The bottom line is you spent .55 and you owe a Jan $32 putter $3.35 so you are in for net $35.35. There are no longer puts on SDS yes but, looking at the Aug $44 puts, which are $6 and seeing that’s a near-even roll to the Jan $37 puts – we can figure we have about $6 worth of leeway into Mid 2012, which is about 20%, which is about a 10% upward move in the S&P so we start to get really in trouble here at S&P 1,200, where we’d better be VERY pleased with our longs.

One way around that is to simply buy a long call, like the Sept $38s for $3.90 and selling the Jan $32 puts for $3.35. That puts you in the $29s for net .55 with SDS currently at $38.33 so you capture every penny (less .22) of an upward move at expiration. In fact, your upside delta is the .53 from the $29 calls plus .26 from the Jan puts so you make .79 for every $1 SDS goes up, all off a .55 outlay! Of course the downside here is harsh so this play is simply about your faith in the rolling process as the SDS heads higher. The bottom line is you spent .55 and you owe a Jan $32 putter $3.35 so you are in for net $35.35. There are no longer puts on SDS yes but, looking at the Aug $44 puts, which are $6 and seeing that’s a near-even roll to the Jan $37 puts – we can figure we have about $6 worth of leeway into Mid 2012, which is about 20%, which is about a 10% upward move in the S&P so we start to get really in trouble here at S&P 1,200, where we’d better be VERY pleased with our longs.

Is it worth the additional risk? If you look at it more like a play you’ll set a $1 stop-loss on, then I think so but not to ride it out to the very bitter end. Let’s take a close look at a more hedged way to play an overall strategy using the Russell:

TZA is a favorite play at PSW and there’s nothing I like more than a good ultra that’s been beaten to death. Poor TZA was at $114 just a year ago and a 100% move up in the Russell has crushed it by 93%. That is FANTASTIC news for us as new investors because, all we can to lose betting the RUT won’t climb another 100% is about $7, but if the Russell falls "just" 50% TZA can jump 150% to $21.50 so let’s see how to play that. For starters – I like the fact that a putter will pay you $1.65 for the Jan $5 puts, betting that TZA will finish at $3.35 or lower on Jan 2012. That’s down 61% from here implying a 20% gain in the Russell to 720. For us to lose $1.65 from there, TZA would have to fall 50% so another 17% for the Russell to 842, which is miles past the ATH – so let’s start by taking that man’s $1.65!

- Leg #1 is collecting $1,650 for 10 TZA 2012 $5 put contracts = Credit $1,650, net margin (non PM) $713. Danger is Russell rising more than 20% (720) and having TZA put to you at $5.

Now TNA is the opposite number so if TZA is going to fall 37% then TNA would go up 37% to $47+. I can play TNA to finish at $45 or even $10 by playing the 2012 $25/30 bull call spread at $2, which will pay me $3 in profit if TNA is flat with a $5 cushion (14%). So there is NO possible way that I can owe my TZA 2012 $5 putter a penny without collecting $3 on my TNA call spread. If I just want to cover my risk of being assigned 1,000 shares of TZA at net $3.35, I can pretty much offset that by buying 10 of these at $2,000.

Now TNA is the opposite number so if TZA is going to fall 37% then TNA would go up 37% to $47+. I can play TNA to finish at $45 or even $10 by playing the 2012 $25/30 bull call spread at $2, which will pay me $3 in profit if TNA is flat with a $5 cushion (14%). So there is NO possible way that I can owe my TZA 2012 $5 putter a penny without collecting $3 on my TNA call spread. If I just want to cover my risk of being assigned 1,000 shares of TZA at net $3.35, I can pretty much offset that by buying 10 of these at $2,000.

You can stop right there if you want to be bullish as you’ve now spent net $350 for a $5,000 return if TNA rises AT ALL all and your "worst case" is that TNA rises more than you thought and you can possibly end up having 1,000 shares of TZA put to you at $5, which would effectively be owning 1,000 shares of TZA at net $350 (now $5,850) so anything over .35 a share (which is another 100% gain on the RUT) is profit to the upside.

If, however, the Russell falls, then TNA goes down and you paid net $350 and get nothing. That’s why that’s a bullish play even though your bullish prize is owning 1,000 shares of TZA for $350 (strange isn’t it?). We can fix that by making another supposition. The TNA 2012 $20 put is $7 and $20 is 42% down from here so the Russell would have to fall about 13% over the next 2 years, back down to 516 for those to go in the money. Let’s say we’re bearish but not THAT bearish and we sell 2 of the TNA 2012 $20 puts at $7 to collect $1,400.

- Leg #2 is spending $2,000 on 10 TNA 2012 $25/30 bull call spreads at $2. Debit $2,000, no margin. Net Debit $350. Danger is a 5% or more fall in the Russell (570), expiring this spread worthless.

- Leg #3 is collecting $1,400 on 2 TNA 2012 $20 puts at $7. Credit $1,400, net margin $1,200 (non PM). Net Credit $1,050, total net margin $1,913. Danger is the Russell falling below 516, forcing you to own 500 shares of TNA at net $20.20 (now $34.54).

Now we have $1,400 burning a hole in our pocket and we have a range on the Russell between 516 and 720 that will make us happy. Now let’s add a little real disaster protection to offset that potential loss for a downside move below 516 and that is very easy because the TZA 2012 $10/20 bull call spread is just $1 so 14 of those $1,400) pays up to $14,000 if the Russell is down 50% by Jan 2012 and pays quite a bit at points in-between as well. Keep in mind that if the Russell DOESN’T fall at least 13% by Jan 2012 – we keep the $3,150 from our $20 TNA putters and we will still be even overall UNLESS the Russell rises SO high that our net $350 purchase of the TZA ETF is wiped out and then we’ll only be out the $350 (but owning 1,000 shares of TZA as a consolation prize).

- Leg #4 is spending $1,400 on 14 TZA 2012 $10/20 bull call spreads at $1. Debit $1,400, no margin. Total net credit = $0, total net margin = $1,640. Danger is the Russell not falling at least 7%, expiring this leg worthless.

What is our "best case" scenario here? If the Russell falls about 15%, which will boost TZA by 45% to $12.50 and pays us $3,500 without triggering the TNA puts at $20. If the TNA puts do trigger in a massive disaster we will own 200 of the TNA ETF for $4,000 (now $6,906), which is not a bad way to take up a bullish position at a new market bottom. Because our TZAs would already be in the money at that point, as soon as we collect the next $500 (.35 on TZA to $12.85) any move between there and $20 gives us 200 shares of TNA PLUS up to $10,510. Of course, this is all very adjustable and we can take advantage of move up and down along the way – I just thought it was a good way to illustrate how you can hedge both sides of the fence for long-term protection where even the "black swan" scenarios aren’t so awful.

What is our "best case" scenario here? If the Russell falls about 15%, which will boost TZA by 45% to $12.50 and pays us $3,500 without triggering the TNA puts at $20. If the TNA puts do trigger in a massive disaster we will own 200 of the TNA ETF for $4,000 (now $6,906), which is not a bad way to take up a bullish position at a new market bottom. Because our TZAs would already be in the money at that point, as soon as we collect the next $500 (.35 on TZA to $12.85) any move between there and $20 gives us 200 shares of TNA PLUS up to $10,510. Of course, this is all very adjustable and we can take advantage of move up and down along the way – I just thought it was a good way to illustrate how you can hedge both sides of the fence for long-term protection where even the "black swan" scenarios aren’t so awful.

Of course keep in mind that this is insurance, not betting. Betting is the call/put combo on SDS, which is a bearish bet on the S&P that has an immeditae payoff on any downward move with an unlimited upside. These are hedges that are meant to perform for you if your upside bets don’t work out and will hopefully not cost you too much money when your upside plays go well. If your upside plays are sensibly hedged, like our buy/writes that pay at least 10% a quarter in a flat to up market, then this kind of sensible insurance is all you should need to offset reasonable dips in the market. It doesn’t mean you don’t need stops.

Now let’s finish up with a specific disaster hedges on the things we are worried about. As a hedge against inflation, some people like gold. I am not a fan of gold as I think it’s overpriced but it does have it’s uses and I wrote a post on hedging into gold back in March of last year so maybe it’s time for an update. As a hedge against many other things, including inflation, I prefer TBT, who I may have mentioned at some point. If there is inflation, then the cost of lending and borrowing money will rise as the lender knows that they will get paid back in dollars that are worth less (worthless?).

Now let’s finish up with a specific disaster hedges on the things we are worried about. As a hedge against inflation, some people like gold. I am not a fan of gold as I think it’s overpriced but it does have it’s uses and I wrote a post on hedging into gold back in March of last year so maybe it’s time for an update. As a hedge against many other things, including inflation, I prefer TBT, who I may have mentioned at some point. If there is inflation, then the cost of lending and borrowing money will rise as the lender knows that they will get paid back in dollars that are worth less (worthless?).

This is why I don’t buy into a commodity rally when the cost of capital is low – clearly the lenders don’t believe rising costs are a long-term factor if they will give you money for 30 years at 5%. Land is a commodity. Copper and wood and even the labor that goes into building your home is a commodity so if gold is a true "hedge" against inflation and gold is up 50% in two years – then we should expect similar appreciation from a home and the banks that are lending Trillions of Dollars at a mere 5% are fools. Maybe they are – maybe gold is a little ahead of itself…

- TBT is a simple bet, we don’t think rates will go lower. Over the past 15 months, rates have stayed down around 0-0.25% on the Fed and TBT has gone from a low of $35.51 to a high of $59.75 and now back to $34.62 on Thursday. on the whole, it has gone nowhere at all in 2 years. That would suit us just fine if we sell the 2012 $35 puts for $3.40 with $8.50 in net margin for our troubles. With $3.40 in hand there is no need to be greedy so we can buy the 2012 $35/50 bull call spread for $4.10 and we’re in the $15 spread for .70 with a lovely 1,900% of upside potential if rates run away. $700 buys 10 of these spreads and your downside follow-through is to roll the puts to 2x longer $20 or maybe $15 puts but that $700 returns $15,000 real dollars if rates move up 20% over the next 18 months – figure to about 3.6% for a 10-year. If you have an adjustable loan and want to hedge it, this is a nice way to do it.

- EDZ is my other universal hedge. It’s a 3x inverse to the MSCI Emerging Markets Index which is BRIC-weighted but also includes Africa, Eastern Europe, the Middle East and Latin America so our bet is that something goes wrong somewhere in the world sometime. With EDZ now at $44, the 2012 $75 calls are insanely overpriced at $21, especially since you can buy the 2012 $50s for $24. Even just paying $3 for this spread is not at all terrible and you can JUST do that and sit on your $24 upside (800%) from a spread that’s currently $2 out of the money. You can also drop your net down to $1.50 by selling 1/4x the Jan $35 puts at $6. I like this play at 8/2 because you are collecting $1,200 against $3,100 in net margin and buying $20,000 worth of upside protection for $2,400 so net $1,200 for the whole play AND, you get you rmargin back in January unless EDZ improves 27% – a 9% move up in Emerging Markets . Should EDZ spike up, you can even pick up a little cash selling front-month calls so a fun, flexible way to sleep well on the weekends and not worry about international mayhem.

As with all of our protection plays, if we become more confident that the market will NOT collapse, then we simply take them off the table with a small loss and that makes us more bullish but having a few hedges like this in your virtual portfolio can do a lot to cushion the blows from any major market sell-offs.

As with all of our protection plays, if we become more confident that the market will NOT collapse, then we simply take them off the table with a small loss and that makes us more bullish but having a few hedges like this in your virtual portfolio can do a lot to cushion the blows from any major market sell-offs.

I cannot remind you enough though that these are insurance plays and they are not ideal for rolling or adjusting and you should EXPECT to lose money if the market heads higher – much the same as you expect to have "wasted" your life insurance premium for the prior year every time you celebrate another birthday….

As with life insurance, it may make you feel good to walk around with $50M worth of protection in case you get hit by a bus but – is it realistic? Look at your virtual portfolio and think about what kind of protection you REALLY need. If you have $100,000 worth of May buy/writes that are good for a roughly 15% dip in the market, then you don’t really need ANY protection against a 15% drop. If the market drops 25%, then you will lose 10% on what you have now. If the market drops 40%, then you lose 25%. We all learned how valuable it can be to simply stay even in a major market drop as opportunities abound then so simply putting 5% away on hedges that will pay 25% back when the market drops 40% will let you cash out with 100% of what you have now and go shopping – that’s all insurance needs to do.

Disaster hedges are a good exercise in managing your virtual portfolio but, unfortunately, like Auto insurance, you just pay and pay and pay until you have that accident. So safe driving!