I hope everyone had a terrific Fourth of July weekend. Today, we have to be excited to see the market returning to normalcy despite an actually poor day of economic news once again. We have been on quite a roll throughout the last month, and I am working hard on a June update that will have our updated virtual portfolios, statistics, and other information. That will hopefully be done today or tomorrow. I am still traveling today back to Chicago, so we will have to see.

That will hopefully be done today or tomorrow. I am still traveling today back to Chicago, so we will have to see.

The market’s tremendous turnaround has given me some hope that we can right this thing and avoid the terrible double dip, and so, I have a nice Day to Overnight Trade for us to complement the excitement in the market. The chart on the right is also a very great bull sign from the venture capital market.

Overnight Trade of the Day: Family Dollar Stores Inc. (FDO)

Analysis: One of my favorite recessionary group of stocks is the value retail stores from the dollar stores, to the bulk stores, to the closeout retailers. The likes of Big Lots, Dollar Tree, Dollar General, Casey’s, and Costco have all seen some tremendous growth despite the slowdown of the major economy. One such company that has been my favorite through it all has been Family Dollar (FDO). This company has seen its revenue grow from $6.8 billion in 2007 to $7.8 billion expected for this year even though the economy was on slow down since then.

The company has been able to truly become a major household name and is not viewed in the same way. For the coming years, Americans are still going to be very wallet conscience. Unemployment is showing no signs of a quick recovery, and things are still taking a long time to return to normalcy. There is no reason but to expect Family Dollar to continue its strength. Tomorrow morning, the company will attempt to continue the successes it has over the past three years with its Q2 2010 earnings from March – May. The company is expected to report EPS at 0.76. This will be a 20% increase in profits over one year ago.

The company actually released their sales for the past quarter already, hitting $1.99 billion in revenue for the second quarter. These estimates were in the range of $1.98 – $2.02 billion that analysts were expecting for sales. That revenue is an 8.4% growth from one year ago in sales, and the company saw same-store sales rise 7% year-over-year. The company commented that they now expect to be at the top of their 0.71 – 0.76 range. The company is not going to have a major surprise, but the company consistently does not because they release their sales ahead of time.

What is interesting to me is that despite the amazing sales increases that were released on June 8 the company’s stock has only risen a bit over 5%. In fact, it has moved backwards over the past 2.5 weeks after getting some rise after the sales announcement. The company, therefore, has information out there that should be factored into the stock. Some of that is in the 1.5% rise we are seeing today, but I think there should be more. Additionally, the company has a history of underestimating their profits. The company has beat expectations over the past three years consistently. The last four quarters have only surprises on average of 4.5%, but those beats are still great for the company. I think we can expect a couple points to the upside for FDO safely. At the beginning of June, Dollar General (DG) saw a great 28% profits per share surprise.

Tomorrow is a "show me what you got" kind of day as I like to call it. The economic data is sparse to none tomorrow, and so, I think companies will rally and fall on what they got out there. What is the company’s buzz? What have they said lately? What is their sector doing? Well, if Family Dollar can beat earnings as should be expected and forecast well as should be expected from the current market woes, then FDO will do well.

from the current market woes, then FDO will do well.

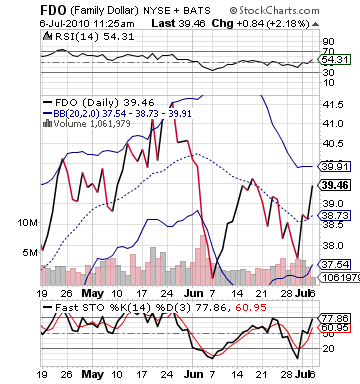

Technically, FDO is in good shape to make a continued move up from where it stands. It should definitely get an afternoon lift moving into earnings. Additionally, fast stochastics are showing a breakout to oversold, but it still has a ways to go before it gets toppy. The stock has movement to its upper band to at least 40. With good earnings, we can expect that to be surpassed. RSI shows a slight overvalue in short term, but it is not significant enough to deter me.

I like this company, and it is really low intraday. Pick up some shares and ride out a nice move to the end of the day.

Entry: We are looking to get involved 39.25 – 39.45.

Exit: We are looking to exit today if we can get a 3%+ gain or tomorrow morning after earnings are released.

Stop Loss: 3% on bottom.

Good Investing,

David Ristau