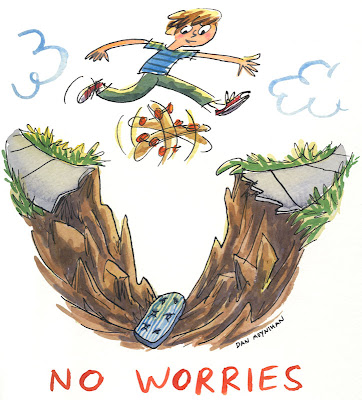

I wasn't worried, were you?

I wasn't worried, were you?

Actually, we were worried enough this weekend to revisit "5 Plays that Make 500% if the Market Falls" as we took off our very profitable April 28th disaster hedges in last week's dip, leaving us net long and just a little nervous going into the weekend. As I mentioned last week, I find myself in the very strange situation during capitulation cycles of having to push back against general Member sentiment as even the most experienced traders tend to fall victim to the combination of market and media manipulation when it's as relentless as it has been for the last 10 sessions as the markets dropped 7.5%, pretty much without a break.

We first noticed the all-out media attack on the markets way back on June 15th, when CNBC featured the tag-team combination of Pimpco's Mohaned El-Erian and Nouriel "Doctor Doom" Roubini – one who is pushing his bonds and one who is pushing his book and both of whom can be counted on to spin things as negatively as possible. That very effectively put the breaks on the rally from 9,800 on June 7th to 10,450 (6.6%) on June 15h and ran us back down to lower lows as EVERYTHING that happened since then was put into a negative light. I won't rehash all the idiotic statements made by Cramer or the Fast Money crew or the rest of the Criminal Narrators Boosting Commodities – it's either obvious to you or you'll never see it at this point.

CNBC has been woking the markets over since May 21st, when I first pointed out how negative their coverage had shifted. Over the weekend, we discussed the workings of the game and the players that CNBC work for and, wouldn't you know it – this morning, timed for lunch in the EU, Dr. Doom Roubini is their very special guest – AGAIN! El-Erian and Gross were kind enough to warn people this morning that "shares are no bargain as the recovery fades" and Barton Biggs is telling anyone who will listen that he liquidated half his tech holdings last week. Funny how they don't tell you WHEN they are buying or selling, just a mention after the fact to "help you" make the right decision.

“The psychology of the stock market couldn’t be worse, yet the valuation probably couldn’t be a whole lot better,” said Phil Orlando, the New York-based chief equity market strategist at Federated, which manages $350 billion. “Because corporate earnings estimates are rising, there’s a significant valuation imbalance that suggests later this year stocks are going to start going up again, and they’ll probably go up sharply.” Profit for Standard & Poor’s 500 Index companies will jump 34 percent in 2010, compared with a projected gain of 27 percent on March 29, according to more than 8,000 estimates compiled by Bloomberg yet if you listen to Corporate News, you would think the World was ending.

We won't be sure the World isn't ending for another week but we made it through the holiday weekend and expectations for Q2 earnings (or at least Q3 guidance) have now been pushed so far down that it will be hard for even PALM to disappoint. Today we get ISM Services and short-term TBill Auctions. Wednesday we'll get MBA Purchase Applications, Redbook and ICSC Retail Sales Reports and a speech from Jeffrey Lacker at night. Thursday we get Chain Store Sales, BOE and ECB rate announcements, 3, 10 and 30-year auction announcements, Natural Gas and Petroleum Reports on the same day, Consumer Credit Report and a look at the Fed's Balance Sheet and the Money Supply after hours. Friday finishes up with Wholesale Trade at 10 so nothing too Earth-shaking ahead but the next week is crazy busy.

We have very few earnings reports this week: CSIQ, FDO, WDFC, COMS, GBX, HELE, ISCA, INXI, LWSN, NUHC and PSMT – that's it! Next week gets interesting with AAP, SHAW, AA, CSX and NVLS on Monday; FAST, INFY, AIR, ADTN, INTC and YUM on Tuesday; ABT, JTX, PGR, TXI and MAR on Wednesday; SCHW, CBSH, FCS, JPM, MTG, NVS, PPG, WWW, GWW, AMD, GOOG, KMP, PBCT, TPX and NCTY on Thursday and BAC, C, FHN, FNFG, GCI, GE, GPC, KNL, MAT and BPOP on Financial Friday, which is also option expirations day so it will be fun to see if we can take back 800 points as fast as we gave it up to finish around the same 10,450 we were at on last options expiration day in this manipulated joke of a market.

Fortunately for Members, we also have "5 Plays that Make 500% if the Market Rises," so we'll have a hot time in the old town tonight watching all the bears scramble to cover. During last week's carnage, we went against the grain entirely and moved from 25% to 35% invested in long-term, well-hedged plays but ditching our Disaster Hedges and covering our Mattress Plays did make for a nervous weekend so you'll have to excuse me for being relieved, at least for the moment. Once we get past the open, we don't mind if the market turns down because we can adjust on the fly, it's the gaps down that we fear when we are bullish into the weekend but just look at how cheap the Dow is getting:

To be more bearish here is to assume the S&P chart will get worse than it was in the ‘08 panic and we’re already passing the ‘09 panic. Earnings have to be TERRIBLE to justify this movement. Taking a look at the Dow above, do you really think all of these companies are not really oversold – that once they report earnings THEN we will see how they are still 20% overpriced? Think about it – it’s not all that likely. Don’t think about the economy and your fears and the Dow index as an abstract – the Dow is a reflection of the performance of these 30 companies just as the Nasdaq is a reflection of 100 (well, mostly just AAPL these days) and the S&P is a reflection of 500 companies.

On Friday, I had said to Members right at 9:38, in the Morning Alert: "If we run up, then it will be prudent to get more neutral into the weekend but if we stay down and hold our levels, then saying a little bullish will be fine. Out of short-term short trades if you haven’t already. Keep in mind we have some great 500% upside plays you can still grab here if you think you are too short." The latter was a reference to our 500% upside plays. We also went with EEM July $38 calls at .99, and a QLD $50/53 bull call spread for $1.30 (selling puts as well for more profits) as well as long plays on RIMM, AA, HOV, VLO and TASR. My optimism was based on the considered TA analysis I shared with Members at 2:39:

.jpg)

After completing last month's "Omega III" market pattern on the Trade Bots, it's now time to spring the bear trap and run the "Apha II" into options expiration on July 16th. Maybe there will be as little logic to the rise as there was to the fall – who really cares – it's just our jobs to try to catch these waves when they come and ride them out for as long as they least (until the cheerleaders are back on CNBC and we know it's time to bail!).

Yesterday Morning I said to Members in Chat (yes, I know, we are a sad bunch of addicts that wake up and talk about the markets on a Monday holiday) that China hanging around 20,000 was still pretty bullish as they were at 11,344 in March, 09 so, when people say markets are failing because they dropped from +100% to + 75%, it does strike me as a bit funny because what the MSM is saying is that anything less than up and up and up without a pullback is a reason to panic.

Remember, China tends to lead us up and down and not vice versa in a long-term view and India, has very interestingly gone the opposite way since mid-may and they are up 114% since March ‘09. One might wonder what they have to be so happy about or one can wonder why are we acting so miserably?

The S&P was at 666, went to 1,220 (up 83%) and is now 1,022 (up 53%), so we’re a lot worse off than China so far but the question is, are they under-reacting and should be down around 16,000 or have we over-reacted and the S&P should be back at 1,140 (up 72%)? Even Europe is bored with going down and flatlined yesterday and they are leading us up today (up 2.5%) after some pretty good gains in Asia as well (up 1.5%). EU bank stress tests come out on July 23rd and the French Finance minister is upbeat about it.

China bought $6Bn worth of Japanese Bonds this morning but said they were not ditching the Euro so that perked up the Euro and knocked down the Yen in overnight trading. Chinese companies, though, are running all over Japan and buying up Japanese firms and the Agricultural Bank of China's $23Bn IPO is 20x oversubscribed so that's $460Bn of sidelined money in China that will have to find something else to invest in later this week – see how smart that EEM play was?

We remain cautiously optimistic. Not much has changed for us, we've been buying on the dips since the flash crash at the same levels – we just never thought we'd get so many opportunties to buy at the lows. Now we'll see what levels we can climb back to so we can work our way into a new set of disaster hedges but, meanwhile, the millions of retail investors who were influence by the MSM to dump their shares at the bottom and now become a part of the pack scrambling to get back in as we open, now up 1.5% in pre-markets should demand more than an apology – they should demand an investigation!