Yesterday, we had a so-so day. We are having a bit of a rough start to the July season. We closed out our position in an Overnight Trade in Family Dollar (FDO) for a significant loss. We got involved at 39.30 on Tuesday, and I sold at the open yesterday at 37.25. It was a nice drop of just over 5% for us. We did have a successful Buy Pick of the Day, yesterday,  in Sirius XM (SIRI). We got involved at 0.98 and sold at 1.01. Our Short Sale of the Day started out looking great as we got involved at 5.42, but it went awry this morning as solar continued to rally. JASO is very overbought and overvalued, but it appears that does not matter for this one. I got stopped out at the open at 5.68 for another loss of nearly 5%.

in Sirius XM (SIRI). We got involved at 0.98 and sold at 1.01. Our Short Sale of the Day started out looking great as we got involved at 5.42, but it went awry this morning as solar continued to rally. JASO is very overbought and overvalued, but it appears that does not matter for this one. I got stopped out at the open at 5.68 for another loss of nearly 5%.

On the bright side, we are going to put the past two day behind us and chug forward. I have a great Midterm Trade for us to get involved with today, and the market is sustaining a great rally. Also, be sure to check out my latest virtual portfolio update. We are up 43% on the year so far for the Buy Pick Virtual Portfolio. We are up 10% on the Short Sell Virtual Portfolio through the end of June.

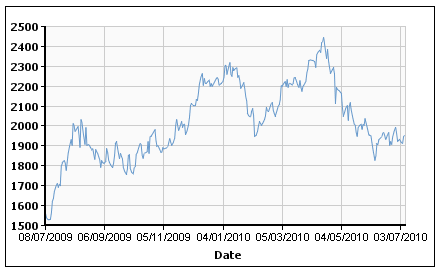

The chart on the left is one of the first main criteria for why I think today’s Midterm Trade will make a big splash.

Midterm Trade: Alcoa Inc. (AA)

Analysis: I am very excited about the upcoming earnings season. Last quarter was a great success as over 70% of companies beat estimates. A lot of companies showed great growth and were looking for more moving forward. One company that I think is poised to have a great showing is Alcoa Inc. (AA). The company is known as the mood setter for the earnings season as it is the first giant to report. The company is expected to report a profit of 0.12 per share, which is a great improvement on the -0.26 EPS the company suffered in Q2 2009. The turn to profit as well as buildup to another great earnings season gives me reason to believe AA can make some money moving into and out of earnings.

another great earnings season gives me reason to believe AA can make some money moving into and out of earnings.

The first place to look at any commodities company is the price of their commodity. At the end of March and beginning of April, aluminum prices were skyrocketing. Prices dropped from there on out, but prices were significantly higher than one year ago. With buyers paying $1900-$2500 per tonne this past quarter vs. the $1500 – $1600 in 2009’s Q2. The chart above shows the significant difference between the end of June 2009 and present. That price differential is fueling the beginnings of my reasoning for why Alcoa will make some big moves.

Next, aluminum consumers are led by soda can companies and jet planes/engines. At the end of March 2010, Boeing announced it was increasing production of its 777 jets from five per month to seven to meet rising demand. Airbus also has signaled that they have upped their production of their A320 with 202 being ordered. Coca-Cola and Pepsi are both poised to make their largest profits since 2008 in this next quarter. I see a great rise in demand for aluminum in Q2 2010 over Q1 2010, which will further fuel sequential gains. Even automobiles are skyrocketing in sales…another aluminum consumer.

One of the biggest knocks on Alcoa is that it has high production costs. The company costs more than competitors like Rio Tinto, Century Aluminum, and UC Rusal. Yet, the company is working hard to reduce these costs. They are working in South America and Saudi Arabia to get cheaper supplies to make their aluminum. Further, prices of aluminum are supposed to remain high throughout 2010 and 2011, according to experts. While there is sometimes an oversupply of aluminum, the type  of aluminum that buyers want to obtain is often not available when they want it. Further, the 2010-2011 scene will be highly affected by the appreciation of the Chinese Yuan, which is expected. As it continues to increase, it will balance the aluminum market. The outlook should be good for Alcoa moving forward.

of aluminum that buyers want to obtain is often not available when they want it. Further, the 2010-2011 scene will be highly affected by the appreciation of the Chinese Yuan, which is expected. As it continues to increase, it will balance the aluminum market. The outlook should be good for Alcoa moving forward.

Will the company beat expectations? The Royal Bank of Scotland believes that the company will double its revenue by the end of next year. The world economy’s recovery has begun, and it will be realized in Q2 earnings, starting with Alcoa. Look for us to have a lot of successes this earnings season. China is currently moving to curtail excess aluminum by making aluminum producers pay more for energy and trying to curb aluminum supply benchmarks. This will also help Alcoa. This company is seeing everything around it turning bullish, and analyst estimates are only 0.01 higher than last quarter. THAT IS AN UNDERVALUATION.

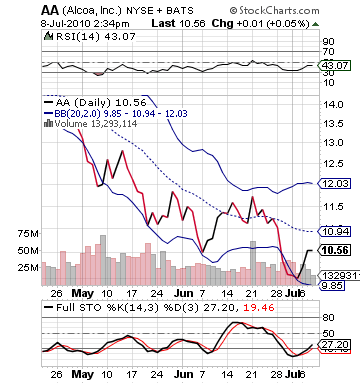

Now, we get to the fun part. Technically, Alcoa is highly undervalued. The stock has dropped over 20% since its last quarterly report. Its RSI is showing it is still below even a neutral level. The stock is near its lower bollinger band, and it is oversold on full stochastics. Yet, the fast stos are moving upwards, and the stock has gained some over the past couple days. With the stock trending upwards, I like to think this stock is poised for a nice close to the week, and we are going to see a great earnings report.

Get involved today!

Entry: We are looking to enter from 10.45 – 10.55.

Exit: We are looking to gain 3-5% through Monday. Otherwise, we will want to exit on Tuesday morning at open after earnings are reported.

Stop Loss: 4% on bottom.

Good Investing,

David RIstau