Depression III, Double Dip Recession, Cooling or Slowing Economy?

Courtesy of Ron Rutherford

The Institute of Supply Management (ISM) has again graced us with another two reports on the Manufacturing and Non-Manufacturing ISM Report On Business®. In this and other posts on the ISM, we wish to delve deeper into the raw numbers and get a better degree of understanding of the underlying currents in the macro-economy. Along the way let us also look at other voices and opinions of the macro-view.

Headline Numbers of ISM Report On Business®.

The PMI index {manufacturing index} was reported as 56.2% and NMI (non-manufacturing index/composite index) was reported as 53.8%. Both numbers missed Market Watch’s Economic Calendar consensus numbers with ISM Manufacturing consensus at 59% and Non-Manufacturing at 55.3%. Econoday reports ISM Mfg Index as 59 consensus and the range as 57.6 to 59.7 and ISM Non-Mfg Index as 55 consensus and the range as 53.5 to 56 which indicates that only non-manufacturing fell within the range of consensus.

Both reports are remarkably similar in that the composite chart is marked most prominently in “Slower” under the rate of change. The indexes and indicators are mostly growing but are growing at a slower pace. Considering the number of months of trending growth especially in the manufacturing report, this slow-down could just be head winds slowing progress or just a small hill that will easily reverse and accelerate the growth in future months. I am just not certain that the slow-down is worth wringing hands over, but could easily frighten the equity markets as they appear to have done prior to this past week. Econoday notes the possible reaction from markets.

Today’s report is not good news for the stock market which may continue to discount economic slowing for the months ahead. Today’s report will also increase talk that new rounds of government stimulus may be in order.

Not sure another stimulus is a prudent move at least at this time. I also want to quote from both reports on the recent cooling episode.

Peak growth may have already come and gone, a worry of the global markets and indicated by the ISM’s June report on non-manufacturing.

…

The acceleration in manufacturing cooled but only slightly in June, according to the Institute for Supply Management’s composite index which slowed to 56.2 from May’s very strong 59.7.

Details, Details, Details.

The one number that was a relief for trending lower was price, which was noted in both reports. Prices for both the manufacturing and services industries are still increasing but at a slower pace with the drop significant in both reports. Manufacturing had the biggest drop from May’s 77.5 to June’s 57 and non-manufacturing dropped 60.6 to 53.8 respectively and from April’s high of 64.7. The manufacturing price index was a sudden drop off and was reported that it was mostly due to stable fuel and energy prices while non-manufacturing is seeing a more stable trend line over the past 3 months with more firms experiencing lower prices and lesser firms experiencing higher prices. At least in this indicator, a slowing of growth is a welcome sign especially considering the high index numbers the reports have shown this year.

Probably the one most disappointing number in both reports was the employment index for non-manufacturing that reversed trends for growth and began “contracting” to 49.7 from 50.4 with the index treading water right around the 50 mark for most of the year. But we also should note that the percentage of respondents with higher employment is greater than the respondents with lower employment and the report notes that 8 industries reported increased employment while 7 reported decreased employment.

Employment in manufacturing maintained its very positive index at 57.8 which was 2 percentage lower than what was reported for May. Mish’s Global Economic Trend Analysis considers the reports pessimistic at best and that the non-manufacturing report is more important considering the economy is more concentrated in services sectors. But growth in employment does not necessarily have to come from the prominent sector. The US and most high income countries are in a post-industrial age so it is right we are not going back to the manufacturing society as our parents and grandparents experienced but manufacturing could lead the way to greater investments and thus economic growth.

The New York Times has a piece that could put a wrench in reducing unemployment in the manufacturing sector Factories Ready to Hire, but Skilled Workers Scarce. Even with so many manufacturing workers out of work there is still a “mismatch between the kind of skilled workers needed and the ranks of the unemployed.” From other reports young people are also unwilling to make manufacturing their career choices and has left the US with an aging but skilled work force without much of a younger class of workers. I can understand their desire to avoid uncertain long term job prospects. Who would want to learn CNC machines if that is suddenly outsourced or becomes obsolete as these skills are not very transferable.

The difficult choices we have as a nation is how to transfer our skill sets and endowments to a future “undiscovered country”. What actions now will result in an optimal solution for now and the millions of unemployed and the future workers? One way is to “prime the pump” with simple Keynesian stimulus and another is to look for structural rigidities in the economy that prevent transitions from one set of economic factors to another. One such tool for transition is immigration. I believe that the industrial revolution would have been more difficult in the US without immigrants. Immigration has also allowed our economy to structurally change through the decades and thus to greater economic growth.

With that in mind, it becomes obvious that plans such as those pointed out by the Wall Street Journal at Global Recession Led to Stricter Immigration Rules is not sound economic thought. Even if other countries decide that limiting freedom of labor to move around, does not indicate that we should follow the same path. Just as long term capital is more productive if allowed to find the most productive places, free flow of human capital will increase productivity. Just as the New York Times article talked about the mismatch, some of that skills and human capital could be imported. Reducing backlogs in employments in certain areas which will increase investment spending and thus create exogenous increases in absorption into the economy. The exact result that is desired from another stimulus package. The authors of the report from the Federal Reserve Bank of Dallas note this in the following statement.

“These could impede countries’ ability to recruit workers in sectors vital to their recovery and long-run economic growth,” the authors say.

What portents do the reports hold?

New orders for both manufacturing and non-manufacturing slowed but were both in growth territory at a strong 58.5 and 54.4 respectively. Manufacturing is just a reversal of the lofty last two months both at 65.7 but non-manufacturing is showing a slowing trend since March from a high of 62.3.

New export orders for the manufacturing sector remained strong at 56 even with a drop of 6 points from last month. Imports remained the same level at 56.5 for manufacturing while non-manufacturing imports dropped to 48. This contraction {under 50} in non-manufacturing imports has also shown up on the new export orders at the same 48. This is one area that manufacturing is more important than non-manufacturing as goods and commodities are still the biggest segment of international trade.

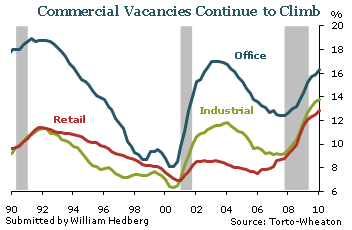

On a side note, I have maintained that construction is not likely to be the impetus to economic recovery {aside from possible Federal stimulus in roads, etc} and so this report on U.S. Office Vacancy Rate at 17 year high indicates that office construction is not likely to change in the near future. Industrial and retail spaces are also on the rise. HT to Paul Krugman at More On Low Business Investment for graph below.

Where is the 3rd depression as the title indicated?

Paul Krugman is actually predicting The Third Depression. As we see from the ISM reports nothing seems to indicate that going forward and we should continue modest growth for the foreseeable future. He is right that unemployment is at too high of levels and if that is the basis for describing the current situation as a depression then it might also be worth considering. He is also right that inflation is not something that should be overblown and that we still face possibilities of deflation as the Capital Spectator noted at DEFLATION RISK IS STILL RISING.

But unlikely that the austerity measures enacted will eliminate all deficits. The IMF and most austerity programs just try to lower the level of debt as a percentage of GDP over time. Thus, this still leaves room for fiscal stimulus, but not on such a grand scale. The question to consider is whether there is marginally reducing benefits from fiscal stimulus. The case example is Japan and not sure anyone can say that more stimulus would have achieved faster growth rates in the 90s and the 00s. Even Krugman at the time questioned Japan’s fiscal policies and noted the following at TIME ON THE CROSS: CAN FISCAL STIMULUS SAVE JAPAN?

What continues to amaze me is this: Japan’s current strategy of massive, unsustainable deficit spending in the hopes that this will somehow generate a self-sustained recovery is currently regarded as the orthodox, sensible thing to do – even though it can be justified only by exotic stories about multiple equilibria, the sort of thing you would imagine only a professor could believe. Meanwhile further steps on monetary policy – the sort of thing you would advocate if you believed in a more conventional, boring model, one in which the problem is simply a question of the savings-investment balance – are rejected as dangerously radical and unbecoming of a dignified economy.

Many have stated that “deficits” do not matter and that is correct in a Keynesian world as the deficits are compensated by surpluses in expanding years. And as we know that is rarely invoked as the drive toward 0 unemployment is unabated in politics. At some time though debt overhang is a concern and needs to be addressed. Also with larger and larger resources in the hands of the Federal Government then it stands to reason that less is available for individuals and businesses to invest and grow the economy. Does too large of central government prevent transitions to the undiscovered country? And does this also create structural rigidity which prevents flexibility of an economy that allows this transition in time?

At the beginning of the year, I predicted unemployment would not go significantly below 9% and just recently the IMF seems to be saying a similar tune as noted at Market Watch, IMF says U.S. on mend but job rate to stay high.

The U.S. economic recovery is becoming increasingly well-established but the unemployment rate will stay above 9% through 2011, according to a report from the International Monetary Fund released Thursday. The U.S. economy and financial system have made great strides in recovering from the Great Recession, but more work needs to be done, the IMF said. “The outlook has improved in tandem with the recovery, but remaining household and financial balance sheet weaknesses –along with elevated unemployment — are likely to continue to restrain private spending,” the IMF said. Important parts of the banking system remain vulnerable to shocks, even though the financial reform legislation would make major steps to close gaps in the regulatory system, the agency said. The European debt crisis has tipped risks to the downside because of potential financial market disturbance, the IMF said.

That is one number I hope we are wrong about in the positive direction and that the unemployment rate will go down sooner. I close with one more link worth reading about what the IMF has recently said and suggested for the USA at U.S. economy recovering well but risks remain.