Its a been a nice week for the markets. It has not been as stupendous of a week for The Oxen Report. We had an exceptional June, but July has been a bit tougher. We are still grinding away. Yesterday, we opened a Midterm Trade in  Alcoa Inc. (AA), which is supposed to report earnings on Monday evening to start off the Q2 2010 earnings season. I am invovled at 10.54, and we are looking for 3-5% to close out before earnings or hold through earnings. The stock is trading up 10.72 in pre-market, so we are getting closer. We also lost out on a short sale in JA Solar (JASO) we had opened on Wednesday. We got stopped out for a 5% loss yesterday morning.

Alcoa Inc. (AA), which is supposed to report earnings on Monday evening to start off the Q2 2010 earnings season. I am invovled at 10.54, and we are looking for 3-5% to close out before earnings or hold through earnings. The stock is trading up 10.72 in pre-market, so we are getting closer. We also lost out on a short sale in JA Solar (JASO) we had opened on Wednesday. We got stopped out for a 5% loss yesterday morning.

We are looking to right the ship with two new day positions today…

Buy Pick of the Day: Ultrashort Proshares Financial (SKF)

Analysis: So, we have had a great rally over the past three days before earnings. This morning, however, it is looking like that rally will not be able to be sustained…at least to start the day. Futures were down about 25 points at 8:15 AM. By 8:35 AM, Dow futures had scooted down to 35 points. There really is a lack of any intriguing news to help us sustain a rally, and it appears traders are looking to take their profits off the table before the uncertainty of Q2 earnings season.

In these times, we want to position ourselves in some inverse ETFs that appear to be poised for gains. Yet, we do not want to just pick an inverse ETF at will because it will follow the market. Rather, we want to have the same analytical support for this ETF like we do any buy we take on in our virtual portfolio. The financial sector got hit late yesterday and today with some poor news that consumer credit fell again in May despite very low interest rates. Translation is that no one is taking on loans…bad for banks.

Consumer credit fell by $9.15 billion in May of 2010. Analysts were expecting a drop but only around $2 billion. The significant drop off shows that once again Americans are not taking on a big ticket purchases and trying to reduce credit to stay afloat in these tough times. The above graph shows the significant dropoff in credit. Its a question of whether banks are unwilling to give out more loans or people just do not want loans. Either way, it is not good for the financial sector or the economy as a whole. Therefore, expecting banks to suffer today, we can take advantage of financial troubles by buying Ultrashort Proshares Financial (SKF).

Additionally, Wells Fargo (WFC), the bank that seems to have been able to withstand a great deal of the economic downturn,.png) announced yesterday evening that they will be cutting over 3,000 jobs as they attempt to complete demolish any remnants of their subprime unit and continue to try and right their ship. It is never a good sign to see job cuts from one of the financial leaders that could be tied to issues at the company deeper than what they are saying. Yet, either way, it is good for SKF.

announced yesterday evening that they will be cutting over 3,000 jobs as they attempt to complete demolish any remnants of their subprime unit and continue to try and right their ship. It is never a good sign to see job cuts from one of the financial leaders that could be tied to issues at the company deeper than what they are saying. Yet, either way, it is good for SKF.

Finally, SKF has been heavily oversold over the past few days. The stock has dropped just under 10% in the past three trading days. Fast stochastics have gone from overbought to oversold in a flash and are coming towards the bottom of the chart, meaning things should shift in the near term. RSI has done the same thing and is at alarmingly low rates on a short term period. The ETF has a ways to go to its lower bollinger band, but it has moved from the top to the middle, which should mean that we see a reinvestment on a down day.

Entry: We are looking to get involved at 21.70 – 21.90.

Exit: We are looking to exit for a 2-3% gain.

Stop Loss: 3% on bottom.

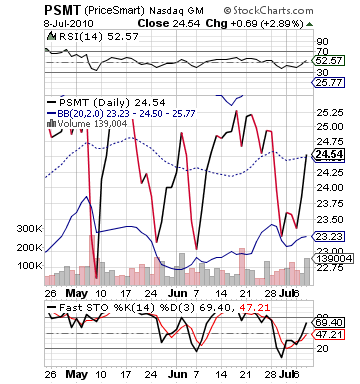

Short Sale of the Day: PriceSmart Inc. (PSMT)

Analysis: Our Short Sale of the Day is a typical recipe. PriceSmart (PSMT) is a company that operates warehouses that sell perishable food and consumer goods in the Caribbean and Central America. It is basically a grocery store. The company had a very nice Q3 of 2010. They reported earnings per share this morning at 0.40 vs. the expected 0.35. The  company saw sales rise 13.5% in Q3 over Q3 2009. The company also saw its revenue over 10%. The company also announced that its June sales had risen 19% over one year ago, as it appears that more good news is on the way for this company.

company saw sales rise 13.5% in Q3 over Q3 2009. The company also saw its revenue over 10%. The company also announced that its June sales had risen 19% over one year ago, as it appears that more good news is on the way for this company.

The issue with PriceSmart, however, is that such great earnings mean a huge uptick to start the day. The company is looking at a 6% gain to start the day. The large gain, though, is not good for a company like PSMT that has a beta at 0.82. The company just does not move at large amounts and is not too volatile. The company in this one uptick has surpassed its upper bollinger band by twenty cents. Therefore, I expect that the company will not be able to sustain these gains.

We should expect the stock market to help aid this one down as it opens down. We want to get involved with this one after the first few minutes, and it has had time to stop jumping around. The big gain is great, and this is in fact a Longterm Position possibility for us moving forward. For today, though, this is our Short Sale.

Good Luck!

Entry: We are looking to short sale from 25.90 – 26.15.

Exit: We are looking to gain 2-3% on bottom.

Stop Buy: 3% on top.

Good Investing,

David Ristau