Happy Monday to all. I hope you had a great weekend. We are looking to get things off on the right foot this week after we had a tough first week of July. On Friday, we closed out three positions. We sold off shares of Alcoa we had picked up on Thursday for a Midterm Trade. We bought in at 10.54 and sold on Friday at 10.91 for a 3.5% gain. The stock is all the way up to over 11 in pre-market this morning, so it will be interesting to see how much higher it can go before the company reports key earnings in after hours. We also had a successful Short Sale of the Day on Friday in PriceSmart Inc. (PSMT). We got involved at 25.35, and we were able to exit at 24.85 for a 2% gain. Our Buy Pick of the Day in Ultrashort Proshares Financials, however, was a dud. We got involved at 21.65, and I took an early exit at 21.33 for a 1.5% loss.

Happy Monday to all. I hope you had a great weekend. We are looking to get things off on the right foot this week after we had a tough first week of July. On Friday, we closed out three positions. We sold off shares of Alcoa we had picked up on Thursday for a Midterm Trade. We bought in at 10.54 and sold on Friday at 10.91 for a 3.5% gain. The stock is all the way up to over 11 in pre-market this morning, so it will be interesting to see how much higher it can go before the company reports key earnings in after hours. We also had a successful Short Sale of the Day on Friday in PriceSmart Inc. (PSMT). We got involved at 25.35, and we were able to exit at 24.85 for a 2% gain. Our Buy Pick of the Day in Ultrashort Proshares Financials, however, was a dud. We got involved at 21.65, and I took an early exit at 21.33 for a 1.5% loss.

This week is very significant because it is time for earnings. They will really shape the entire market over the next four weeks and whether we have a great rally out of the market’s best week in over a year or do we finally have the financials out of companies to match the doom and gloom of economic reports as of late. We will have to wait and see…

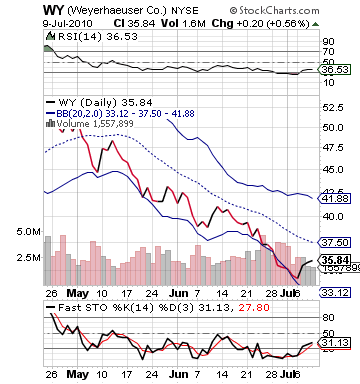

Buy Pick of the Day: Weyerhauser Inc. (WY)

Analysis: Typically when I see a stock is up 7-8% in pre-market, I think short sale. Today, however, that 7-8% could be just the beginning of gains for Weyerhauser Inc. (WY). The company, which is currently a timber and wood producer that manages forestlands for wood products and build homes, is planning a conversion in 2011 to a REIT on their tax forms. The conversion is something the company has been working on for quite some time, but today, the company made one step even closer by announcing that they would be doling out a special dividend to shareholders of $5.6 billion. Yes that says billion not million. With just over 200 million shares, that is a payout of $26 per share. Rules state that dividends cannot be more than 10% of price, so the company will be handing out share for free to shareholders.

says billion not million. With just over 200 million shares, that is a payout of $26 per share. Rules state that dividends cannot be more than 10% of price, so the company will be handing out share for free to shareholders.

$26 per share, and the stock has jumped just over $2 this morning. The reason that this is not an instant selloff is that I think a lot more investors will still want to get involved. Obviously traders will want to make the quick buck, but a lot of investors are going to want to hold onto their shares for this significant dividend. That holding will reduce the supply of shares while demand is going to be high today. I see this acting as a catalyst for a quick pop and run up this morning.

Further, WY has been losing quite a bit as of late. Since the beginning of May, WY has lost over 25% of its share prices. It has been riding a slippery slope, bouncing along its lower bollinger band. On Friday, the stock for the first time in weeks popped above its lower band, and fast stochastics turned into a buying range for the first time in awhile. It is a great sign for WY and now the news makes that trend look even more attractive.

I want to get involved right away with WY. The market’s futures are down slightly at around 20 points on the Dow, but it was down as much as 40 around 8:15 AM. It has moved up to around 20 now. The futures are similar to Friday in movement, and on Friday, the market opened in the green. There is a lot of good news breaking today, and foreign markets did very well. I don’t think we have reason to fear a big pullback today.

Get in WY at the start and let it ride.

Entry: We are looking to get involved as the market opens on this one.

Exit: We are looking to exit for a 2-3% gain.

Stop Loss: 3% on bottom.

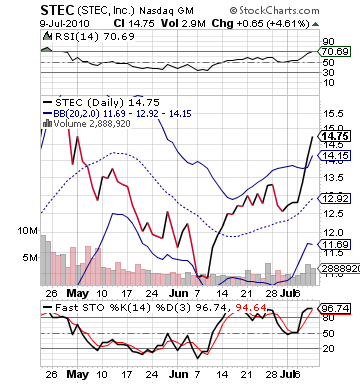

Short Sale of the Day: STEC Inc. (STEC)

Analysis: STEC is a company that is up 5-6% in pre-market that does not have the legs for it. STEC is a technology company that produces Flash solid state drives that go in large servers to store data. Solid state drives are extremely  reliable and safe compared to the standard hard disk drive that spins. STEC has had a significant run of success as of late that attracted the attention of ThinkEquity brokerage. STEC got an upgrade to buy from hold from TE.

reliable and safe compared to the standard hard disk drive that spins. STEC has had a significant run of success as of late that attracted the attention of ThinkEquity brokerage. STEC got an upgrade to buy from hold from TE.

This upgrade has helped the stock jump 5% in pre-market trading. STEC, however, has already moved nearly 25% since just the beginning of July. The stock is flying upwards, and it closed Friday well outside its upper bollinger band. The stock simply cannot maintain this type of momentum. Comparing the graphs of WY and STEC, one can see that with WY there is a lot of room for WY to move above its 50-day MA. STEC has already surpassed that, and the significant increases are not going to be able to be upheld. STEC should fall and fall hard soon.

The market’s slight downward positioning in pre-market does bring some more reason to expect some pullback; however, I am skeptical we will see much of a pullback from the market.

Overall, STEC looks poised for a significant pullback itself, and we want to take advantage of this with a solid short sale.

Entry: We are looking to get involved with STEC at 15.35 – 15.50.

Exit: We are looking to cover for a 2-3% gain.

Stop Buy: 3% on top.

Good Investing,

David Ristau