Good Wednesday. We had a pretty nice day yesterday but did not close any positions. Our Buy Pick of the Day was in  AMR Corp. (AMR). The airline company moved their earnings report to next Monday. We entered at 7.00 and were looking to exit at 7.14 – 7.28. Luckily, the stock opened at 7.20 and moved to the high side of our range where I exited with a limit for a 4% gain. AMD,our Play of the Week, looked poised to make a huge run after INTC had great earnings, but the market could not sustain the gains. AMD opened a t7.82 just two pennies outside of our range. LIke I said yesterday, I took half of my position off at 7.78 for a 3% gain. I am holding the other half, but we are still up over 1%.

AMR Corp. (AMR). The airline company moved their earnings report to next Monday. We entered at 7.00 and were looking to exit at 7.14 – 7.28. Luckily, the stock opened at 7.20 and moved to the high side of our range where I exited with a limit for a 4% gain. AMD,our Play of the Week, looked poised to make a huge run after INTC had great earnings, but the market could not sustain the gains. AMD opened a t7.82 just two pennies outside of our range. LIke I said yesterday, I took half of my position off at 7.78 for a 3% gain. I am holding the other half, but we are still up over 1%.

Finally, we got involved with a two-day Overnight Trade with Marriott International (MAR). We got involved at 31.95 and were looking for 4-6% gains in the range of 33.20 – 33.55. MAR hit a high of 32.23 but has come down some. It is looking like MAR is going to be a typical Overnight Trade as it is pretty much in line with where we started with it.

Overnight Trade: Fairchild Semiconductor Inc. (FCS)

Analysis: Semiconductors may be the gem of Q2. We saw a great earnings report come out from Intel Corp. (INTC) last night as the company majorly beat expectations, revenue estimates, and future earnings estimates. The company opened with a 5% gain, and we are hoping for something similar for Advanced Micro Devices (AMD) and now Fairchild Semiconductor Inc. (FCS). Fairchild is a power analog, power discrete, and certain non-power semiconductor manufacturer. They produce semiconductors for cars, computers, and other commercial devices. They are right in the mix there with Intel and AMD. Reporting tomorrow morning, FCS is expected to report an EPS of 0.31 vs. one year ago’s loss of -0.03.

mix there with Intel and AMD. Reporting tomorrow morning, FCS is expected to report an EPS of 0.31 vs. one year ago’s loss of -0.03.

What first attracts me to FCS is the fact that the company is poised to move to a profit on a year ago. This is a key metric for successful Overnight Trades. Investors are always attracted to companies that show a move to profits from one year ago. Further, FCS is poised to make a fifth straight quarter of sequential growth. Last quarter, the company reported an earnings of 0.25. Therefore, even a meet will continue to show great signs, but a beat will be needed to get significant gains.

Can FCS beat? Looking at Intel’s smash and the statistics from the semiconductor industry gives me great reason to believe they can. When I reported on Advanced Micro Devices (AMD), I noted the great movement upwards for the semiconductor industry in 2010. Just in May, semiconductor sales were up over 45% year-over-year and nearly 5% from April to May. Further, a lot of analysts were commenting they thought semiconductor sales would top out. I don’t disagree that sales will slow down, but I do disagree it will adversely affect these companies. Demand won’t fall. It just won’t rise at alarming rates. Intel proved that with their great future forecasting. Fairchild should follow suit.

The company has continued to position itself well over the past few quarters, continuing to improve margins and free cash. Additionally, Fairchild has a number of very highly rated semiconductors. In the past three months, the company has received a number of awards for their semiconductors. For example, they won a 20th Annual EDN Innovation Award for the company’s  UBS Switch analog device. The company also received a supplier award from Longcheer Holdings, who makes cell phones in China as their best supplier for the third year in a row. The company’s coverage in the cell phone industry is another major plus.

UBS Switch analog device. The company also received a supplier award from Longcheer Holdings, who makes cell phones in China as their best supplier for the third year in a row. The company’s coverage in the cell phone industry is another major plus.

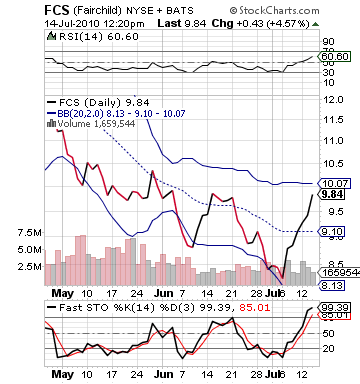

Fairchild has made some movement up as of late. After declining 20% from early June to the latest rally, the company has nearly recovered all of those losses over the last week or so. Yet, the gains have been slow and consistent…moving with the market. Today, the company is moving against the market with a 2% gain, but that is caused by the buzz of earnings. Therefore, I do not think earnings are already configured. If they were, we would see a 3,4,5% gain today. FCS also has barely moved into an overvalued category on RSI. There is still a large amount of room to the upper bollinger band for FCS.

Finally, FCS’ industry of the specialized semiconductor in the integrated circuits has had some late June reportings. Three companies reported all with suprise gains above 25%. We should see FCS doing something of the same and giving us some nice gains into tomorrow.

Good luck to all!

Entry: We are looking for an entry at 9.50 – 9.60.

Exit: We are looking to exit tomorrow morning after earnings report.

Stop Loss: None.

Good Investing,

David Ristau