Good Thursday to all. I am happy to report that our positions are all looking to be in good shape. Last night, Marriott International (MAR), our two-day Overnight Trade from Tuesday, reported solid earnings with an EPS beat of 0.31 vs. the expected 0.28 and tripled their profits. The company’s stock did not make big moves in after hours and is only up 1% in pre-market trading. We got involved at 31.95 and at least would like to get a 2-3% gain out of this one. We will hold out of the open until we get in the range 32.58 – 32.90. While the company reported very well and had good guidance, investors  do not appear to be too impressed. We also got into another Overnight Trade yesterday with Fairchild Semiconductor (FCS). This company reported earnings this morning that were also pretty outstanding. The company reported earnings per share at 0.40 vs. the expected 0.31. The company had great guidance, beat revenue, which increased 47%, estimates, and had great guidance. We are selling this one out of the gate as it is trading in the 10.30 area, and we entered at 9.60.

do not appear to be too impressed. We also got into another Overnight Trade yesterday with Fairchild Semiconductor (FCS). This company reported earnings this morning that were also pretty outstanding. The company reported earnings per share at 0.40 vs. the expected 0.31. The company had great guidance, beat revenue, which increased 47%, estimates, and had great guidance. We are selling this one out of the gate as it is trading in the 10.30 area, and we entered at 9.60.

Our Play of the Week in Advanced Micro Devices Inc. (AMD) has been up and down. We exited half our position yesterday at 7.78 as the stock got a nice boost from Intel. Today, it should be getting a solid boost as it moves into its after hours report and FCS’ report. AMD is up to 7.56 in pre-market, so we are hoping for more gains before the close today.

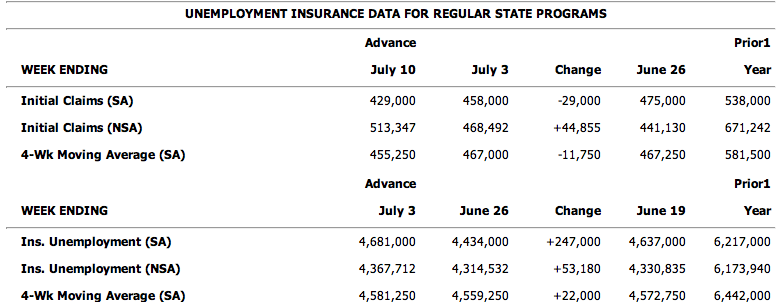

The market is looking strong today on earnings reports that were very solid across the board especially from leaders like JP Morgan (JPM) and Novartis (NVS). The Initial Jobless Claims report showed another large drop this week to 429,000 – well below expectations of 449,000.

Let’s get into today’s plays…

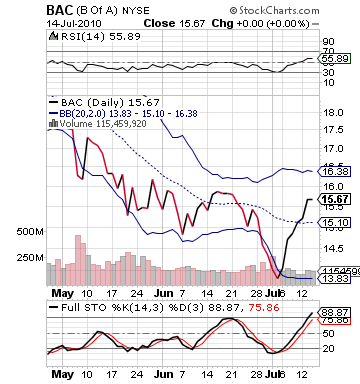

Buy Pick of the Day: Bank of America Inc. (BAC)

Analysis: The big news of the day is obviously the JP Morgan story. The company was expected to report profits near 0.70 EPS, but they blew that figure out of the water with an EPS of 1.09. Their net income increased 77%. What was most significant for JPM was that they were able to make a lot of their profits this quarter from reducing their loan losses rather than from their investing arm. The company only needed just over $3 billion to cover bad loans, which was a 65% decrease from one year ago. Yet, with all that, the stock is only up 1% in pre-market trading. Either way, I view this as a  very good sign of what is to come from many other banks that have smaller trading arms and more focus on loans and traditional banking – a la Bank of America (BAC).

very good sign of what is to come from many other banks that have smaller trading arms and more focus on loans and traditional banking – a la Bank of America (BAC).

BAC reports their earnings tomorrow morning. While I am not recommending this to be an overnight trade, it could become one; however, I think that BAC will have a very nice day today. TCF Financial (TCF) had a solid report as well, and the unemployment news is great. Futures slipped after a worse than expected PPI report and NY State Manufacturing Index, but these appear to be temporary setbacks. BAC will get a lot of investor interest from the news that JPM recorded. Can BAC have a similar quarter? We want to play on that buzz.

The good thing about this situation is that BAC has not made a big move this morning yet. The futures are only up a little over 0.5%. So, we are not going to have to worry about much of a premium on purchasing shares. Further, BAC is not heavily overbought on full stochastics, but it has moved into that range. It is slightly overvalued on RSI, but it has a whole dollar to the upside on bollinger bands from its current position.

We are looking to get involved at 15.75 – 15.90, but we would be happy to take a lower entry if it presented itself as well. I think we will get a lot of investor interest in BAC today before earnings. Get in this morning and ride the wave.

Entry: We are looking to get involved at 15.75 – 15.90.

Exit: We are looking to exit on a 2-3% gain.

Stop Loss: 3% on bottom.

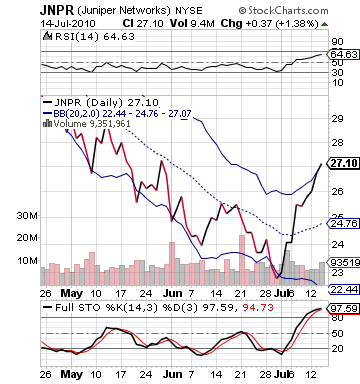

Short Sale of the Day: Juniper Networks Inc. (JNPR)

Analysis: One company that has had quite a great July thus far is Juniper Networks Inc. (JNPR). The company has advanced just over 18% so far this month. By doing so, JNPR has come right above its upper bollinger band, which always sparks short-term interest. When we combine that with a downgrade, what we get is a solid short sale. The stock is down about 1.5% already this morning, but it has more to go.

always sparks short-term interest. When we combine that with a downgrade, what we get is a solid short sale. The stock is down about 1.5% already this morning, but it has more to go.

Oppenheimer came out this morning saying that they are removing their $34 price target because the company has made a significant move, and they are worried that revenue will be risky moving forward because of the problems at AT&T, which is one of Juniper’s main buyers. This downgrade is not good for Juniper, who has made a big move. It definitely gives investors reason to take profits before earnings are released on Tuesday.

Originally, I was considering a short sale in Juniper, but I thought futures were going to blow out. They fell from 45 at 8:20 to around 12 at 8:35 AM. So, it appears that we are not going to have quite as significant of start to the day. Juniper may not get the break with a big day from the market, and I think it will be more of a neutral day that will be a "show me" day.

Juniper does not have much room to grow even from its current place, so we should expect significant declines.

Get in early and

Entry: We are looking to get involved at 26.75 – 26.50.

Exit: We are looking to gain 2-3% on cover.

Stop Buy: 3% on top.

Good Investing,

David Ristau