Dip, what dip?

I didn’t see any dip, what dip are you talkin’ about? Oil spill? I don’t see no oil spilling, do you? Goldman did what? They’re regulating who? Fuhgeddaboudit! That’s right markets, move along, nothing to see here. In fact, exactly as we predicted since the market first started dropping – it’s all just noise in between options expiration days, a way to traumatize the retail suckers who run in and out of positions under the direction of their chosen media messiahs. Clearly most market analysis is nothing more than "a tale told by an idiot, full of sound and fury, signifying nothing."

If you think this chart looks a little like someone is laughing at you – you are not being paraniod. This smiley face pattern is bought to you by the chart painters at GS and the rest of the Gang of 12 and their media lapdogs who push and pull the markets around on a daily basis. I asked back on the 6th, when I very accurately called for a "Turnaround Tuesday – Will CNBC Apologize to America?" as I pointed out the ridiculous degree of negativity that had contributed to the mini crash, which I had predicted on Monday the 21st, when my 9:40 Alert to Members said:

Good morning!

I have to go with my gut initially and stick to our plan, which is roll up the USO and DIA short plays (rolling the open puts to higher strikes) and, if the Dow holds 10,500 and USO holds $36 ($80 oil), we’ll have to sell June puts and roll our puts to a longer month – hoping for a post-holiday sell-off.

Upside levels are 50 dmas at: Dow 10,600, S&P 1,140, Nasdaq 2,350, NYSE 7,130, Russell 683, SOX 366 (already over), Transports 2,130, Oil $78 and Gold $1,200 (already over). Anything less than that is just a move to the top of our range and then we can expect a nice pullback by Wednesday.

Obviously, it’s a great time to add some disaster hedges, I now like selling TZA $6 puts for .45 and buying the TZA $6/8 bull call spread for .50 and that’s net .05 on the $2 spread so even if you have to margin $3,000 for 10 short TZA puts, the $450 you collect plus another $50 buys you $2,000 worth of downside insurance.

I like those DIA June 30th $104 puts for .57 too as a day trade.

I’m not liking any upside chases at the moment

The June 30th $104 puts finished at $6.26 (up 998%) and the TZA hedge is still worth $1.05 (up 2,000%), even if you didn’t take the money and run when it was almost double that two weeks ago. So we at PSW are proud to be flip-floppers – We like to be bearish when the markets are going down and we like to be bullish (see the very well-timed July 7th article "9 Fabulous Dow Plays Plus a Chip Shot"). It’s a funny little concept called "buying low and selling high" that I must have picked up from a book or something and it amuses me to see how upset people get that I’m not ALWAYS bullish or ALWAYS bearish – as if you have to pick a side and stick with it.

The June 30th $104 puts finished at $6.26 (up 998%) and the TZA hedge is still worth $1.05 (up 2,000%), even if you didn’t take the money and run when it was almost double that two weeks ago. So we at PSW are proud to be flip-floppers – We like to be bearish when the markets are going down and we like to be bullish (see the very well-timed July 7th article "9 Fabulous Dow Plays Plus a Chip Shot"). It’s a funny little concept called "buying low and selling high" that I must have picked up from a book or something and it amuses me to see how upset people get that I’m not ALWAYS bullish or ALWAYS bearish – as if you have to pick a side and stick with it.

You cannot AFFORD to get emotionally invested in the markets. Stocks do not love you or hate you, they do what they do for a variety of technical and fundamental reasons and we analyze those as well as the influences contributed by the Media, politics and crowd psychology. While I get criticized for discussing things that "don’t relate to the markets" like income disparity and Corporate Kletpocracy, I will continue to insist that if you don’t explore ALL the things that affect the market environment that you will NEVER understand the markets and it will ALWAYS seem like a series of random events to you.

I advise our Members to spend at least 25% of their time reading things that totally disagree with their point of view. For many of them, that’s my own posts! Most of our Members are Conservative and I’m some kind of Socialist/Anarchist – something that used to be called a Capitalist back in the days when "building a better future" and "helping your fellow man" weren’t concepts that were considered some kind of moral weakness by our current "every man for himself, kill them all and let God sort them out" brand of Capitalists, who are worshiped these days. More about that on the weekend – for now, lets see what’s up this option expiration day.

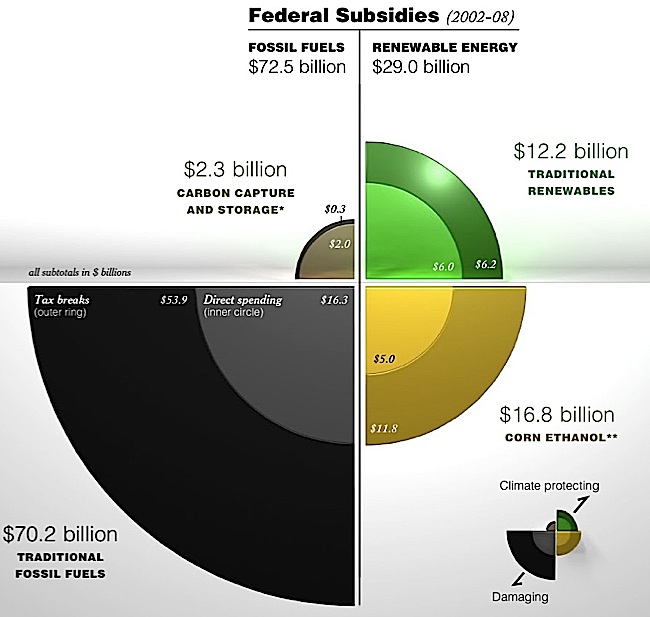

Speaking of helping our fellow man. You can’t say that the Ameican people don’t know how to be charitable. Between 2002 and 2008 we gave $72Bn worth of desperately-needed subsidies to energy companies, as noted in this chart. Those greedy renewable energy companies got $12.2Bn while Bush’s ethanol lobby pals collected $16.8Bn in that misguided venture that doubled the price of food in order to save a nickel on a $3 gallon of gas. According to Fox, we have to stop that madman Obama from "wasting" more money on "greenie subsidies" and let the "free market" decide our energy policy. ROFL!!!

Speaking of helping our fellow man. You can’t say that the Ameican people don’t know how to be charitable. Between 2002 and 2008 we gave $72Bn worth of desperately-needed subsidies to energy companies, as noted in this chart. Those greedy renewable energy companies got $12.2Bn while Bush’s ethanol lobby pals collected $16.8Bn in that misguided venture that doubled the price of food in order to save a nickel on a $3 gallon of gas. According to Fox, we have to stop that madman Obama from "wasting" more money on "greenie subsidies" and let the "free market" decide our energy policy. ROFL!!!

The big news of the day is, of course, the GS settlement and I have no need to discuss that here as it was exactly the nonsense we expected. FinReg passed but we knew that would happen and BP stopped the leak but we knew that would happen too (we were big BP buyers at the bottom) so – YAWN. That makes the really big news that GOOG missed and we didn’t see that coming but they missed expectations of $6.52 by 0.07 or 1% on a 25% increase in revenues with big R&D and hiring spending so they are a BUYBUYBUY on the dip. The only other misses ALL week, out of 30 reports, were HITK (10%), AIR (10%), PGR (13%), MTOX (20%) and MAT (6%) – not too shabby for our first week of earnings….

Nobody gave negative guidance – another thing the bears promised us that isn’t happening. What’s key for us is all of our financials hit their targets. That isn’t stopping them from selling off a bit after a nice run but JPM, GE, C, BAC and CBSH all put in solid earnings so we can probably ditch our Financial hedges (but not until Monday) as we gear up to play some earnings. It’s all well and good we have removed a lot of the bearish overhang but it’s still going to be put up or shut up next week and we do need a NEW catalyst to get us over our target levels (Dow 10,290, S&P 1,102, Nas 2,257, NYSE 6,930 and RUT 651).

Nobody gave negative guidance – another thing the bears promised us that isn’t happening. What’s key for us is all of our financials hit their targets. That isn’t stopping them from selling off a bit after a nice run but JPM, GE, C, BAC and CBSH all put in solid earnings so we can probably ditch our Financial hedges (but not until Monday) as we gear up to play some earnings. It’s all well and good we have removed a lot of the bearish overhang but it’s still going to be put up or shut up next week and we do need a NEW catalyst to get us over our target levels (Dow 10,290, S&P 1,102, Nas 2,257, NYSE 6,930 and RUT 651).

Of course, since we are AT our target levels into the weekend, we will be looking at a hedge unless we have a huge move up today, which is possible if we get an AAPL rally at 10 am, right after a surprisingly improved Michigan Sentiment Report. We will absolutely be picking up some Google longs but with copper failing to hold $3 in pre-market, that’s going to steer our trading today.

Asia was flat except Japan, where exporters FREAKED OUT as the Yen hit 87 to the dollar and even that was on BS support as our FOREX trade that never misses (mostly) scored another big win today as the Yen dropped from 87.35 at 3am to 86.50 at 8am. The Nikkei dropped 2.86% this morning to 9,408 and that is a huge and unusual gap to the Dow, which closed at 10,359 and, if the Nikkei doesn’t improve soon, we could end up snapping back ourselves so everyone go out and by something from TM or SNE this weekend, please.

The good news is that the volatile Nikkei could be uber-bullish for us if they do turn back up but that’s hoping for a break of a 20-year downtrend from 35,000 so don’t hold your breath. EU markets are trending from a good open back to flat ahead of the US open and our futures are off half a point for no particular reason so we will just go with the flow today and see what happens. Big earnings week next week along with June Housing Data will give us plenty to look forward to and today our goal is simply to hold the gap from Monday’s close – should be doable…

Have a great weekend,

– Phil