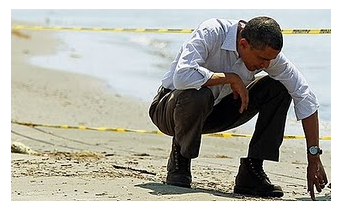

Hugh Hendry: "If There Was A Way To Short Obama, I Would"

Courtesy of Tyler Durden at Zero Hedge

In his traditionally curt and to the point way, Hugh Hendry proclaims his "love" for the president, in this rare profile piece on the Scottish fund manager by the NYT. While none of his opinions will come as a surprise to Zero Hedge regulars ("The euro? It’s finished, Mr. Hendry proclaims. China? Headed for a fall."), we do recommend the article to those still unfamiliar with one of the truly iconoclastic fund manager still left in the open.

In his traditionally curt and to the point way, Hugh Hendry proclaims his "love" for the president, in this rare profile piece on the Scottish fund manager by the NYT. While none of his opinions will come as a surprise to Zero Hedge regulars ("The euro? It’s finished, Mr. Hendry proclaims. China? Headed for a fall."), we do recommend the article to those still unfamiliar with one of the truly iconoclastic fund manager still left in the open.

While Hendry does not run a fund nearly as large as some behemoths out there (his Ecletica is less than $1 billion, John Paulson is $30), it does afford him a nimbleness that JP (whose recent rumored liquidations in the gold market are destined to create feedback loops that further accelerate liquidations) or, much more blatantly, Pimco (with its $1 trillion + in Treasuries, Corporates, Sovereigns and Mortgages) which is the market in all its verticals, can only dream about. It also affords him the opportunity to say what is on his mind, and on those of many others, who however dread the political consequences for being a little too honest. It is this forthrightness and honesty that has reserved Hendry a sterling place within the Zero Hedge community, his candor regularly scoring posts receiving well over 20k reads (and at 60k hits, his "I recommend you panic" is among the Top 20 most popular Zero Hedge posts of all time).

Some snippets from Julia Werdigier’s profile of Hendry:

Mr. Hendry runs the successful hedge fund firm Eclectica Asset Management. It is an old-school macroeconomic fund company with a big-think, globe-straddling style more akin to the Quantum Fund, of George Soros fame, than to the high-tech razzle-dazzle of Wall Street’s math-loving quant analysts.

“Hugh is an anachronism,” said Steven Drobny, a founder of Drobny Global Advisors. “He reminds one of the original hedge fund managers from the ’70s and ’80s.”

At 41, Mr. Hendry is also emerging from the normally secretive world of hedge funds to captivate fans and foes with a surprising level of candor.

And speaking of "I recommend you panic" which is must watch for everyone…

Last May, on British television, he verbally sparred with Jeffrey D. Sachs, director of the Earth Institute at Columbia and perhaps the best-known economist writing on developmental issues.

Another Hendry spectacle was his undressing of the naked Joseph Stiglitz emperor (full clip here):

Before that, he took on Joseph E. Stiglitz, the Nobel laureate, about the future of the euro. “Hello, can I tell you about the real world?” Mr. Hendry interjected at one point. It was a huge hit on YouTube.

By all accounts, Eclectica is not your typical 2 and 20 FoF-leeching dream corpse. Unlike most places, here you will likely know if you are en route to getting blown up well before the PMs shut down the place, and suspend redemptions, as was the case for 99% of all US hedge funds in late 2008:

Mr. Hendry has made — and sometimes lost — money for his investors. Eclectica’s flagship fund, the Eclectica Fund, is up about 13 percent this year, besting by far the average 1.3 percent loss among similar funds.

But returns have been erratic — “too much sex, drugs and rock ’n’ roll” for some investors, he concedes. In 2008, the Eclectica Fund was up 50 percent one month and down 15 percent another. Mr. Hendry plans to change that.

The firm bet correctly that the financial troubles plaguing Greece would eventually ripple through to the market for German bonds, considered the European equivalent of ultra-safe United States Treasury securities. But the firm lost money betting on European sovereign debt in the first quarter of last year.

And just like subprime was John Paulson’s ticket to riches (with a little now settled help from Goldman Sachs), so China has all the makings of pushing Eclectica from a modest fund by modern zero cost of money standards, to the next big thing should Hendry be proven right (which he will be)… within a reasonable time frame:

His latest obsession is China. He likens the country to Starbucks: good at growing quickly but not so good at creating wealth.“The idea is that things would happen today that are commonly thought of as impossible, most notably a significant reversal of China,” Mr. Hendry said.

Maps cover the walls of his office. On one, blue magnetic pins plot his recent trip through China. He filmed himself there in front of huge, empty office buildings and giant new bridges in the middle of nowhere — signs, he said, of a credit bubble.

Along with his fund co-manager Espen Baardsen, a former goalie for the Tottenham Hotspur soccer team, Mr. Hendry is devising ways to bet on a spectacular deterioration of China’s economy. He declined to divulge any details.

As for Hugh Hendry’s book club, those who wish to follow in his footsteps, here is the recommended reading:

The inspiration for his investment approach comes from an unlikely source: “The Gap in the Curtain,” a 1932 novel by John Buchan that is borderline science fiction. The plot centers on five people who are chosen by a scientist to take part in an experiment that will let them glimpse one year into the future. Two see their own obituaries in one year’s time.

We certainly wish Mr. Hendry all the best, as his post-activist ways inspire a certain jouissance within his fans that none of the other deeply institutionalized hedge fund managers can recreate. And obviously we are excited by his eagerness to participate in open media discourse of his views: should a domestic TV station be able to tap into his raw id and spark highly-intellectual round table debates, the long-forgotten art of watching TV for intelligent content (and certainly commercial free) may actually one day come back to the US.