Good morning to all. Yesterday, we got involved with ETN at 68.50 for an Overnight Trade per my Oxen Alert. Eaton report, as was expected, very solid earnings this morning. The company beat earning estimates, hitting a 1.36 vs. the expected 1.17. The company saw revenue grow 16%, and they lifted their dividend by the same rate. We are going to exit right at the open of the session today. We also had a very successful Buy Pick of the Day in Seagate Technology (STX) yesterday. We got involved at 13.85 and exited at 14.26 for a 3% gain. We also got involved with a Short Sale of the Day in Hovnanian (HOV). We got involved at 6.75 and exited for a quick 2% at 6.68. We are continuing to roll through the earnings with another Overnight Trade – my favorites.

Overnight Trade: Reliance Steel & Aluminum Inc. (RS)

Analysis: We are continuing are great stretch of Overnight Trades with another dip into the steel industry. Our first play  back at the prequel to earnings was not so successful, but we are changing from broadline steel production to metal fabrication. Reliance Steel & Aluminum (RS) is a metal fabricator that works with steel and aluminum to produce over 100,000 metal products. The company distributes these products to non-residential construction, rail, ship, trucks, aerospace, electronics, and semiconductors. The company is expected to report earnings at 0.82 for this quarter, which is a significant improvement over -0.08 EPS one year ago.

back at the prequel to earnings was not so successful, but we are changing from broadline steel production to metal fabrication. Reliance Steel & Aluminum (RS) is a metal fabricator that works with steel and aluminum to produce over 100,000 metal products. The company distributes these products to non-residential construction, rail, ship, trucks, aerospace, electronics, and semiconductors. The company is expected to report earnings at 0.82 for this quarter, which is a significant improvement over -0.08 EPS one year ago.

As always, what I look for in an Overnight Trade is an opportunity for great earnings, typically better than expected. In addition, I look for an undervaluation in a company that with the expected earnings should be doing significantly better than it is. Reliance Steel provides that type of opportunity for us. It is in an industry that is doing quite well this quarter, and its competitors have shown some strong signs that the steel and aluminum fabrication industry is showing great signs of recovery.

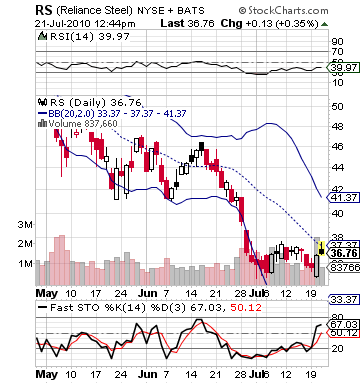

As I noted in my reasoning for why I like Eaton is because I have seen some great strength in the aerospace industry first of all. Boeing and Airbus have show great signs of building more planes and ordering more parts. That was seen in the great successes of Eaton, which was also propelled by the automotive sector. Yet, Reliance will need more than just aerospace to be able to surprise. Rail traffic continues to show significant improvement over 2009 numbers. Just this past week, for the first time, rail traffic actually surpassed 2008 levels. While higher rail traffic does not mean more railcar supply production. In its latest earnings, Greenbrier, one of the largest railcar constructors showed some very positive signs of improvement. Its backlog of orders was higher than delivery for the first time in several quarters. The company was back in the black. This is a great sign for Reliance. (the chart to the right is steel price)

The company, additionally, should benefit from a very significant improvement in the semiconductor industry. Semiconductors, across the board, are doing very well in the second quarter. Semiconductors have seen significant sales growth in Q2 of 2010. Sales are improving, and this should also help Reliance. Ship construction is also doing extremely well, which is another avenue of business for Reliance. Daewoo and Hyudnai heavy shipbuilding sectors are showing very positive signs. The ship businesses are both seeing new orders and reporting their first profits in some time.

The distribution line is doing very well as can be seen from the various industries Reliance is connected with. One of its competitors Ladish Co., which supplies airline production companies and fabricates metals, just had a very great earnings report that had a 70%+ surprise on earnings. Reliance is the first major aluminum and steel production company to report earnings, so we will be waiting to see. Other similar companies like Alcoa have also shown great signs of recovery. Even nonresidential construction  has been rising. It is very likely that Reliance is going to be able to show very stong earnings in this quarter.

has been rising. It is very likely that Reliance is going to be able to show very stong earnings in this quarter.

On the supply side, the price of aluminum and steel have declined in the past three months, which is yet another great improvement that will help Reliance. Steel prices and aluminum prices decline is great for the supply side that can also help Reliance.

The stock has shown some significant decline lately. Since the beginning of June, the stock has dropped more than 20%. The stock is significantly undervaled, and it is even slightly oversold on fast stochastics. This undervaluation means that the stock has significant ability for improvement in the coming report, and if it does have strong earnings, then the stock will be able to make a major rise. The stock has about 20% room of improvement to its upper bollinger band. So, we are looking at a great opportunity.

Get in today!

Entry: We are looking to get involved at 36.70 – 36.90.

Exit: We are looking to exit tomorrow morning after market opens and earnings are reported.

Stop Loss: None.

Good Investing,

David Ristau