Is it Feast or Famine at Johnson & Johnson?

Courtesy of Pharmboy at PSW and Phavorites of Pharma

Over the past few years, there has been a lot of talk about pharmaceutical manufacturing and persistant problems in quality control. Genzyme, Schering Plough, are ones that comes to mind, but now Johnson & Johnson came under fire. Manufacturing is a killer for any pharmaceutical company, as news breaks, companies scramble, and CEOs come on saying that everything is OK, and we are going to recall the product and get things fixed. Unfortunately, those fixes take a lot longer than one would think, and in the case of a company as diverse as Johnson & Johnson (NYSE:JNJ), their current crisis is a good one.

Johnson & Johnson is a global American pharmaceutical, medical devices and consumer packaged goods manufacturer founded in 1886. The corporation’s headquarters is located in New Brunswick, New Jersey, United States. Its consumer division is located in Skillman, New Jersey. The corporation includes some 250 subsidiary companies with operations in over 57 countries. Its products are sold in over 175 countries. J&J had worldwide pharmaceutical sales of $22.5 billion for the full-year 2009 represented a decrease of 8.3% versus the prior year. Net earnings and diluted earnings per share for the full-year 2009 were $12.3 billion and $4.40. Full-year 2009 net earnings included an after-tax restructuring charge of $852 million and an after-tax gain of $212 million representing the net impact of litigation matters. Full-year 2008 net earnings included special items related to in-process research and development charges of $181 million with no tax benefit and an after-tax gain of $229 million representing the net impact of litigation matters. Excluding these special items, net earnings for the full-year 2009 were $12.9 billion. Diluted earnings per share for the full-year 2009 were $4.63, representing an increase of 1.8%, as compared with the full-year in 2008.

The Company announced earnings guidance for full-year 2010 of $4.85 to $4.95 per share, which excludes the impact of special items.

In 2010, a suit brought by the United States Department of Justice alleges that the company from 1999 to 2004 illegally marketed drugs to Omnicare, a pharmacy that dispenses the drugs in nursing homes. JnJ is vigorously fighting this claim, but I think they will settle it out of court. More recently JnJ has broadened their recall children’s medications for a manufacturing issue in a Puerto Rico plant. Since last November, McNeil has recalled about 11.7 million bottles of various Motrin products and about 6.3 million bottles of Tylenol Arthritis Pain caplets, according to the F.D.A.’s Web site. The company began the recall after receiving consumer complaints about a moldy odor emanating from some products. The smell was caused by contamination from a chemical byproduct of a substance used to treat wooden transport pallets, the company said. Senators on capital hill have called JnJ uncooperative. Time will tell, but I thought all the companies have survived these ordeals (at least the big pharma have), and JnJ should be no different. Wit the recent pull back in price, I thought we should look under the hood to see what they have leaving (patent expiries), what is moving, and what is coming down the pipe.

Johnson & Johnson’s brands include numerous household names of medications and first aid supplies. Among its well-known consumer products are the Band-Aid Brand line of bandages, Tylenol medications, Johnson’s baby products, Neutrogena skin and beauty products, Clean & Clear facial wash and Acuvue contact lenses. Their medical device division has implants, surgery, vision, blood diagnostics and many more. It is also a steady income stream, but it does not offer the punch that the pharma unit has with respect to profits.

Here is their 2008 pipeline (does not include their Cougar Bio purchase in 2009).

Noted in the pipeline:

- Xarelto (blood thinner w/ Bayer). This is a new mechanism and should set the stage and most likely their most important small molecule in development. JnJ and Bayer have spent considerable time showing the safety and efficacy of Xarelto, and unlike warfarin and other anticoagulants, this drugs does not typically require coagulation monitoring and has no significant drug-drug interactions.

- Invega Sustenna is an oral dose, extended release (ER) formulation of paliperidone—a metabolite of risperidone, the active component in Risperdal (mouthful, huh?) The formulation uses the J&J subsidiary ALZA’s OROS drug delivery technology (of whom they closed down a few years ago (remember the $12B for ALZA?). I am not sure the premium is going to be paid for by insurance and medicare, but what do I know…..patients forget to take their meds, so a once monthly may help, or hinder if one has to take it only once a month….

- Simponi (golimumab) is a human monoclonal antibody which is used as an immunosuppressive drug and targets tumor necrosis factor alpha (TNF-alpha), a pro-inflammatory molecule and hence is a TNF inhibitor (Humira; Enbrel; Remicade lineage). Simponi is approved in Canada and the United States as a once monthly subcutaneous treatment for adults with moderately to severely active rheumatoid arthritis, psoriatic arthritis, and ankylosing spondylitis. Simponi is marketed by Schering-Plough(MRK) in Europe. The real question here is – do we need another and what will be its advantages over the above mentioned? Simponi can be given IV, so that offers some advantage over Remicade, but otherwise, I am not sure if the real world will pay the premium…..this remains to be seen.

- Velcade was in-licensed from Millennium Pharmaceuticals (now Takeda) and was launched for multiple myeloma. The drug has a low toxicity profile, and Millennium and J&J are attempting to garner line extensions by conducting trials in several other cancer types.

- Bapineuzumab – with the influx of money into Elan, JnJ is trying to corner their share of Alzheimers. Remember that LLY and PFE have two monoclonals that hit the same target, but one works in the brain, the other in the blood. Well, this one is the PFE one, and by buying a big stake of Elan, JnJ hopes to also corner this area using bapineuzumab. I do not see it working, but IF it does, it will corner the market for years to come.

-

Others of note: Procrit (Eprex) was J&J’s largest product in 2002, with global sales of $4.3 billion, but Amgen’s Aranesp eroded J&J’s market share. In addition, the emergence of safety concerns relating to the wider epogen market helped to pull sales down to $2.2 billion in 2009. Tibotec-Virco have the non-nucleoside reverse transcriptase inhibitors (NNRTIs), Intelence and rilpivirine. Intelence reached the market in 2007 and rilpivirine is expected to launch in 2010 (Gilead).

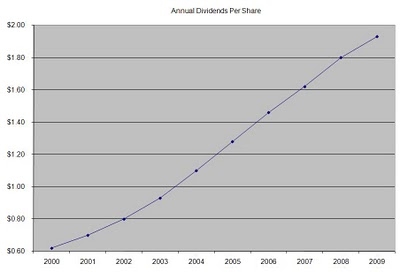

On the money side of things, JnJ has increased its annual dividend payments by an average of 13% annually since 2000, which is much higher than the growth in EPS. A 14% growth in dividends translates into the dividend payment doubling almost every five years. Since 1971 JNJ has indeed managed to double its dividend payment every 5 years.

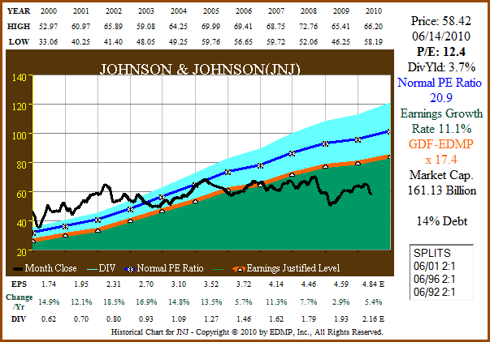

Chuck Carnevale wrote on Seekingalpha recently that t’he recent weakness in the stock market and a recent recall and marketing faux pas has caused Johnson & Johnson’s stock price to trade at one of its lowest valuations in over 20 years. Notwithstanding these issues, Johnson & Johnson recently raised their dividend by 10.2%.’ Below is his graph showing JnJs performance.

Not unlike its brethren, JNJ has some real challenges ahead. The patent cliff remains steep, but the company did purchase Cougar Biosciences for its prostate cancer treatment last year. If a few of the things in the pipe come winners, JNJ should have a decent (not stellar) few years ahead. We should know in the coming few years how they are doing. With the stock price being a bit higher than MRK, BMY, and even PFE (ugh), and the dividend lower, I favor buying the January 2012 $57.50 calls and selling September 2010 $57.50 calls in a 2:1 ratio for a net debit of ~ $8.50. If one has the margin for it, selling an equal amount of January 2012 $50 Leaps as the 2012 Calls for $4 makes the entry a net $0.50.

Join us at Phils Stock World and find out the other exciting stock picks in the daily chat, as well as get your answers to many of life’s questions!

Disclosure: I do not own any JNJ as of this writing. I do have shares of MRK and BMY.