Good Wednesday to all. You will have to pardon me taking a half day today because today is my birthday, and my friends took me out for breakfast. We’ll play a fun game in the comment box of guessing my age. The first right person gets a personal stock recommendation…ooooh. Anyways, we had a bit of hurter this morning with Silicon Labs (SLAB). I did my research and found a winner. The stock doubled profits and exceeded revenue by lightyears. The only problem was the company guided a bit below estimates. I personally find that a 4% drop on this is actually quite unfair; therefore, I am going to continue to hold SLAB for a bit of time and recover some of my losses. We got into SLAB yesterday at 42.80. The stock opened and is down about 5% lower. We will continue to monitor this one, but if the fundamentals are good, which they are, then we should hold.

We are going to work on another new Overnight Trade for tomorrow. I am hoping that will at least be a decent birthday present in the market.

Also, our Long Term Position in GMCR is highly affected by the company’s earnings tonight, so we should watch for that.

Overnight Trade #1: Teradyne Inc. (TER)

Analysis: I want to get back into this one prior to earnings. It was our Play of the Week on Monday, and it sure was good to us. Yet, it has declined with the rest of the market since its Monday high and further today. The company is slated to report earnings this evening. I will pull some information from the Play of the Week article and add some new developments.

(semi sales to the left)

First off, Teradyne Inc. (TER) is a semiconductor and memory device testing device manufacturer. Their equipment tests all kinds of chips, conductors, memory devices, analog devices, etc and is well diversified across the entire technology industry. Teradyne is set to report earning this evening at an EPS of 0.47 vs. a loss one year ago when EPS was at -0.21. One of the best reasons to like semiconductors is because they continue to outperform. Even our miss from yesterday in SLAB, beat earnings by more than 10%. Since the beginning of June, nine out of eleven reporting semiconductor equipment manufacturing companies have beaten earnings. Additionally, one of Teradyne’s largest competitors Verigy Ltd. (VRGY) reported in June a beat of over 250%. One would expect that TER would be fairly overvalued or buying into earnings with such success, but it is not. Its a bit undervalued on RSI and has over 5% room to grow up to its upper band.

Additionally, today, it was announced that semiconductor equipment manufacturers sold their greatest amount of equipment at over $1.8 billion in three years for a single month. June saw an over 10% growth year-over-year in sales. This is great news for TER and should result in fantastic earnings. TER should definitely be able to exceed its expectations, and we are hoping guide well to the future. The company’s peers and competitors are all reporting very solid earnings, but the company itself has ben continually reporting earnings beats with over 10% surprise earnings for four straight quarters. The company, in the latest quarter, was recognized by Texas Instruments as the top semiconductor testing company supplier, and the company continues to grow its distribution line with its testing product – UltraFlex. The company operates mostly in the mobile devices, semiconductors, automotive, computers, and electronic gaming equipment. I don’t need to harp on how well semiconductors have done, but the other sectors are worth a glance.

Automotives are doing exceptional as well. Ford (F), this past week, reported that the company had a $2.6 billion profit in the latest quarter and sales are at the highest levels in years. Toyota Motors (TM) is poised to report a $1.1 billion profit. In April – June, auto sales slowed in April from March, but across the board, were significantly higher than one year prior. Auto sales rose 19% in May, year-over-year, and while June was disappointing, auto sales were still over 15% higher across the board. The return of the automotive industry has been very helpful to semiconductor companies, and companies like Teradyne will definitely benefit from their continued return to profitability and higher sales.

Software for computers and electronic gaming systems was fairly weak in April through June, but mobile devices more than made up for that which is Teradyne’s bread and butter. Device sales at Apple, Motorola, and Palm all are reported to be.png) higher in Q2. All these companies that are seeing growth are buying more semiconductors, chips, analog devices, and they all have to be tested. This is where Teradyne comes into the picture. The company continues to also grow its presence in China, taking on a new agreement with Chinese mobil device manufacturer Specturm.

higher in Q2. All these companies that are seeing growth are buying more semiconductors, chips, analog devices, and they all have to be tested. This is where Teradyne comes into the picture. The company continues to also grow its presence in China, taking on a new agreement with Chinese mobil device manufacturer Specturm.

Further, the company has a desperately low P/E ratio at 6.6. The company’s industry average is around 15. With that low P/E, a small earnings beat will be taken very well and increase share prices heavily. The company should definitely growthroughout the week as it gets closer to earnings. Another great sign for TER is that in the past three months it has received two new analyst estimates at "Buy" ratings, as analysts agree this company is too undervalued.

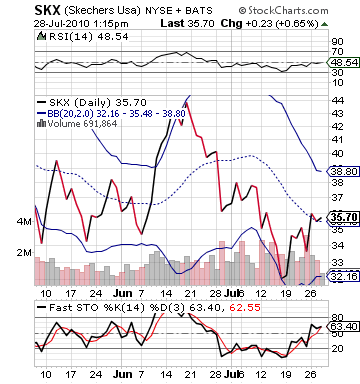

Technically, TER has moved below the fair value on RSI at 50 by hitting a 49. That means the stock should move up despite any news, and a solid earnings report will make it rise even greater. Further, the stock on fast stochastics has shown some nice selling over the past few days, which means buyers are on the sidelines. Finally, the stock has nice room to the upside, and we can see a large gain before it hits its upper band and experiences some trouble going higher.

Entry: We are looking to get involved at 10.20 – 10.30.

Exit: Tomorrow morning after earnings are reported.

Stop Loss: None

Overnight Trade #2: Skechers Inc. (SKX)

Analysis: All I have to say is Shape Ups. I don’t know how many you are familiar with these shoes or have them, but they appear to be quite at the front of a craze. They are the shoes that help you stand up more straight and are actually more fitness-oriented than flat shoes. My personal opinions of them are beside the point because these shoes are very popular. Benjamin Graham’s favorite way to look at something was to just look around you at what is popular. Three or  four months ago…I did not see many Shape Ups. Now, I see them everyday. Someone is making money off of that, and it is Skechers USA Inc. (SKX).

four months ago…I did not see many Shape Ups. Now, I see them everyday. Someone is making money off of that, and it is Skechers USA Inc. (SKX).

SKX is slated to report earnings this afternoon, and they are expecting to report an EPS of 0.44 vs. one year ago’s loss of -0.13. The company should be seeing a great turn to profit from one year ago and looks poised for a solid beating on their recent success with Joe Montana-backed Shape Ups. On the footwear front, it has been a mixed bag. Decker’s Outdoors, who makes UGG shoes, saw a really great quarter, beating earnings by over 100%. While Timberland was a bit weaker with a miss. Timberland is really out of style it appears right now, while Ugg is not…that is my conclusion. Skechers is definitely in a different market than both of these, but retail is all about what is in, and Skechers are moving back in after quite a hiatus from style.

Wedbush analyst Camilo Lyon said that the company should see profits rise over 170% from one year ago. Besides the fact that this company is looking to make big splashes this year, Skechers is also well positioned in the market from high-end to low-end. The shoes can be bought at higher-end sporting goods stores and malls, while they are also comfortable in the Shoe Carnival and lower-end shoe stores.

I am feeling good about Skechers’ future too.

Here is a bit from IBD:

"Skechers has an early-mover advantage," said David Turner, an analyst with Avondale Partners. That gives it pricing power as well, he says.Priced at $100, Shape-ups sell for about twice as much as other Skechers shoes. Women 25 to 45 are the biggest fans, but men seem to be increasingly falling in step. Shape-ups sales continue to grow, even as some skeptics raise doubts about their alleged benefits or point out sore points, especially for people with balance problems. Next-generation line extensions include Extended Fitness sneakers and sandals, an All-Terrain model and Work pull-ons. Resistance Runner shoes, priced at $150, will have a wide launch on July 15.

expectations, which is exactly what we want to see. Skechers is creating a new line of shoes, and they are definitely the market leader in the category. They have created the brand name, and even as new competition enters the picture, Skechers will be first.

expectations, which is exactly what we want to see. Skechers is creating a new line of shoes, and they are definitely the market leader in the category. They have created the brand name, and even as new competition enters the picture, Skechers will be first.Entry: We are looking to get involved at 35.30 – 35.50.

Exit: We are looking to exit tomorrow morning after earnings.

Stop Loss: None

Good Investing,

David Ristau