Consumer Metrics Institute News: July 30, 2010 – Inside the New GDP Numbers

Courtesy of Rick Davis at Consumer Metrics Institute

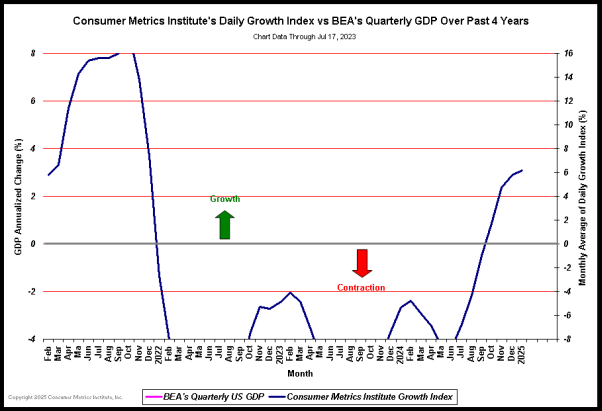

Bureau of Economic Analysis (‘BEA’) released its "advance" estimate of the annualized growth rate of the U.S. Gross Domestic Product (‘GDP’) during the 2nd quarter of 2010. Per their report, the GDP grew during the quarter at an annualized rate of 2.4%, down from 3.7% in the 1st quarter of 2010. Several points from the report merit comment:

* Readers familiar with prior GDP reports will be more surprised by the reported 1st quarter growth as by the new 2nd quarter number (which had been leaked by Mr. Bernanke last week), since only last month the Q1 of 2010 was supposedly growing at a 2.7% rate. Why did the Q1 number suddenly get altered upward by 1%? The BEA quietly revised the 1st quarter inventory adjustment up to a level that represents a 2.64% component within the revised 3.7% figure, with 1st quarter "real final sales of domestic product" now reported to be growing at a modestly improved 1.06% annualized clip, compared to the 0.9% number reported last month. In short, factories were piling on inventory at a substantially higher rate than previously thought, while the "real final sales" remained anemic.

* The 2.4% figure will garner all of the headlines, but the more important "real final sales of domestic product" continues to be weak, growing at a reported 1.3% annualized rate. The real cause for concern is that the reported inventory adjustments dropped from a 2.64% component in the revised 1st quarter to a 1.05% component during the 2nd quarter. If factories have begun to realize that end user demand remains anemic, the inventory adjustments could well go negative soon, pulling the reported total GDP down with it.

(Click on chart for fuller resolution)

* The BEA revised much more than the first quarter of 2010. They revised down 2009, 2008 and 2007 as well. Apparently the "Great Recession" has been worse than our government has previously reported. And the recovery’s brightest moment, Q4 2009, has been revised down from 5.6% to 5.0%. Similarly Q3 2009 dropped from 2.2% to 1.6%. And so on. The bottom of the recession was shifted back one quarter, with Q4 2008 now reported to have contracted at a -6.8% rate, revised down from the previously reported -5.4% rate. Most quarters of 2007, 2008 and 2009 have been revised down substantially, shifting the recession shown in the chart above back in time.

* The new GDP report shows that the current gap between the consumer demand that we measure and the BEA’s reported number continues to grow as factories build their inventories in anticipation of a strong recovery. If factories curb their enthusiasm during the third quarter, the BEA’s "advance" estimate for Q3 2010 might be brutal, just 4 days before the U.S. mid-term election.

* We understand that economists want to ultimately get the numbers right, even if it is three years after the fact. We applaud the BEA for their efforts. But we also understand people who are concerned about quiet governmental revisions to history.

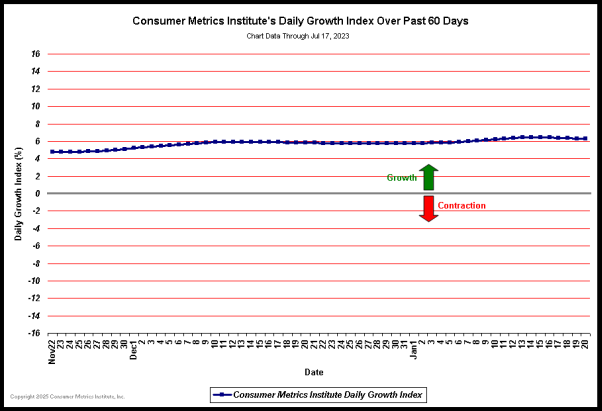

Back to the real world: our Daily Growth Index has dropped to new recent lows, and it is now contracting at a -3.4% rate.

(Click on chart for fuller resolution)

This contraction rate puts the trailing ‘quarter’ nearly into the 5th percentile among all quarters since 1947, meaning that only about 1 in 20 quarters officially recorded by the BEA since then has been worse. Our "Contraction Watch" places this movement into the perspective of the 2006 and 2008 contractions:

(Click on chart for fuller resolution)

The 2010 contraction is now clearly worse than the "Great Recession" was at the same point in their respective time lines. And we don’t see a bottom forming yet.