Wheeee, what fun!

Check out yesterday’s action on the Russell, up 1% from the gap up open (rejected at 665), down 1% and then up 1% to finish up 1.7% for the day, pretty much right where they started the mornining. Our other indexes had more conviction than the small caps, who have been our leader all year so perhaps, just maybe, they are consolidating at the 5% line (666) waiting for the other indexes to catch up? We had a similar situation in late February, where the Russell paused to wait (like a dog running ahead of it’s master) and again in later March while in April the Russell was slow to follow the other indexes as they trended lower.

Yeah, remember April when the Russell was at 740? Ah, good times… It was easy to call a top then and we hedged for disaster on April 28th so it’s not like we can’t see these things coming. It was easy to BUYBUYBUY as we tested our lows in June and July as that was the bottom of the same range (this is not rocket science, folks!) but now it is HARD to say which way we will go because we are in the middle of our range. I see too many of our Members looking for trades every day but not every day is a good day to trade. Some days are good for watching and waiting. Some weeks are good for watching and waiting…

I reiterated our 1,000% SDS spread from the weekend post in the morning in our morning Alert to Members as it’s nice to be able to commit $500 to a $5,000 pay-off that protects $50,000 worth of bullish positions from a 10% drop. That’s what insurance is supposed to do – it’s a "just in case thing." Since the market is now on a 10% "limit down" system, we don’t need to go too crazy with our insurance as even another 9/11-type event should not, in theory, give us more than a 10% drop before the markets are halted, giving us a chance to reposition on the fly. That’s why those Fed reports are such good practice for us – we get major market-moving information in the middle of the day and we react to it within moments and we’re good enough at it that we actually look forward to those violent Fed day moves!

I reiterated our 1,000% SDS spread from the weekend post in the morning in our morning Alert to Members as it’s nice to be able to commit $500 to a $5,000 pay-off that protects $50,000 worth of bullish positions from a 10% drop. That’s what insurance is supposed to do – it’s a "just in case thing." Since the market is now on a 10% "limit down" system, we don’t need to go too crazy with our insurance as even another 9/11-type event should not, in theory, give us more than a 10% drop before the markets are halted, giving us a chance to reposition on the fly. That’s why those Fed reports are such good practice for us – we get major market-moving information in the middle of the day and we react to it within moments and we’re good enough at it that we actually look forward to those violent Fed day moves!

Another bearish trade idea yesterday was the SPY weekly $110 puts at a .40 average, which fell to .30 at the days end so a rotten trade so far but we thought it was prudent to go contrarian as the S&P tested 1,120 and the Russell was rejected at 666 and the Nas couldn’t take back 2,300. We are still waiting for Dow 10,700 to break the tie and, after that, we’ll be looking for S&P 1,155 and NYSE 7,350 and THEN we will be bullish about a breakout of our range. We were strong enough looking yesterday that we were able to look at short-term bullish plays on AXP and UNG but that was balanced out with a so far, so bad, short play on USO so let’s call us neutral at the 5% line although we can only lose 100% (assuming we don’t stop out) on our long plays while our short plays can be 10-baggers!

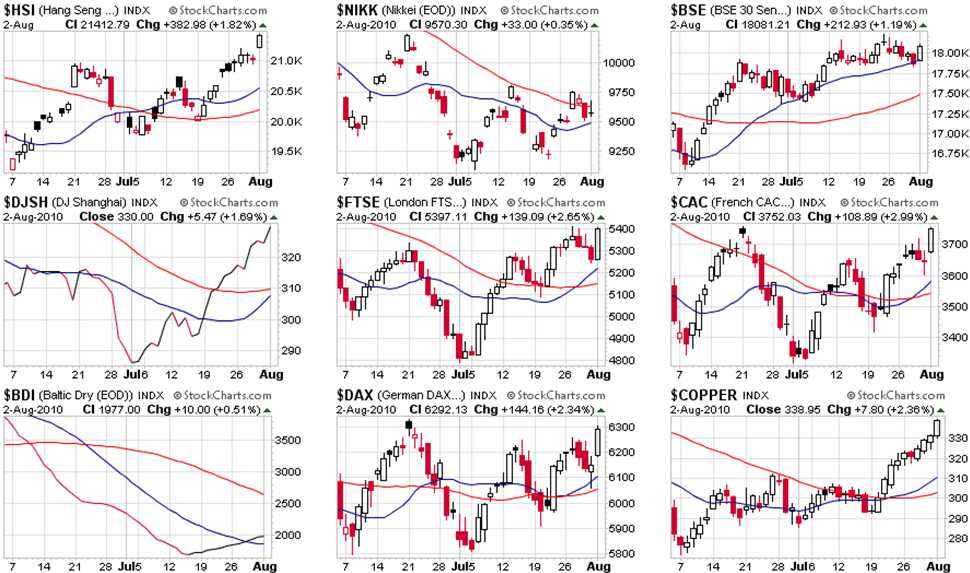

Internationally, the markets are on pause – so it’s a great day to look at the charts, as they are a day behind. The Nikkei was our best performer this morning, with a 1.3% gain (I did mention our EWJ trade in yesterday’s post) and the Shanghai balanced them out with a 1.7% loss against the Hang Seng’s 0.2% gain. Other than that, the World is flat this morning, which is another theory I think should be given equal time in schools (inside joke):

The Nikkei is still very disturbing as it finished the day at 9,694, almost exactly 1,000 points behind the Dow, which is anomalous to say the least. Copper has gone nuts but we’re still scared to short it and we will be watching that DAX test at 6,350 with great interest. The BDI needs to break that 2,000 mark or copper is clearly on drugs but, on the whole, everything is coming up roses on the global markets as they, like the Russell, wait patiently for the US to catch up and join the Global party.

Are we partying like it’s 1999 again or is this the start of something new? We got a little data this morning with Personal Income flat vs. up 0.1% expected so YAY Capitalism for driving those labor costs down. The lack of wage increases (and jobs, for that matter) didn’t stop American consumers from spending though as Personal Spending held flat vs down 0.1% expected. PCE Core Prices were also flat vs. up 0.1% expected – a triple goose-egg for today’s data so party on markets, it’s business as usual in the American Worker’s Paradise.

Are we partying like it’s 1999 again or is this the start of something new? We got a little data this morning with Personal Income flat vs. up 0.1% expected so YAY Capitalism for driving those labor costs down. The lack of wage increases (and jobs, for that matter) didn’t stop American consumers from spending though as Personal Spending held flat vs down 0.1% expected. PCE Core Prices were also flat vs. up 0.1% expected – a triple goose-egg for today’s data so party on markets, it’s business as usual in the American Worker’s Paradise.

Speaking of Socialism, I am very surprised at the number of delusional Conservatives I speak to who seem to think they will somehow be taking control of Congress in the fall. Aside from the fact that they just did a survey and found that the only thing people hate more than Democrats is Republicans, math is not really on the Republican’s side (not that math has ever been their strong suit – see deficits). The Dems hold a 256-179 seat advantage in the house, that means the Republicans need to defeat 40 Democratic incumbents while holding 100% of their own seats. A 40-seat swing has only happened twice – 1946 and 1994 (Newt’s revolution). On the Senate side, Republican’ts need 10 seats. Only 37 Senate seats are up for grabs this year and only 11 of those are held by Democrats considered to be vulnerable (vs. 7 Republicans falling in the same category).

Why is this important? Well we have to consider to what degree there is irrational exuberance among Conservative investors who think the political agenda will drastically change in the Fall. A reinstatement of the Bush tax cuts will require the House and the Senate to pass a bill and then Obama has to decide not to veto it – good freakin’ luck. Yet you can tune into Fox and hear endless hours of idiocy discussing how "the tide is turning in Washington." If money is flowing into the markets on this basis, then we may be setting ourselves up for one hell of a crash when reality hits on November 2nd.

Why is this important? Well we have to consider to what degree there is irrational exuberance among Conservative investors who think the political agenda will drastically change in the Fall. A reinstatement of the Bush tax cuts will require the House and the Senate to pass a bill and then Obama has to decide not to veto it – good freakin’ luck. Yet you can tune into Fox and hear endless hours of idiocy discussing how "the tide is turning in Washington." If money is flowing into the markets on this basis, then we may be setting ourselves up for one hell of a crash when reality hits on November 2nd.

So, while I’d love to ignore politics, I’d say this is going to be a pretty damned critical investing event that’s going to affect our investment decisions for the rest of the year.

Meanwhile, oil is running up to a test of $82.50 this morning, where we REALLY like them for a futures short, using the $82.50 line as our on/off switch (see yesterday’s Member chat for USO play too!). A lot of this rally has been a weak dollar rally and the dollar has now fallen all the way to the 200 dma at 80.57, down 10% from 88.71 on June 7th so exactly 10% in exactly 2 months is good for a 2% bounce according to our 5% rule so we’ll be looking for a quick move back to 82 at least and possibly 83.5, which is about a Fibonacci retrace (speaking of Italian scientists) of the drop.

That should keep copper off the $3.40 mark as should LOGIC because, as every reader of the China Economic Review is well aware, the China Iron & Steel Association said at a press conference yesterday that domestic prices of hot-rolled coil dropped for seven straight weeks prior to July 16, as government measures to curb property speculation hindered demand for steel. Sluggish steel demand in China, the world’s largest consumer of the metal, has caused 40% of the mills to cut output or go into plant maintenance mode this year. If no one is using steel – what the heck is all that copper for?

No increase in dry bulk shipping, declining volumes of steel – things that make you go hmmm… The Wells Fargo/Gallup Small Business Survey is AWFUL, hitting a brand new ALL-TIME LOW in July as the bottom 99% of businesses are getting screwed over in America just as badly as the bottom 99% of its citizens. Not only do small business owners detest their present situation but they also have never been more negative about the future.

No increase in dry bulk shipping, declining volumes of steel – things that make you go hmmm… The Wells Fargo/Gallup Small Business Survey is AWFUL, hitting a brand new ALL-TIME LOW in July as the bottom 99% of businesses are getting screwed over in America just as badly as the bottom 99% of its citizens. Not only do small business owners detest their present situation but they also have never been more negative about the future.

Small-business owners are the embodiment of America’s entrepreneurial and optimistic spirit. As a result, their increasing concerns about their companies’ future operating environment do not bode well for the economy in the months ahead. Nor do small-business owners’ intentions to reduce capital spending and hiring: 17% of owners plan to increase capital spending in the next 12 months — down significantly from 23% in April — and 13% expect jobs at their companies to increase, while 15% expect them to decrease over the year ahead.

Big-firm earnings and global growth may drive profits on Wall Street, but small business is the major source of U.S. job creation. And most small-business owners are unlikely to hire as long as they are becoming increasingly uncertain about the revenues and cash flows of their companies in the months ahead.

While we are happy to invest in Big Business, small business, just like the bottom 99% of American Households, are in a downward spiral that isn’t going to end without some serious government intervention. My bullish economic premise is based on what I consider an inevitable move towards QE2. The Senate will be voting on a $27Bn Aid package for the states, which is being filibustered by the Republican’ts and about a Million jobs rest on the outcome of this one so we’ll see what happens.