REGARDING THOSE “STRONG” CORPORATE BALANCE SHEETS

Courtesy of The Pragmatic Capitalist

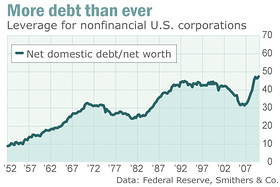

Brett Arends had an excellent piece on MarketWatch yesterday regarding the true state of US corporations. You’ve probably heard the argument before that corporations are sitting on record piles of cash – their balance sheets are in immaculate condition. Right? Wrong! These comments are generally made without accounting for both sides of the ledger. What is often ignored is that the total debts of these companies has also skyrocketed. Admittedly, I’ve been guilty of this in the past when discussing corporate cash levels and Arends (rightfully) sets the record straight. He notes that corporations are even worse off today (in terms of debt levels) than they were when the crisis began:

“American companies are not in robust financial shape. Federal

Reserve data show that their debts have been rising, not falling. By some measures, they are now more leveraged than at any time since the Great Depression.You’d think someone might have noticed something amiss. After all, we were simultaneously being told that companies (a) had more money than they know what to do with; (b) had even more money coming in due to a surge in profits; yet (c) they have been out in the bond market borrowing as fast as they can.

Does that sound a little odd to you?

A look at the facts shows that companies only have “record amounts of cash” in the way that Subprime Suzy was flush with cash after that big refi back in 2005. So long as you don’t look at the liabilities, the picture looks great. Hey, why not buy a Jacuzzi?

According to the Federal Reserve, nonfinancial firms borrowed another $289 billion in the first quarter, taking their total domestic debts to $7.2 trillion, the highest level ever. That’s up by $1.1 trillion since the first quarter of 2007; it’s twice the level seen in the late 1990s.”

This will also sound familiar to readers of John Hussman who has debunked the cash on the sidelines story more than once:

Interestingly, some observers lament that corporations and some individuals are holding their assets in “cash” rather than spending and investing those balances, apparently believing that this money is being “held back” from the economy. What is preposterous about this is that the “cash” that companies and individuals are observed to be holding is primarily in the form of government securities and base money created over the past couple of years, which somebody has to hold at every point in time until those liabilities are retired. This is not money that is waiting to be spent. It is a stack of IOUs representing resources that have already been squandered, and nowsomebody has to hold these pieces of paper until they are retired.

In short, instead of directing savings toward investments in real, productive assets that we would observe as physical output, fixed capital, and equipment (and claims on those assets in the form of corporate stocks and bonds), our economy has been forced to choke down a massive issuance of government liabilities in order to bail out bad debt. For every dollar of debt that should have defaulted, we now have two dollars of debt outstanding (the original debt, and a newly issued government security). What appears to be “sideline cash” is simply the evidence of past spending. Again, the crucial consideration is how the government spent the funds in the first place. Rapidly mounting evidence suggests that the answer is “not very well.”

Our friends at Annaly Capital added to the Hussman story several weeks ago when they showed that non-financial firms are indeed worse off than they were when the crisis began:

“We decided to scale the aforementioned $1.8 trillion of liquid corporate assets by the total credit market debt owed by those corporations, with predicable results.

As it turns out, in relation to their debt outstanding, corporations are less liquid than they were prior to the recession.”

Arends continued his piece with a similar conclusion to those by Hussman and Annaly:

“The debt repayments made during the financial crisis were brief and minimal: tiny amounts, totaling about $100 billion, in the second and fourth quarters of 2009.

Remember that these are the debts for the nonfinancials — the part of the economy that’s supposed to be in better shape. The banks? Everybody knows half of them are the walking dead.

Central bank and Commerce Department data reveal that gross domestic debts of nonfinancial corporations now amount to 50% of GDP. That’s a postwar record. In 1945, it was just 20%. Even at the credit-bubble peaks in the late 1980s and 2005-06, it was only around 45%.”

The obvious conclusion here is quite simple. It’s not just the consumer and banking sectors that remain overly indebted and poorly positioned in the long-run. The period of de-leveraging (balance

Unfortunately, the government continues to misdiagnose our problems as having originated in the banking sector so they continue to throw money at the issue while misallocating resources, increasing moral hazard and destroying public sentiment. Our monetarist friends at the Fed have convinced themselves (and our politicians) that they control the economy with their insignificant press releases on monetary policy. Until this changes the risks in this economic and market environment will remain abnormally high. Konnichiwa my friends!