I thought we would change up things today and take a look at a longterm position. Yesterday, we had a fun day with four new positions. We started the day with a Buy in Crocs Inc. (CROX), which turned out to be good for 4%. We got in on the morning, per my Morning Levels Alert, below our initial range at 12.03 and sold at 12.52 later in the morning. Our Short Sale of the Day scared us for awhile, but we were able to turn a nice 3% profit on Carrizo Oil & Gas (CRZO). We doubled down our position for an average entry of 22.70 and exited at 22.02 for a solid gain. Our Overnight Trade in Brooks Automation (BRKS) appears to have been killed by the jobs report. We got in at 7.95, and we exited at the open at 8.04 for a 1.25% gain. The company had tremendous earnings, but it appears that it was not good enough to be the jobs report. Finally, we finished things off with a Midterm Trade in Sunpower Corp. (SPWRA).

average entry of 22.70 and exited at 22.02 for a solid gain. Our Overnight Trade in Brooks Automation (BRKS) appears to have been killed by the jobs report. We got in at 7.95, and we exited at the open at 8.04 for a 1.25% gain. The company had tremendous earnings, but it appears that it was not good enough to be the jobs report. Finally, we finished things off with a Midterm Trade in Sunpower Corp. (SPWRA).

Looks like a good day to sit back and look long term and avoid the market’s death…We don’t want to be like AOL…

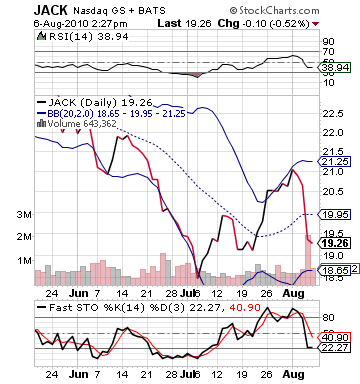

Long Term Investment: Jack in the Box Inc. (JACK)

Thesis

Jack in the Box is one of the leading fast food restaurants in the USA. The company operates a majority of its business in the West Coast. Before the recession, Jack in the Box (JB) appeared to be a company that was poised for tremendous growth as it grew its revenue from 2000 to 2007 75%. Yet, the company has seen a decline in its revenue since the 2007 year. As unemployment has continued to rise, JB has been adversely affected by declining income levels. The company though has differentiated itself from rivals with a unique menu, a growing concept in Qdoba, and an engaging television campaign. As employment returns, Jack in the Box will find itself a severely undervalued company with lots of room for growth.

One of the best reasons to like Jack in the Box is its current undervaluation. The company has a current P/E ratio of just over 10 at 10.73. The industry average is 18.00 with competitors like McDonald’s (MCD), Burger King (BKC), and Yum Brands (YUM) with P/E ratios at 16, 12, and 18 respectively. It is fairly obvious that JB has seen a significant decline in its share price and business during this recession. At its 2007 revenue, JB was at at nearly $40 per share. It now sits at less than $20.

10 at 10.73. The industry average is 18.00 with competitors like McDonald’s (MCD), Burger King (BKC), and Yum Brands (YUM) with P/E ratios at 16, 12, and 18 respectively. It is fairly obvious that JB has seen a significant decline in its share price and business during this recession. At its 2007 revenue, JB was at at nearly $40 per share. It now sits at less than $20.

Therefore, if the company can start to move out of the recession and regain its revenue that it had in 2007 then the company will definitely be able to increase its price per share back to the $40 levels. It really is dependent on the economy’s ability to move back up from the current state of unemployment. One metric that has been tough to swallow is the decline in same-store sales. The sales declined nearly 10% in the latest quarter, but the company saw its Qdoba line rise nearly 4%.

Qdoba is one of the most attractive aspects of Jack in the Box’s business. This year, the company is planning to open forty more Qdoba restaurants and fifty Jack in the Box stores. Another attractive aspect of JB’s business is that the company is looking to enfranchise 70-75% of its business by 2013. This means that new businesses are franchises, reducing overhead, and the company is gaining money by selling off current assets to enfranchise. The franchising of Jack in the Box will help reduce costs significantly.

While the company has suffered from the recession, the company has focused on a significant re-imaging project that is supposed to finish in 2011 that is remarketing the company and allowing it become a larger player in the marketplace. The company has a top notch menu that is very diversified among different options than other fast food restaraunts. That diversification allows Jack in the Box to appeal to a wider audience.

An even more appealing aspect of Jack in the Box is that the company has a great ability to expand. It is mostly centered in the West and Southwest, but the company has a great capacity to move into the Midwest and East. The expansion is a great  way for the company to increase its revenue coming out of the recession on top of the employment capabilities. Additionally, the company recently did a complete overhaul of its capital structure to help it increase its future capabilities as well. Great sign for financial strength.

way for the company to increase its revenue coming out of the recession on top of the employment capabilities. Additionally, the company recently did a complete overhaul of its capital structure to help it increase its future capabilities as well. Great sign for financial strength.

The company, however, does face some serious difficulties for the very near future. Until unemployment starts to change, Jack in the Box will not be able to really improve its business. Additionally, the company is going to have significant competition at all times. They cannot create any type of economic moat at any time besides a very minute one. Despite this complication, the company has much opportunity.

Valuation

My fair value estimate for Big Lots is $32.75 per share based on discounted cash-flow analysis. The company has seen a dip in its ability to grow its revenue as of late. They have not seen the double-digit revenue growth they used to see in several years. I have operating income growing less than 10% for the next few years.

Good Investing,

David Ristau