Happy Monday everyone. Hope you all had a fantastic weekend. We are looking to start off this week on a good foot with a weekly position. On Friday, we took an examination of a new Longterm Position in fast food restaurant parent Jack in the Box Inc. (JACK). My fair value estimate on JACK is at the low 30s, so this one has a ways to go. Additionally, we have a current position in a Midterm Trade from Thursday in Sunpower Corp. (SPWRA). We got involved at 12.80 and are looking for 4-6% on this one before it reports earnings tomorrow evening. The stock opened up today in the low 13s, so we are close to halfway there.

Happy Monday everyone. Hope you all had a fantastic weekend. We are looking to start off this week on a good foot with a weekly position. On Friday, we took an examination of a new Longterm Position in fast food restaurant parent Jack in the Box Inc. (JACK). My fair value estimate on JACK is at the low 30s, so this one has a ways to go. Additionally, we have a current position in a Midterm Trade from Thursday in Sunpower Corp. (SPWRA). We got involved at 12.80 and are looking for 4-6% on this one before it reports earnings tomorrow evening. The stock opened up today in the low 13s, so we are close to halfway there.

Let’s take a look at a Weekly Position. Additionally, after that, I will be finishing up a Virtual Portfolio Update to show you my current statistics and virtual portfolio success rate.

Play of the Week: NVIDIA Corporation (NVDA)

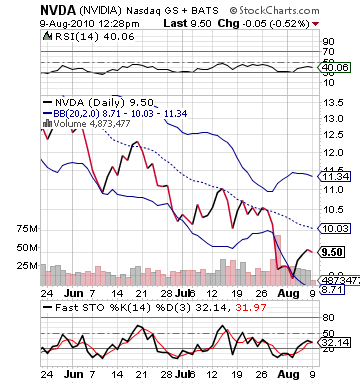

Analysis: NVIDIA moving into this quarter’s earnings report has not had the most upbeat outlook. The downward spiral for NVDA began with the company reporting outlook below estimates in its Q1 of 2010. The company was expecting revenue, at that time, of $950 to $970 million. That report came at the beginning of May. At the end of July, the company cut forecasts even further to revenue of $800 to $820 million. Since the beginning of May, the share price of NVDA has  dropped more than 50%.

dropped more than 50%.

So, why would we want to get involved with a company that is not expecting good things. The reason is because even at these revenue levels I think NVDA will be able to beat earnings estimates. One year ago, the company produced a revenue of just over $775 million and recorded an EPS of 0.07. With a revenue of $900 million, the company hit an EPS of 0.19. The company, therefore, hits another 0.01 for every $10 million of revenue. The company is still estimated by most analysts to hit a revenue of $830 million or so, which would give the company another 0.05 – 0.06 of EPS, meaning an EPS of 0.12 – 0.13, at the lowest.

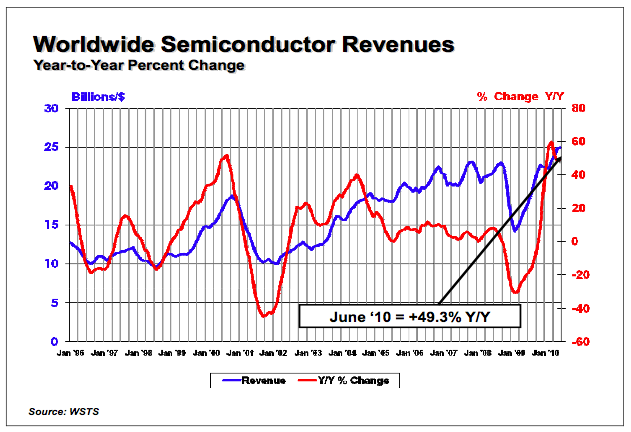

Yet, nearly every specialized semiconductor has had significant beats on earnings and revenue. Despite the warning from NVDA, I still feel confident in the entire sector. Since the beginning of July, nineteen out of the twenty-two specialized semiconductors to report earnings beat estimates. Close competitors of NVDA, Intel (INTC) and Advanced Micro Devices (AMD), both had outstanding quarters that were well above estimates. AMD and Intel both beat earnings by more than 60%, and they have very similar consumers and production costs as those two.

Chip sales in Q2 of 2010 were up 7.1% from Q1 and 50% from one year prior. The year prior NVDA reported an EPS of 0.07. It is hard to believe that a 50% in sales worldwide could only help NVDA improve their revenue by a mere $25 million. Original expectations were for NVDA to possibly hit close to $1 billion in sales. The company continued to move this down due to rising costs and European sales declines.

due to rising costs and European sales declines.

We want to hold this stock, though, before they report earnings. With such a decline and such a strong industry, the question is whether the stock can rise into earnings or will it fall. My thoughts are it will rise. The stock is actually in a bit of a bullish movement, and fast stochastics are increasing. The market has continued to be bullish, and the company has priced in its estimated declines. The semiconductor industry has continued to be exceptional, and that exceptionality has started to move into the NVDA price. It should continue.

The specific chips that NVDA produces with graphic cards is a growing business. Higher processing chips are in higher and higher demand as video games, computers, and processors require more advanced chips. I think the future looks bright for NVDA, and this week should have some nice advances for NVDA in store.

Entry: We are looking to enter at 9.40 – 9.50.

Exit: We are looking to exit for 4-6% gain.

Stop Loss: 5% on bottom.

Good Investing,

David Ristau