Good morning to all. The market is looking rather weak this morning moving into the open as a slew of poor economic data and expectations from the Fed have plagued futures. Currently, we have one open position that we entered yesterday in NVIDIA Corp. (NVDA) as a Play of the Week. We got involved at 9.48, and we are looking to exit at 9.86 and above. The stock closed yesterday at 9.64, but it will most likely take a hit this morning with the market being down. Additionally, yesterday, I posted a virtual portfolio update that updates you on how The Oxen Report is doing and how all of our virtual portfolios are standing. You can check it out here.

Well, let’s get into today’s plays…

Buy Pick of the Day: LDK Solar Co. Ltd. (LDK)

Analysis: The market is not looking too strong to start off the day. We got some bad news out of Nonfarm Productivity and Unit Labor Costs as they were both worse than expected. Nonfarm productivity’s decline means that the number of hours being worked by employees as well as the GDP is declining. Productivity dropped from up 3.6% last month to down 0.9% this month. This, along with the FOMC statement, are hurting the market. Therefore, our Buy Pick of the Day needs to be something we think can open lower and move down some with the market but has the ability to bounce back after a decline.

after a decline.

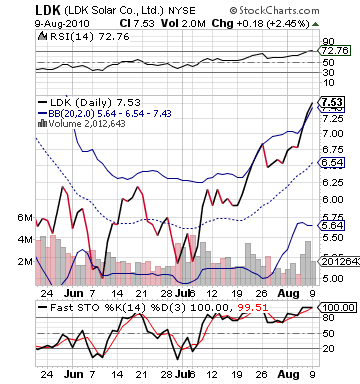

Therefore, we want to look for a company that might get some strong movement into its earnings report intraday rather than overnight. One such company should be LDK Solar (LDK). The solar company is expecting to report a major turn to profits from a year ago loss (0.22 EPS vs. -2.03 EPS). The company has gotten a strong run up into earnings, moving up 25% over the past month. This run up has caused the stock to become overvalued and overbought. Yet, the buying interest in LDK is very strong.

On any decline, buyers move back into the stock. Therefore, it would make sense that this morning LDK would gain some significant buyer interest moving into earnings, and on top of that, the stock declined yesterday and is set to open lower today. The stock has an upper bollinger band at 7.55. Therefore, an entry at the mid 7.30s and below would give us 3% and more if it moved that high, and there is no reason to not expect it to move that high.

The solar industry has produced some very strong results thus far in the earnings season. First Solar, Solarfun, GT Solar, and JA Solar this morning all have produced earnings beats, and LDK is expecting a major turn to profits from one year ago with a 112.5% improvement from one year ago in profits.

Watch the open and a decline before buying. This one is volatile so it may move down very quickly, and you do not want to get burned.

Entry: We are looking to enter LDK at 7.28 – 7.38.

Exit: We are looking to exit for a 2-3% gain.

Stop Loss: 3% on bottom.

Short Sale of the Day: Fossil Inc. (FOSL)

Analysis: Fossil Inc. is looking to be one of our typical short sales this morning. The company reported some very strong earnings this morning for its Q2. The company hit an EPS of 0.58 vs. the expected 0.34 and one year ago’s 0.25. .png) The company raised revenue 30% from one year ago. It was a very good earnings report from a company that has moved away from just watches and has developed a higher-end teen and young adult fashion line. Fossil is one of the first retailers to report, and it is showing that we can expect good things from other retailers.

The company raised revenue 30% from one year ago. It was a very good earnings report from a company that has moved away from just watches and has developed a higher-end teen and young adult fashion line. Fossil is one of the first retailers to report, and it is showing that we can expect good things from other retailers.

Yet, I think we can make some money on FOSL by short selling it. The stock, before it reported earnings, was already at its upper bollinger band, was overbought, and overvalued on RSI. Therefore, the seller interest on FOSL should be pretty high, and the gains it made today at the 6-7% level should not be able to be sustained. Equip that logic with a downward movement in the market as a whole, and we have a definite short sell on our hands.

We want to get involved this morning pretty much out of the gate as I think the market will take a dip before any movement upwards. We are looking for FOSL to open above 45, and I think it will make a small bounce before being taken over by the market movement.

Entry: We are looking to get involved at 45.15 – 45.50.

Exit: We are looking to cover for a 2-3% gain.

Stop Buy: 3% on top.

Good Investing,

David Ristau