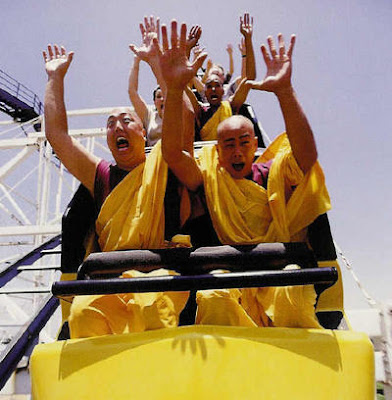

Wheeee – I told you this was going to be fun!

Wheeee – I told you this was going to be fun!

What a day we had yesterday with the down and the up and the down and the up and now, this morning – down again! We cashed our directionals on the morning dips yesterday but now our disaster hedges are putting us in a great mood this morning (I mentioned our QID play in yesterday’s post and that was a very easy fill on yesterday’s run-up). This morning’s action should push QID over goal ($17) and we’ll see what sticks as we test our first line of (hopefully) defense at Dow 10,450 and S&P 1,100.

If we lose the S&P then the Dow has a quick ride back to 10,200 so we’ll be looking at DXD again for a add-on hedge. We already have DXD plays and we were just adjusting them on Monday, as some Members were worried that the market was going too far the other way, which led me to comment in Member Chat:

When all you guys start capitulating on your short positions I usually figure that’s a great time to get aggressively short because the end is probably near. Keep in mind we are trading a range and right now we are at the top of that range so hedges like DXD are going to get stressed. If you do not need the protection, of course take it off the table but if you do need downside hedges, then a simple roll on the call side can give you a much bigger upside.

Range trading is great but you have to BELIEVE in your range. The bottom of our range, as I posted in yesterday’s Morning Alert to Members, is Dow 10,200, S&P 1,070, Nas 2,200, NYSE 6,800, and Russell 635 and until we fail 3 of those 5, we will continue to make bullish plays when we get near those levels, just as we make our bearish bets as we test our breakout levels. Even these levels are just 2.5% off our midpoints so we don’t get gung-ho bullish until we hit the full 5% bottom – which is now the rising 50 dmas (red lines) – but we’re kind of losing faith in getting back there so we’re a little more aggressive with our buys now than we were last month.

What I love about our 5% rule is that, eventually, the charts finally catch up and confirm the levels we’ve been using as targets all year. As I said on Monday, July 26th (with the S&P at 1,102) we are finally at the "right" place in the indexes to reflect what we consider to be the true value of the equity indexes based on our fundamental analysis. That means, hopefully, we can just kick back and enjoy the trading range until something real comes along to change the game again.

Sadly, the global small charts are do not include today’s trading but we have the same very good visual representation of our watch levels:

The Nikkei had an UGLY day today and is a big concern as they fell 2.5% to 9,292 so right back to that mid-July low but that can be expected with the Yen up at 85 to the dollar as Uncle Bens QE2 (or, as Barry accurately calls it – QE 1.5) may not have been enough to make the markets happy (see my Fed notes and this neat side by side comparison) but it was plenty generous enough to devalue the dollar – AGAIN.

The Hang Seng fell to 21,294 (-0.8%) but the Shanghai made it’s 0.5% bounce (off yesterday’s 2.5% drop) back to 324. Bombay made a bombing run to the critical 18,000 line (down 149) but held it at 18,070 thanks to that 20 dma providing a bit of support. As of 8:30, the FTSE (5,297), DAX (6,176) and CAC (3,666) are all down about 1.5% and we REALLY want those lines to hold as they complete a 2.5% drop over 2 days and are also right on those 20 dmas which need to at least put up a fight if we expect our 50 dmas to provide proper support.

The Hang Seng fell to 21,294 (-0.8%) but the Shanghai made it’s 0.5% bounce (off yesterday’s 2.5% drop) back to 324. Bombay made a bombing run to the critical 18,000 line (down 149) but held it at 18,070 thanks to that 20 dma providing a bit of support. As of 8:30, the FTSE (5,297), DAX (6,176) and CAC (3,666) are all down about 1.5% and we REALLY want those lines to hold as they complete a 2.5% drop over 2 days and are also right on those 20 dmas which need to at least put up a fight if we expect our 50 dmas to provide proper support.

China has been ordering their banks to reclaim loans from trust companies and clean up their books. Industrial Output slowed substantially (still up 13.4% for the year) but inflation did not, rising 3.3% and curving up on the Russian wheat crisis. Minimum wages in China are up 20% since July 1st and so far, so good but we could run into trouble if the global economy does pick this month to slow down considerably so let’s keep an eye on corporate cash-flow in China!

Congress just does not get it as the House voted yesterday to CUT renewable-energy subsidies buy $1.5Bn, which is the second reduction this year, dropping the program to $25Bn from it’s original $50Bn. The boys at PimpCo couldn’t be more pleased as Tony Crescenzi says "The Federal Reserve’s decision to buy Treasuries and keep interest rates low will support “risk assets” without bringing down unemployment… “Low volatility tends to be good for the interest-rate climate,” said Crescenzi, who is based in Newport Beach, California at Pimco, manager of the world’s biggest bond fund. “It does push investors out the risk spectrum generally. That tends to be good for risk assets."

It’s going to be a good day for a little bottom fishing – providing we hold our watch levels, of course but be careful out there…