On Friday, we got involved into two brand new positions. The first position was in a Midterm Trade in Suntech Power (STP). This solar company is set to release earnings on Wednesday morning, and it should make some moves before earnings as solar has been killing earnings. This morning, Jinko Solar (JKS), for example, reported an EPS of 1.39 vs. the expected 0.58. We are involved with STP at 8.90, looking for 4-6%. Additionally, on Friday, we got involved in a Long Term Position in Sanitation Systems of Sau Paulo (SBS). This Brazilian company has great long term outlook, and I think it could be a great play for us moving forward. We are involved at 40.10.

On Friday, we got involved into two brand new positions. The first position was in a Midterm Trade in Suntech Power (STP). This solar company is set to release earnings on Wednesday morning, and it should make some moves before earnings as solar has been killing earnings. This morning, Jinko Solar (JKS), for example, reported an EPS of 1.39 vs. the expected 0.58. We are involved with STP at 8.90, looking for 4-6%. Additionally, on Friday, we got involved in a Long Term Position in Sanitation Systems of Sau Paulo (SBS). This Brazilian company has great long term outlook, and I think it could be a great play for us moving forward. We are involved at 40.10.

Futures are down this morning as we move into the open on news out of Japan that its Q2 growth slowed. Further, Japan’s economy is now smaller than that of China. There was not much economic news on the morning, but at 10 AM is the housing market index.

Let’s see if we can find some plays…

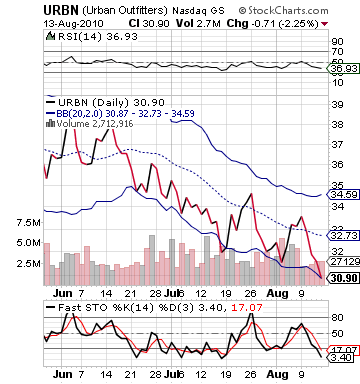

Buy Pick of the Day: Urban Outfitters Inc. (URBN)

Analysis: Monday is not looking like a high flying day thus far, but futures have started to move towards the green after a nice bullish report from the NY Fed Manufacturing Index that showed the index improving to 7.1 vs. the expected 5.1. The news is honestly one of the first positive economic data points I have seen in a week. While the index is not going to light a fire under the market, it does help keep things from falling even further to start this week. The 10 AM Housing Index will also be key. Overall, though, we are most likely at a neutral day with things not shifting too greatly. One stock, though, that I think has the ability to open at an extreme undervaluation and make a move this morning and into the afternoon is Urban Outfitters (URBN).

I am young enough where there was a time when URBN was my heaven. I only shopped at this store. Its a great mid-teen to college store, but it has felt the brunt of an exodus of money from the hands of these money spending hordes as they have declined in jobs and their parents’ wealth has decreased. The company, though, is set to make a nice rebound in Q2 of 2010. The company is set to report an EPS of 0.39 vs. one year ago’s 0.29. A solid improvement of 35% year-over-year. Unfortunately, URBN does not release their sales each month, so we do not know how well they are doing in numbers; however, the combination of expected growth and the current undervaluation of the company should make for a solid rise today.

None of URBN’s competitors have shined a light on their quarter as of yet. H&M’s parent company in Sweden released solid July sales numbers that improved 10%. The company also mentioned that they expect to continue to see rapid expansion. H&M is a close fashion counterpart to URBN, so it is good to see the company doing well. No other teen or young adult retailer has reported earnings as of yet.

H&M is a close fashion counterpart to URBN, so it is good to see the company doing well. No other teen or young adult retailer has reported earnings as of yet.

Technically, URBN becomes very attractives. After a solid rise to start August, last week the stock dropped around 8% to hit its lower bollinger band to close the week. The company is heavily oversold on fast stochastics, and it is below 40 even on RSI. The stock has over 10% upside to its upper bollinger band. There is a ton of selling going on with this stock over the past few sessions, but today should change the fate of the stock. There are not a lot of people looking to sell left, and the momentum of URBN should shift.

The retail sector has had a great start to Q2 earnings, and so I think URBN can play off of that. Couple that trend with undervaluation, and we have a solid Buy of the Day.

Entry: We are looking to enter URBN at 30.70 – 30.90.

Exit: We are looking to exit for a 2-3% gain.

Stop Loss: 3% on bottom.

Short Sale of the Day: Eastman Kodak (EK)

Analysis: I saw that Eastman Kodak (EK) was up over 5% in pre-market. Yet, there was no story to give weight to such a gain. Not even any juicy speculation on the oft mistaken message boards. So, I am not quite sure what drove EK up to such levels. On a slow Monday when literally nothing is heavily in the green, EK looked to be one of our only options for a short sale. Despite already having lost some pre-market value, I set a range where EK would have to gain above 4% today to make it into the range. With nothing truly moving EK, if it does hit this range, then it is definitely a great short sale.

sale.

Despite the stock is oversold, EK has been below 50 on RSI for every single day for three months except for about a four day stretch. The company is literally in a terribly slow death that is actually hard to watch. It is the fading of an industry and a way of life that just is no longer. So, anytime we see a 5% gain on EK, it is always followed by a 5% selloff. The company has made its way all the way to $8 in the last year, but that was a one time hurrah. The company most recently reported EPS at -0.51 vs. the expected -0.39. They are projected to hit another negative next month as well.

I really think it is only a matter of time till they are bought out, and the film industry becomes a niche industry for very certain professional photographers and artsy individuals. Eastman’s stock cannot survive.

We will definitely take advantage of a market spook, though. This morning, if EK cant travel back into the land of 4% – 5% up, then we can short it right away.

Entry: We are looking to short sale at 3.85 – 3.95.

Exit: We are looking to gain 2-3%.

Stop Buy: 3% on top.

Good Investing,

David Ristau