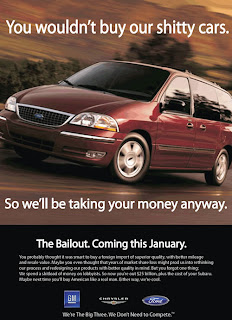

Can GM Really Call That an "Initial" Public Offering?

Courtesy of Jr. Deputy Accountant

Initial would imply they didn’t embarrass themselves by getting kicked off the exchange the first time around.

General Motors Co has completed the paperwork for an initial public offering, and timing of its filing with the U.S. securities regulators rests with the board of the top U.S. automaker, sources familiar with the process said on Monday.

The initial prospectus, expected to be for $100 million, is likely to be filed with the U.S. Securities and Exchange Commission on Tuesday, two people said, asking not to be named because the preparations for the IPO are private.

Meanwhile, GM will tell you they have paid back the government in full but that’s not exactly true. They’ve paid back the $6.7 billion they were actually loaned but the total $49.5 billion extended to GM to help it through bankruptcy is still outstanding. A large chunk of that (the part they DON’T mention in the "we paid you back!" commercials) consists of the government’s equity in GM, so GM can turn around and say they paid back the bailout loan and technically be correct. Tricky ain’t it?

It gets worse when you realize they used government money to pay back the government.

As it turns out, the Obama administration put $13.4 billion of the aid money as "working capital" in an escrow account when the company was in bankruptcy. The company is using this escrow money—government money—to pay back the government loan.

GM claims that the fact that it is even using the escrow money to pay back the loan instead of using it all to shore itself up shows that it is on the road to recovery. That actually would be a positive development—although hardly one worth hyping in ads and columns—if it were not for a further plot twist.

Sean McAlinden, chief economist at the Ann Arbor-based Center for Automotive Research, points out that the company has applied to the Department of Energy for $10 billion in low (5 percent) interest loan to retool its plants to meet the government’s tougher new CAFÉ (Corporate Average Fuel Economy) standards. However, giving GM more taxpayer money on top of the existing bailout would have been a political disaster for the Obama administration and a PR debacle for the company. Paying back the small bailout loan makes the new—and bigger—DOE loan much more feasible.

In short, GM is using government money to pay back government money to get more government money. And at a 2 percent lower interest rate at that. This is a nifty scheme to refinance GM’s government debt—not pay it back!

Now hurry up and file, GM, we’re waiting for the rest of our money back.