DARK HORSE HEDGE – Road To Nowhere

By Scott at Sabrient and Ilene at Phil’s Stock World

Maybe you wonder where you are

I don’t care

Here is where time is on our side

Take you there…take you there

Road to Nowhere, The Talking Heads

How do we make money on our long positions while believing, at least in the near term, that the market is on a road to nowhere? Selling option premium on our open long positions will create the yield enhancement for our beta neutral Dark Horse Hedge (DHH) virtual portfolio that we desire. The LONG positions in DHH were selected because we believe they are value long-term companies which will outperform the market over time. Ilene and I believe that we are in for a choppy 2-3 months, at least, and want to capture income on our long positions while we wait for the market to carry them higher.

Remember that each option contract covers 100 shares of the underlying stock. As we have discussed in the past, all strategies have a Alpha, Beta and Sharpe ratio, and option overlays are a good yield enhancer (Alpha). Over 60% of traded options expire worthless, and selling calls on our positions allows us to collect premium while holding onto our stocks. If the stock is selling above the strike price when the sold calls are set to expire, we will have to give up any gains beyond the strike price of the calls. However, we keep the premium that we sold to the call holder. If the stock is trading lower than the strike price, we keep the stock plus the amount we collected from selling the calls.

Sell FRX Nov $29 call on Tuesday, August 17, 2010 (+$1.35)

In our virtual portfolio we allocated 7.5% of the $100,000 virtual portfolio to purchase FRX on 7/26/10. We are recommending selling 2 contracts (200 shares) of FRX101120C00029000 for $1.35/contract. By doing so we are lowering our cost basis by $1.35 and agreeing to sell 200 shares (which we already own) of FRX between now and November 19, 2010. If FRX is below $29 we increase our yield (much like a dividend) on FRX by $1.35 and can decide at that time based on market and company progress to sell another option contract, sell the stock or simply hold. We also have the option on any date to purchase the option back which we will do if it moves below $.50 with any reasonable amount of time left on the contract.

Sell GME Oct $20 call on Tuesday, August 17, 2010 (+$1.35)

In our virtual portfolio we allocated 7.5% of the $100,000 virtual portfolio to purchase GME on 7/23/10. We are recommending selling 3 contracts (300 shares) of GME101016C00020000 for $1.35/contract. By doing so we are lowering our cost basis by $1.35 and agreeing to sell 300 shares (which we already own) of GME between now and October 15, 2010. If GME is below $20 we increase our yield (much like a dividend) on GME by $1.35 and can decide at that time based on market and company progress to sell another option contract, sell the stock or simply hold. We also have the option on any date to purchase the option back which we will do if it moves below $.50 with any reasonable amount of time left on the contract.

Sell WDC Oct $26 call on Tuesday, August 17, 2010 (+$1.15)

In our virtual portfolio we allocated 7.5% of the $100,000 virtual portfolio to purchase WDC on 7/13/10. We are recommending selling 2 contracts (200 shares) of WDC101016C00026000 for $1.15/contract. By doing so we are lowering our cost basis by $1.15 and agreeing to sell 200 shares (which we already own) of WDC between now and October 15, 2010. If WDC is below $26, we increase our return (much like a dividend) on WDC by $1.15 per 100 shares of stock, and we can decide at that time based on market and company progress whether to sell additional calls, sell the stock, or simply hold. We also have the option on any date to purchase the option back which we will do if it moves below $.50 with any reasonable amount of time left on the contract.

Sell XRTX Dec $12.50 call on Tuesday, August 17, 2010 (+$1.06)

In our virtual portfolio we allocated 7.5% of the $100,000 virtual portfolio to purchase XRTX on 7/1/10. We are recommending selling 5 contracts (500 shares) of XRTX101218C00012500 for $1.06/contract. By doing so we are lowering our cost basis by $1.06 and agreeing to sell 500 shares (which we already own) of XRTX between now and December 17, 2010. If XRTX is below $12.50 we increase our yield (much like a dividend) on XRTX by $1.06. Later, we will consider selling another five option contracts against our XRTX position. We also have the option on any date to purchase the option back.

Remember to adjust the amount of contracts to match your virtual portfolio size.

*****

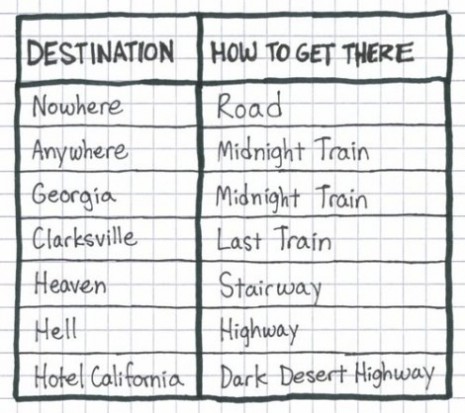

And if you wish to hear more music tips about your traveling plans, here’s a ROCK AND ROLL ROAD MAP FOR DUMMIES, via Marc Campbell at Dangerous Minds.