Hello everybody. Happy Wednesday. It’s another slow, dreary day on the market. So, let’s make it exciting by looking into an Overnight Trade that can make us some nice returns. Our Play of the Week and half Overnight Trade in Suntech Power (STP) worked out rather well. Yesterday, the stock jumped up 4% during the trading session and returned most of our losses and then some. Before the close, I exited half the position at 9.00. The other half we exited this morning. The company reported EPS in line, and then raised its 2010 outlook and CapEx. I had a market order ready to go for the open and got out at 9.24. That was an average exit of 9.12. On an entry of 8.90, we made a solid 2.75%.

Hello everybody. Happy Wednesday. It’s another slow, dreary day on the market. So, let’s make it exciting by looking into an Overnight Trade that can make us some nice returns. Our Play of the Week and half Overnight Trade in Suntech Power (STP) worked out rather well. Yesterday, the stock jumped up 4% during the trading session and returned most of our losses and then some. Before the close, I exited half the position at 9.00. The other half we exited this morning. The company reported EPS in line, and then raised its 2010 outlook and CapEx. I had a market order ready to go for the open and got out at 9.24. That was an average exit of 9.12. On an entry of 8.90, we made a solid 2.75%.

Let’s find another opportunity that can make that sort of return and more…

Overnight Trade of the Day: Tech Data Corp. (TECD)

Analysis: We have made a good deal of money off of the technology sector this quarter, and I want to continue that trend with another Overnight Trade. This time we turn to a new industry in wholesale IT solutions. Basically, we are looking at a technology distributor. For how well semiconductors have been doing so far this year, those semiconductors have to be going to something that needs to be sold. The second cycle of the industry hits the actual technology products and those that distribute them. With its earnings May – July, Tech Data Corp. (TECD) might just be the company that can deliver some outstanding results.

looking at a technology distributor. For how well semiconductors have been doing so far this year, those semiconductors have to be going to something that needs to be sold. The second cycle of the industry hits the actual technology products and those that distribute them. With its earnings May – July, Tech Data Corp. (TECD) might just be the company that can deliver some outstanding results.

TECD is a information technology distributor and also works as a consultant to companies buy their technology and helps with logistics and optimization. The company is the world’s second largest technology distributor behind Ingram Micro. he company is estimated to report EPS at 0.78 vs. one year ago’s 0.70. The company saw in its quarter previous EPS at 0.88. What initially attracted me to TECD was its undervaluation moving into earnings and its continuous success at beating earnings estimates.

In Q2 of 2010, worldwide PC sales grew 22% year-over-year.

“The PC market remains robust, and in a recovery phase, despite challenges to a broader economic recovery, such as slow job growth and a more conservative outlook in Europe and Asia/Pacific,” said Jay Chou, research analyst with IDC’s Worldwide Quarterly PC Tracker. “The factors which led to the recent PC rebound – an aging commercial installed base, a proliferation of low-cost media-centric PCs, and low PC penetration through much of the world – remain key drivers going  forward.”

forward.”

Tech Data is not only in the PC market. They also sell a wide array of cell phones, IT solutions, data storage devices, and are very well diversified across the entire technology sector. Cell phones saw a 14% rise from one year ago in sales. IBM commented that their Q2 earnings were strong due solely to the fact that they are seeing a heavy rise in their data storage devices. Tech Data is at the distribution of all these types of products.

What has happened is that many companies are arming themselves for a recovery by doing what is necessary and preparing their armor and weapons…their technology equipment. One of the best ways to improve efficiency and deal with competition is to increase your technology prowess. With continuous advances in technology, aging commercial tech equipment has to replaced, and TECD is at the front of all those relationships.

Tech Data only really has one compatible competitor in Ingram Micro (IM). The company, in its Q2 earnings report beat expectations by 10% and was in line with its Q1 earnings. If TECD could come close to its Q1 earnings, they could see a solid 15% earnings beat and would definitely see a rise in shares.

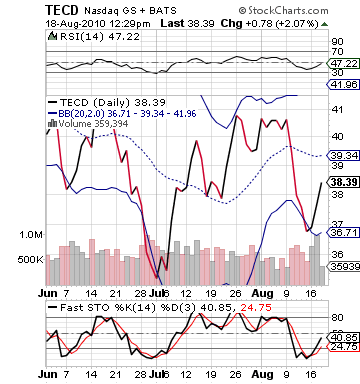

With its current undervaluation, the company does not need a whole lot to get some movement. The stock has dropped 10% since the beginning of last week, and it currently sitting below 50 on RSI. It hit the bottom of fast stochastics oversold category and is actually bouncing back as of the past two days. Catching this stock on its upswing could be even more beneficial to our gains. People are showing some interest moving into earnings, which is a good sign!

Entry: We are looking to get involved from 38.00 – 38.20.

Exit: We are looking to exit tomorrow morning after earnings are reported.

Stop Loss: None.

Good Investing,

David Ristau