58 out of 58 Economists Overoptimistic on Philly Fed Manufacturing Estimate; Median Forecast +7 Actual Result -7.7, a "Veritable Disaster"

Courtesy of Mish

They may call economics the "dismal science" but it would be hard pressed to find a more optimistic lot than economists, anywhere in private industry.

Fresh on the heels of a perfect 42 of 42 overoptimistic predictions on weekly claims (Please see Weekly Unemployment Claims Hit 500,000, Exceed Every Economist’s Estimate; No Lasting Improvement for 9 Months), a perfect 58 out of 58 Economists were overoptimistic regarding the Philly Fed Manufacturing survey.

Unexpected Shrinkage

Bloomberg reports Factories in Philadelphia Area Unexpectedly Shrink

Manufacturing in the Philadelphia region unexpectedly shrank in August for the first time in a year as orders and sales slumped, a sign factories are being hurt by the U.S. economic slowdown.

The Federal Reserve Bank of Philadelphia’s general economic index fell to minus 7.7 this month, the lowest reading since July 2009, from 5.1 in July. Readings less than zero signal contraction in the area covering eastern Pennsylvania, southern New Jersey and Delaware.

Economists forecast the measure would rise to 7, according to the median of 58 projections in a Bloomberg News survey. Estimates ranged from minus 6 to 10.

The Philadelphia Fed’s survey was in sync with a report this week from the Fed Bank of New York. The bank’s so-called Empire State Index increased less than forecast, as orders and sales cooled.

Forecast for "More Modesty"!

“We expect the recovery that we’ve seen in our business to continue, but in a more moderate pace than we’ve experienced in the first half,” Chief Financial Officer Nicholas Fanandakis said on a conference call with analysts.

Fed policy makers last week voted to keep the benchmark interest rate at a record low and made their first attempt to shore up a recovery they said was likely to be “more modest” than earlier anticipated.

Philly Fed Business Outlook Survey

With that undoubtedly overoptimistic "modest recovery" out of the way, please consider actual results from the Philly Fed Business Outlook Survey.

Results from the Business Outlook Survey suggest that regional manufacturing activity weakened in August, after two months of slowing activity. Indexes for general activity, new orders, and shipments all registered negative readings this month.

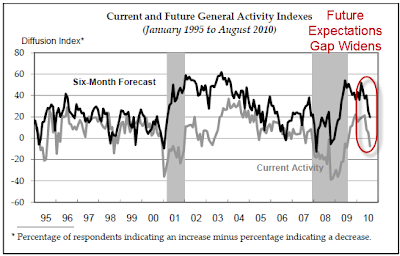

Firms also reported declines in employment and work hours. The survey’s broad indicators of future activity continue to suggest that the region’s manufacturing executives expect growth in business over the next six months, but optimism has waned notably in recent months.

Indicators Suggest Weakness

The survey’s broadest measure of manufacturing conditions, the diffusion index of

current activity, decreased from a reading of 5.1 in July to ?7.7 in August. The index turned negative, marking a period of declining monthly activity for the first time since July 2009.Indexes for new orders and shipments also suggest a slowing this month; the new orders index fell slightly, to ?7.1, while the shipments index turned negative, declining to ?4.5. Indicating weakness, indexes for both delivery times and unfilled orders remained negative this month.

The percentage of firms reporting a decline in employment (23 percent) was higher than the percentage (20 percent) reporting an increase. More concerning was the significant drop in the average employee workweek index from 1.7 in July to ?17.1 in August.

Firms Report Lower Prices for Products

On balance, firms reported declines in prices for their own manufactured goods: More firms reported decreases in prices (19 percent) than reported increases (6 percent).

Future Expectations Gap Widens

Veritable Disaster

This was not a "weak report" this was a "veritable disaster".

click on table for sharper image

Note that every component of the index except for prices paid is in contraction. This represents a massive squeeze on profits.

Also note the huge, widening spread between current conditions and future expectations. One of them is wrong and I suggest manufacturers are taking their clues from clueless economists who continually think things are going to get better.

Flashback July 15, 2010

Here are some comments I made a month ago in Philly Fed Manufacturing Index Barely Positive, Future Expectations Overly Optimistic

Where To From Here?

If manufactures are ramping up production, even modestly, in expectations for a better second half, they are going to regret it.

Data suggests durable goods sales are about to collapse.I made the case for a significant manufacturing slowdown in Expect Second-Half Housing and Durable Goods Crash. Please take a look.

Manufacturers may be more optimistic six months from now, but consumer attitudes suggest something dramatically different. Ramping up production is the wrong thing to do.

Amazingly, optimism still remains supreme in nearly every economic report. There is virtually no reason for it.