Bond funds are attracting cash like stocks during the dot-com boom.

Bond funds are attracting cash like stocks during the dot-com boom.

That's the headline this morning on Bloomberg, who says: "The amount of money flowing into bond funds is poised to exceed the cash that went into stock funds during the Internet bubble, stoking concern fixed-income markets are headed for a fall. Investors poured $480.2 billion into mutual funds that focus on debt in the two years ending June, compared with the $496.9 billion received by equity funds from 1999 to 2000, according to data compiled by Bloomberg and the Washington-based Investment Company Institute." $480Bn?!? Whuck!?!

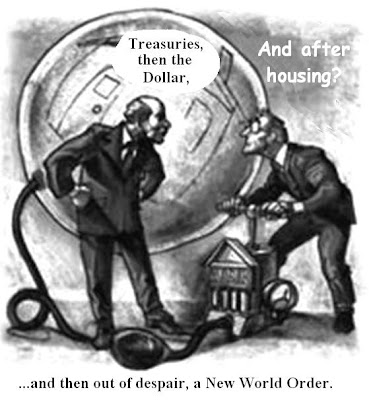

First of all, who the hell has $480Bn to do anything with in this economy? That's where I stop reading and start pondering. Of course, not all this cash is from America but holy cow – that is A LOT of money in these troubled times. Imagine if some of that money starts going into equities. Well, don't imagine that if you are bearish because you won't be able to sleep at night! The cash inflows have pushed investment-grade US Corporate Debt down to a record 3.79% while Treasury Yields fell to an all-time low of 0.5%.

The money flowing into bonds is “probably not repeatable on a consistent basis,” said Joel Levington, managing director of corporate credit in New York at Brookfield Investment Management Inc., which oversees $24 billion. “Eventually it won’t be sustainable. Whether that means five years from now or five weeks is a little difficult to tell,” he said. Let's be very clear about that last part – in order for any bubble to sustain itself it must continue to be fueled. $480Bn is A LOT of money being put into instruments that provide little return. I just did some charts and data on historical inflation in this weekend's "Defending Your Virtual Portfolio With Dividends" post for Members as we already see the writing on the walls with the Bond market and need to move into things that will actually make money (and protect our basis – which bonds do not at these levels).

Investors took $9.1 billion OUT of equity funds in the week to Aug. 19, the most since July, according to Oleg Melentyev, a credit strategist at Bank of America Merrill Lynch Global Research in New York. Stock funds have had $215.4 billion of outflows the two years ended June, ICI data show. Citigoup's Tobias Levkovich says The “extremities of the money flows” into fixed income from equities is troubling. "In 2000 or late 1999, we saw massive amounts of money going into the equity market at just the wrong time,” he said, while still predicting the S&P 500 Index will rise 9.6 percent from now to end the year at 1,175. “I feel the same way when I look at all the money going into bonds.”

Investors took $9.1 billion OUT of equity funds in the week to Aug. 19, the most since July, according to Oleg Melentyev, a credit strategist at Bank of America Merrill Lynch Global Research in New York. Stock funds have had $215.4 billion of outflows the two years ended June, ICI data show. Citigoup's Tobias Levkovich says The “extremities of the money flows” into fixed income from equities is troubling. "In 2000 or late 1999, we saw massive amounts of money going into the equity market at just the wrong time,” he said, while still predicting the S&P 500 Index will rise 9.6 percent from now to end the year at 1,175. “I feel the same way when I look at all the money going into bonds.”

Meanwhile, stocks are holding up pretty well considering the $215Bn outflow handicap since June of 2008. The Dow was at 11,350 on June 30th of 2008 and, despite the long, strange trip we've been on – we're only down 10% at 10,200. The S&P was at 1,280 on the same date in '08 and is down 16%, which makes sense since the Dow was goosed by the switch from GM and C to TRV and CSCO, who have helped boost the Dow's performance since last June and make historical Dow Jones comparisons a little tricky. I had advocated replacing GM with TM, which would have been more realistic but Uncle Rupert never listens to me otherwise he wouldn't have gotten caught with his hand in the cookie jar by John Stewart:

| The Daily Show With Jon Stewart | Mon – Thurs 11p / 10c | |||

| News Corp. Gives Money to Republicans | ||||

|

||||

At least Rupert's money is well spent as trust in Government has never been lower. Heck, if I say something positive about Washington I get a ton of angry EMails calling me a sell-out so I guess I'd better learn to be a good boy and just blindly hate everything about Washington if I want to "fit in," right? Speaking of Australians can make Americans say "how high" when they say "jump," it's the LIBERALS in Australia who want to kill the mining tax and that may happen as the Labor Party has been unable to form a majority in this weekend's elections (civilized countries have their elections on weekends so the people who work are able to vote). This could be great news for RTP and BHP (who are bidding for POT) as they are slated to be hit with $9.4Bn worth of taxes in the first two years of the levy.

A fun way to play RTP long-term (and a nice inflation hedge) is to buy the 2012 $47.50 calls for $11.70 and sell the 2012 $52.50 calls for $9.50, which is net $2.20 on the $5 spread. RTP is currently at $51.05, so you start out with this trade $3.55 in the money (up 61% if it expires here) with an upside potential of $2.80 (127%) and a maximum loss of $2.20 but a stop at $1.10 is sensible and the net delta on the spread is .07, which means a $10 drop in RTP should only cost you about .70 in the short-term so a fairly easy-to-manage trade that should be well on track if either the mining tax goes away or it turns out to not look like too big of a hit or if we have runaway metals inflation that boosts RTP's earnings or if some of that bond money just flows back into the markets. Lots of good reasons to try this one!

A fun way to play RTP long-term (and a nice inflation hedge) is to buy the 2012 $47.50 calls for $11.70 and sell the 2012 $52.50 calls for $9.50, which is net $2.20 on the $5 spread. RTP is currently at $51.05, so you start out with this trade $3.55 in the money (up 61% if it expires here) with an upside potential of $2.80 (127%) and a maximum loss of $2.20 but a stop at $1.10 is sensible and the net delta on the spread is .07, which means a $10 drop in RTP should only cost you about .70 in the short-term so a fairly easy-to-manage trade that should be well on track if either the mining tax goes away or it turns out to not look like too big of a hit or if we have runaway metals inflation that boosts RTP's earnings or if some of that bond money just flows back into the markets. Lots of good reasons to try this one!

Of course miners risk the dreaded "China slowdown," if it ever really comes but I'm still hoping for a US speed-up but the anti-stimulus rhetoric is still coming in hot and heavy from the do-nothing side of the aisle. US Corporations are sitting on record piles of cash and they have their pick of the litter with what little hiring they do decide to do and the last thing they want is the US government putting people back to work – especially in small businesses that may offer quality local service and production to draw consumers away from their cheap, outsourced goods and labor.

One way to keep US consumers from "buying American" for a little bit more money is to make sure they don't have any and the banksters are on the job, jamming credit-card rates to a new nine-year high. The EU continues to NOT be a safe haven for investors so, despite the many and obvious concerns, I still like US equities. Mike O'Rourke of BTIG agrees with me and says that "the current environment is that the level of equity undervaluation relative to Treasuries today using this model is equivalent to the extreme levels registered in early March of last year." (see chart)

We're not going to hang our hats on it but we will continue to watch our levels, which have yet to be breached in a meaningful manner and, when you consider the handicap of negative outflows from retail investors as well as the flows we discussed above – that's pretty impressive so far. We have Durable Goods, New Home Sales and revised Q2 GDP this week so light data but Durable Goods will be a big market mover, especially if it's negative.

It's going to be an interesting week. We're ready to look up but let's be careful out there!