Last week was quite atrocious for the markets, but we managed to come out of it pretty unscathed. This week, we will be looking to continue our successes, starting with today’s Play of the Week and Overnight Trade. We finished off the week on Friday with a Long Term Play in Ford Inc. (F). I like the company’s long term outlook amidst an undervaluation and upcoming GM IPO. I think it has a potential 100% growth opportunity.

Last week was quite atrocious for the markets, but we managed to come out of it pretty unscathed. This week, we will be looking to continue our successes, starting with today’s Play of the Week and Overnight Trade. We finished off the week on Friday with a Long Term Play in Ford Inc. (F). I like the company’s long term outlook amidst an undervaluation and upcoming GM IPO. I think it has a potential 100% growth opportunity.

The market has been pretty rattled, but there are a lot of basement bargains out there, and the market cannot continue on down like this with the same repetition. I think we will have a seesaw week with some stocks being able to break out while others remain pretty much neutral.

Let’s take a look at a stock that I think has a lot of potential to move throughout the end of the day and break out with earnings tomorrow morning…

Overnight Trade: Trina Solar Inc. (TSL)

Analysis: Trina is one of our Long Term Virtual Portfolio Plays that has been the top performer. We got involved at the end of May at 17.25 and have been holding ever since. We have a FV estimate for the company at $30. Trina is one of solar’s top performers and most established company that has begun a solid diversification out of Europe, where in 2008 it did 95% of its business, to the USA, China, and other Asian nations. Tomorrow morning, Trina is set to release its Q2 earnings that are expected to be at 0.49 EPS. This will be a solid improvement from one year ago’s EPS of 0.36.

The company is attractive as an OT for a number of reasons. First off, Trina is in an industry that is performing very well in this earnings season. Nearly every solar company is blowing earnings out of the water. Since they started reporting in August, 10/13 or 78% have reported surprise earnings. One miss from JA Solar (JASO) was due to a large accounting decrease. Most of the major swingers like First Solar (FSLR), Yingli Green (YGE), and SunPower (SPWRA) have all made major movements upwards after reporting their earnings.Trina is in a position where it has most likely been undervalued due to too heavy markdowns on currency exchanges.

Trina, itself, had a very solid May through July and is solar’s company with the highest gross margins due to its ability to produce highly efficient crystalline PV cells at a very inexpensive rate. It is only outpaced in low cost by First Solar (FSLR). For the three month period, Trina got two key upgrades from Jeffries and CitiGroup. I always like to see a company getting upgrades in a reporting month because it signals that the big guns are behind the stock as well, and they don’t want to see it falter. Jeffries believes solar power will grow 80% this year and that the market should be won by company’s with the best cost structure, a la Trina. Citi copied me in June with a $30 price target.

Citi analyst Timothy Arcuri commented, "We see solid execution, no need for capital, conservative estimates, and sustained cell/module cost advantages all at a discounted valuation" for Trina.

Additionally, in the past three months, the company made some great movement into the USA. The company is set to supply Southern California Edison with 45 MW of PV cells between June 2010 and the end of Q1 of 2011. This is a significant deal that continues to allow Trina to hedge its business in Europe. The deal will supply around 25,000 homes with solar panels. The company has its US headquarters in San Fransisco and is right in the heart of that market. The company, additionally, got a deal to supply SunEdison through its US subsidiary, showing that the company continues to grow in the USA.

Additionally, in the past three months, the company made some great movement into the USA. The company is set to supply Southern California Edison with 45 MW of PV cells between June 2010 and the end of Q1 of 2011. This is a significant deal that continues to allow Trina to hedge its business in Europe. The deal will supply around 25,000 homes with solar panels. The company has its US headquarters in San Fransisco and is right in the heart of that market. The company, additionally, got a deal to supply SunEdison through its US subsidiary, showing that the company continues to grow in the USA.

Further, tariff cuts in Germany and Italy were not as great as originally feared, which will help keep revenue up and costs down through the end of the year. Cuts will start to take place in 2011. Most of these cuts are already priced into the stock, and the ability for these to continue to be reduced will help Trina.

The big worry for Trina continues to be its currency exchange. Most other companies have been able to hedge currency and not seen a great deal of loss attributed to it. CEO Jifan Gao, on the subject, commented, "With regard to current macroeconomic concerns involving the European markets and the euro, we are still seeing strong demand for our products, and that our shipment flow to customers has not been negatively affected by credit availability or other related factors. We continue to expand and refine our internally-managed currency hedging program, which has been in place since the fourth quarter of 2008."

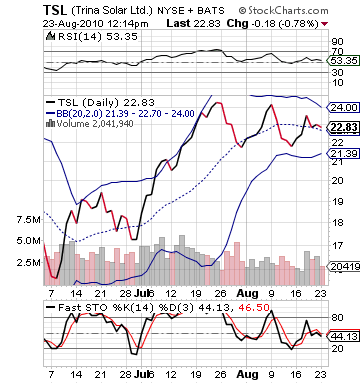

Technically, TSL is in a great position to make a large rise tomorrow morning. The stock has around 8% growth capability to its upper bollinger band, and as we have all seen, a good earnings report can take a company well over that upper band. The stock is a bit overvalued on RSI at 53, but this is actually a low number for the company that has been operating above 53 for quite a significant amount of time. Additionally, the stock is in the oversold category on fast stochastics. A lot of buyers are still on the sideline, waiting for earning.

Trina is in a great position to beat earnings and make a move tomorrow!

Entry: We are looking to get involved at 22.50 – 22.65.

Exit: We are looking to exit tomorrow morning after earnings are reported.

Stop Loss: 3% on bottom.

Good Investing,

David Ristau