DARK HORSE HEDGE – Don’t let the sun (profits) go down

By Scott at Sabrient and Ilene at Phil’s Stock World

Recovery in danger as firms, homebuyers cut back – AP

Not exactly the kind of headline that anyone wants to wake up to, but if you simply change a few words, it is as if we have slipped into the movie Groundhog Day. Each day’s gloomy headline is much like the day before’s, with a few words changed. Fortunately, DHH began with the premise that how news is going to be headlined and short-term market moves have proven over time to be nearly impossible to predict with any consistency.

So we seek to have long positions that are the best of the best, leveraged against short positions that are the worst of the worst. We combine the ability to reduce beta, or market correlation, with two alpha (return) improving measures. Our first measure is to tilt the balance of the Long/Short portfolio based on market trend, and the second is to use options for yield enhancement.

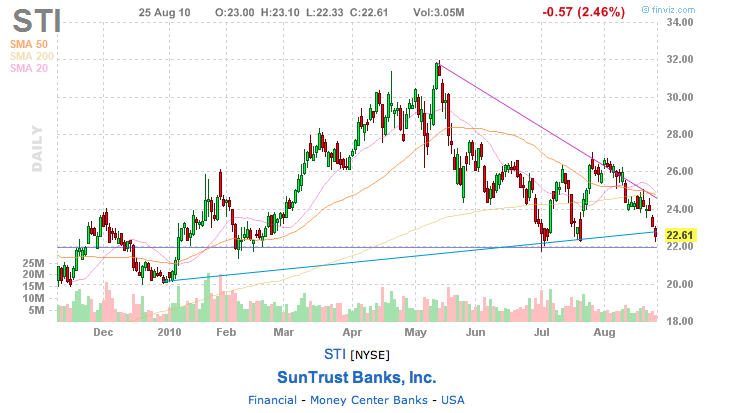

We are currently in the middle of a 5th consecutive down day for the S&P 500 and we believe in taking profits off the table when the risk/reward premise changes. DHH recommended a short position in SunTrust Banks, Inc. on July 13, 2010 at $25.54 and following the companies $750 Million tender offer of debt on Monday, we believe it is time to cover our STI short position at these prices. We have earned a 11.9% profit in just over a month, and so it is time to let the sun go down alone if its trend continues, but not to let our profits go down.

BUY TO COVER SunTrust Bank, Inc. (STI) at the market, Wednesday, August 25, 2010

Chart from Finviz.

So what kind of positions do we want to add in this market? One that I like and am recommending is VEECO Instruments Inc. (VECO) using Phil Davis’s buy/write strategy. VECO has a strong buy rating from Sabrient, with excellent scores for growth and value.

Excerpt from Sabrient’s Ratings Report for VECO:

Veeco Instruments Inc., together with its subsidiaries, designs, manufactures, and markets solutions for customers in the high brightness light emitting diode (HB LED), solar, data storage, scientific research, semiconductor, and industrial markets worldwide.

Earnings and Revenue Update: For the quarter ended June 30, 2010, Veeco reported earnings of $52.4 million or $1.20 per share compared with $26.0 million or $0.62 per share for the prior quarter and $-14.7 million or $-0.47 per share for the same quarter one year ago. Revenues were $253.0 million for the quarter ended June 30, 2010 compared with $163.2 million for the prior quarter and $72.0 million for the same quarter one year ago. Last twelve months’ earnings were $2.42 per share compared with $-3.56 per share a year ago. Last twelve months’ revenues were $661.6 million compared with $360.9 million a year ago.

Sabrient Analysis

Sabrient rates VECO a Strong Buy for its superior value and growth profiles, which indicates a stock that should outperform the market.

- Growth: VECO earns exceptional marks as a growth stock with a Sabrient Growth Score of 97.6. Rigorous backtesting reveals that stocks with similar growth profiles outperform the market in the long term. A high growth stock does carry the risk of substantial downside price movement if the company should miss its earnings targets.

- Value: VECO receives top marks for value with a Sabrient Value Score of 88.2.

- Momentum: VECO scores 59.7 for the Sabrient Momentum Score, which is a composite measure of price, earnings and group momentum.

- Timeliness: VECO has a Sabrient Timeliness Score of 39.1. This is a composite measure of short-term and long-term price performance and long-term group performance.

VECO has performed remarkably well beating estimates handily the last four quarters. Because we are in a SHORT tilt situation, we are adding a long (1/2 position at this time or 3.75%) and selling the Oct $32 call for $3 and selling the Oct $32 put for $3.20. We are able to take advantage of market weakness and pick up VECO, trading at $32, and bring in $6.20 in option premium while we wait for market strength to take it higher later in 2010 or early 2011.

BUY Veeco Instruments, Inc. (VECO) at the market, Wednesday, August 25, 2010

Our strategy (for each 100 shares of VECO stock, sell 1 Oct. $32 call and 1 Oct. $32 put):

- Buy Veeco Instruments, Inc. (VECO) at the market, Wednesday, August 25, 2010 (1/2 position, 3.75% of portfolio, because we are selling puts to make up the other half of this position). VECO is currently trading at $32.

- Sell VECO Oct $32 call at the market, Wednesday, August 25, 2010: Sell VECO101016C00032000 call at $3.00.

- Sell VECO Oct $32 puts at the market, Wednesday, August 25, 2010: Sell VECO101016P00032000 put at $3.20.

Alternative strategy (selling calls, without selling puts):

- Buy Veeco Instruments, Inc. (VECO) at the market, Wednesday, August 25, 2010 — full position

- Sell VECO Oct $32 call at the market, Wednesday, August 25, 2010 — 1 call per each 100 shares VECO long

*****

Don’t Let the Sun Go Down on Me – Elton John