Burning Down the House; New Home Sales Consensus 330K, Actual 276K, a Record Low; Nationwide, Zero New Homes Sold Above 750K

Courtesy of Mish

Courtesy of Mish

I failed to comment yesterday on the huge miss by economists on consensus new home sales, but Rosenberg has some nice comments today in Breakfast with Dave.

Once again, the consensus was fooled. It was looking for 330k on new home sales for July and instead they sank to a record low of 276k units at an annual rate. And, just to add insult to injury, June was revised down, to 315k from 330k. Just as resales undercut the 2009 depressed low by 15%, new home sales have done so by 19%. Imagine that even with mortgage rates down 100 basis points in the past year to historic lows, not to mention at least eight different government programs to spur homeownership, home sales have undercut the recession lows by double-digits.

in the aftermath of a credit bubble burst and a massive asset deflation, trauma has set in. The rupture to confidence and spending from our central bankers’ and policymakers’ willingness to allow the prior credit cycle to go parabolic has come at a heavy price in terms of future economic performance. Attitudes towards discretionary spending, credit and housing have been altered, likely for a generation.

The scars have apparently not healed from the horrific experience with defaults, delinquencies and deleveraging of the past two years — talk about a horror flick in 3D. The number of unsold homes on the market exceeds four million and that does include the shadow bank inventory, which jumped 12% alone in August, according to the venerable housing analyst Ivy Zelman.Nearly 1 in 4 of the population with a mortgage are “upside down” and as a result are now prisoners in their own home. We have over five million homeowners now either in the foreclosure process or seriously delinquent. The government’s HAMP program was supposed to bail out between 3 and 4 million distressed homeowners and instead we have only had a success rate of fewer than half a million.

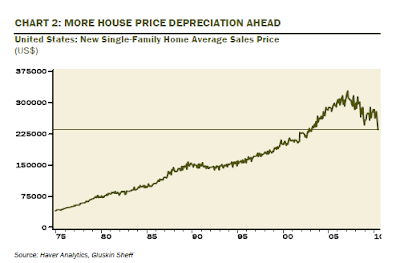

Now back to the new home sales data. Every region in the U.S. was down, and down sharply. The homebuilders did not cut their inventory levels and as a result, the backlog of new homes surged to 9.1 months’ supply from 8.0 months in June, which means more discounting and margin squeeze is coming in the homebuilder space. As it stands, median new home prices were sliced 6% in July and this followed on the heels of a 4.7% drop in June. And, at $235,300, average new home prices are down to levels last seen in March 2003, down nearly 30% from the 2007 peak. If the truth be told, if we are talking about reversing all the bubble appreciation that began a decade ago, then we are talking about another 15% downside from here. The excess inventory data alone tell us that this has a realistic chance of occurring.

The high-end market, in particular, is under tremendous pressure. In fact, it is becoming non-existent. Guess how many homes prices above $750k managed to sell in July. Answer — zero, nada, rien; and for the second month in a row. Only 1,000 units priced above 500,000 moved last month. That’s it! Over 80% of the homes that the builders managed to sell were priced for under $300,000. Just another sign of how this remains a full-fledged buyers’ market — at least for the ones that can either afford to put down a downpayment or are creditworthy enough to secure a mortgage loan (keeping in mind that 25% of the household sector does have a sub-600 FICO score).

This is going to sound like a broken record but it took a decade of parabolic credit growth to get the U.S. economy into this deleveraging mess and there is clearly no painless “quick fix” towards bringing household debt into historical realignment with the level of assets and income to support the prevailing level of liabilities. We are talking about $6 trillion of excess debt that has to be extinguished, either by paying it down or by walking away from it (or having it socialized).

New Privately Owned Housing Units Started

click on any chart for sharper image

Single Family New Home Sales

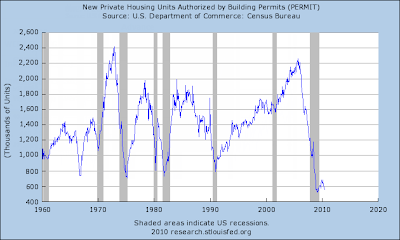

Building Permits

Inventory is up, sales are down, sentiment has soured, and tax credits have gone poof.

Prices will follow.