OK, time to get it over with.

OK, time to get it over with.

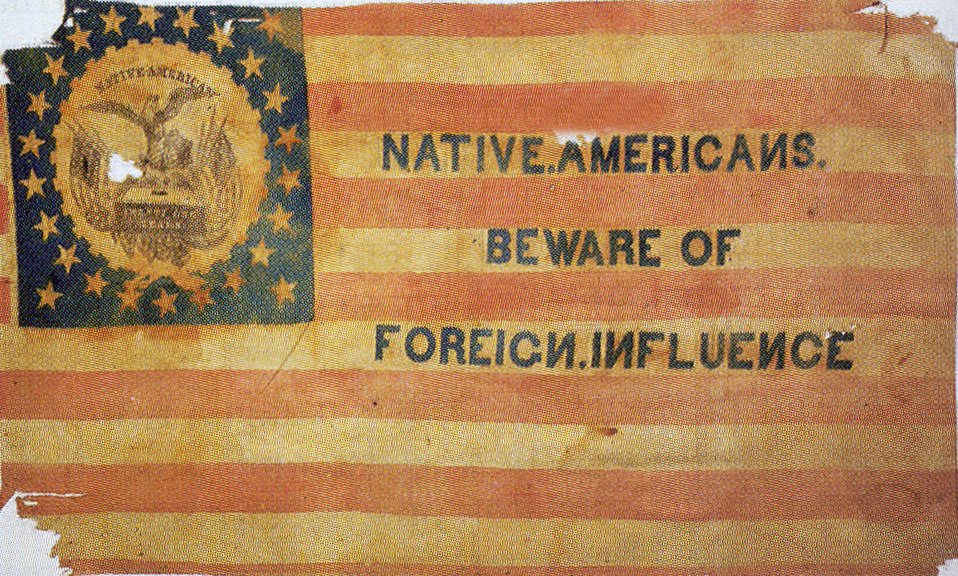

One thing that has been clear this week is that everyone has an opinion, and they are all wrong. Tim Eagan points out in "Building a Nation of Know Nothings" that you can look in a newspaper these days and he sports scores and temperature are not subject to debate, but pretty much everything else is. What happened to facts? What happened to truth? Tim uses the example that 27% of the people polled (generally Republicans) actually believer Obama wa not born in Hawaii, even though my 8 year-old daughter can Google his birth cirtificate.

That does not stop Fox news, who donated $1M to Republican candidates this year from having guest after guest come on their station and continue to spew this nonsense without once being corrected by the "moderators" who, more often than not, simply dogpile on whatever BS agenda is being pushed that day.

How does this affect our investments? Well, when the nation's #1 news network is a total joke, then why should the financial news networks act any differently – clearly they are just "giving the people what they want" – as if that excuses everything in Circus Maximus America.

Speaking of clowns, woe unto us when Jim Cramer is the voice of reason but last night he said:

The problem with these data-inspired sell-offs, though, is that we don’t actually have enough data to justify them. The Chicago and Maryland Feds say positive things one day, the Philadelphia and New York Feds say something negative the next. Put simply, there is not enough information out there to warrant the big swings or big moves like we've had this week. Yet we are trading on every little data point, be it macro or micro.

Bearish sentiment has now hit 70%, historically a buy signal so it will be good to finally get this expected downward revision to the GDP over with so we can move on. Yesterday I asked if the media tail was wagging our dog of an economy or is the MSM just giving investors what they want – a very bearish outlook! My comment in member chat was:

Calling the recovery a failure because it’s slow is really what the problem is with the attitude of the MSM – it’s short-sighted at best. There are way too many people who have their money invested in the bear case and they will say anything to create an environment that is likely to make them a profit.

That is the sad reality of a market where bearish sentiment is 70% – the top 10% (70% of whom are bearish) stop spending and stop hiring and the MSM, who "give the people what they want" both echo and magnify that sentiment and eventually you have a majority of the media and the people CELEBRATING bad news and taking pleasure in the destruction of wealth in this country. This is the problem with a system that enables profitable betting on destruction – while there is a healthy "price discovery" mechanism, of course, they system has been perverted when you can have a bearish majority (in the investing class – I’m sure the bottom 90% would rather have jobs), who want government to fail, and business to fail and cities to fail and countries to fail – all so they can make their individual profits.

Speaking of profits. Robert Reich has an excellent plan to re-tool the Payroll Tax deduction and stop taking 12.4% of the first $20,000 in income. That works out to a $1,240 tax break for ever working person in America AND THE PEOPLE THEY WORK FOR – a very nice, constant stimulus that can put money right back into the economy. How do we then pay for it? Simply by charging that 12.4% to currently exempt incomes over $250,000. I think you'll find that very few of the "small businesses" that our Republican friends claim to represent have employees with $250,000 salaries. As our former Secretary of Labor says:

In addition, this idea would make it cheaper for employers to hire, because they wouldn't have to pay their share of the tax. It wouldn't add to the deficit. Revenues would be made up by applying payroll taxes to income exceeding $250,000 — which is fair. As of now, the Social Security payroll tax doesn't apply to any income over $106,000. Having the tax kick in again at $250,000 draws on the top 3 percent of earners, who now rake in a larger portion of total income than at any time since 1928.

8:30 Update: GDP was revised down to 1.6%. That sucks but better than 1.3% expected and WAY better than Cramer's 0.4% prediction. In the government's first report of the economy's benchmark indicator a month ago, the growth rate was estimated to have slowed to 2.4% after a 3.7% expansion in the first quarter so 1.6% means the World's largest economy is "only" growing at an average of 2.65% in the first half of 2010, on pace to add "just" $400Bn (the entire GDP of Sweden, the World's 22nd largest economy) in growth for the year.

Quick Maw, head for the shelter! ROFL bears, what total silliness. Greece's entire GDP is $330Bn but that doesn't stop the MSM and their crew of "expert" pundits from telling you how their debt can destroy the $60,000Bn global economy. As I pointed out earlier and yesterday – the media is selling fear and the jackles take advantage of your fear and use it to force you in and out of positions as they spin the news back and forth to suit their needs. Don't take my word for it – here's Jim Cramer telling you how to manipulate the media and the market to make your fund trading profitable (this is before he discovered it's even better when you have your own show!).

I love Uncle Rupert's spin on the GDP: "Friday's report also showed that companies barely managed to post profit gains, following several very profitable quarters. After-tax earnings edged up 0.1%, well off the previous quarter's gain of 11.4%. First-quarter profits were revised down from the initial estimate of a 12.1% increase."

In fact, overall, corporate profits are up 37.7% from last year, with 3/4 of the year over, yet we are trading flat to last August and well below the S&P 1,120 level we hit at the end of the year. Perhaps the bears are right and next quarter we will drop 37.7% and erase all of this year's gains – I sure hope they are betting on it because we love a good squeeze, don't we?

Still, it don't mean a thing until we get back over at least 3 of 5 of our watch levels at: Dow 10,200, S&P 1,070, Nas 2,200, NYSE 6,800, and Russell 635 – we're likely to go neutral into the weekend, depending on what Ben has to say at 10:30 and how the market reacts but, for the moment, my plan to cover the covers is paying off nicely as we picked up an SSO hedge in yesterday's Member Chat.

Overall, we are just very happy that we didn't fall into the bear trap and we didn't let the manipulators scare us out of our positions. Sensible, covers can help you ride out the rough patches in the market and, keep in mind, it's cheaper to buy your disaster hedges when the market is going up and we're not out of the woods yet!

Have a great weekend,

– Phil