Record Low Mortgage Rates, A Record Low Federal Funds Rate And Obscene Economic Stimulus Spending Have All Failed – Will Nothing Stimulate This Dead Horse Of An Economy?

Courtesy of Michael Snyder at Economic Collapse

Courtesy of Michael Snyder at Economic Collapse

Over the past several years, the Federal Reserve and the U.S. government have tried everything that they can think of to stimulate this dead horse of an economy but nothing has worked. The Fed has slashed the federal funds rate to record low levels, mortgage rates have been pushed to all-time lows and the U.S. government has spent hundreds of billions of dollars in an effort to get the economy going. But despite all these of these extraordinary efforts, the U.S. economy continues to just lie there like a dead corpse.

Never before have the Federal Reserve and the U.S. government done more to try to stimulate the economy and never before have their efforts produced such poor results. Home sales continue to set new record lows, more than 14 million Americans continue to be unemployed, foreclosures continue to soar, personal bankruptcies continue to soar and an increasing number of Americans continue to sign up for food stamps and other anti-poverty programs. All of the things that once worked so well to stimulate the U.S. economy seem to be doing next to nothing here in 2010, and the American people are becoming increasingly frustrated by economic problems that just keep getting worse.

Once upon a time, a big drop in mortgage rates would get Americans running out to buy homes in big numbers. But that is just not happening this time.

As you can see from the chart below, mortgage rates are at ridiculously low levels right now. The average rate for a 30-year fixed mortgage was 4.32 percent this week. That is the lowest it has ever been since Freddie Mac began tracking mortgage rates back in 1971.

These low rates have motivated millions of Americans to refinance their existing home loans, but sales of new and existing loans remain at record low levels. In fact, the number of Americans refinancing their homes is now at its highest level since May 2009, but the U.S. housing crisis just continues to get worse. Despite these record low mortgage rates, existing home sales declined 27 percent during the month of July and new homes sales dropped to the lowest level ever recorded in July.

So if Americans are not buying houses when mortgage rates are this ridiculously low, what in the world is going to cause a turnaround in the U.S. housing market?

The Federal Reserve has sure been trying to do what it can to resuscitate the U.S. economy. For decades, a drop in the federal funds rate could always be counted on to give the economy a jump start. But the Fed has dropped the federal funds rate almost to zero for quite some time now and it has done next to nothing to get things moving again.

So is the Federal Reserve out of ammunition? Well, let’s just say that they have used up all of their "best" ammunition. The Fed has been telling us since March 2009 that the federal funds rate will remain between zero and 25 basis points "for an extended period" of time, but the U.S. economy doesn’t seem to care.

Of course Ben Bernanke insists that the Fed is not out of ammunition and that everything is going to be okay, but at this point there is just not a lot left of Bernanke’s fading credibility.

The U.S. government tried to do their best to help the economy by passing stimulus bill after stimulus bill, but it just has not helped much. The government spent hundreds and hundreds of billions of dollars on some of the most wasteful things imaginable, and while the massive injection of cash may have helped temporarily stabilize the economy, it has not brought about the "recovery" that our politicians were hoping for.

Now the pendulum has swung the other way in Congress and there is very little appetite for more economic stimulus spending. But if the economy was not recovering when the government was throwing giant piles of money at it, what is going to happen as the economic stimulus totally dries up?

Already there are signs that the U.S. economy is in big, big trouble. General Motors announced this week that U.S. sales in August fell 24.9% to 185,176 vehicles from 246,479 vehicles in August 2009.

But don’t let up and down sales reports fool you. One month they may be down and the next month they may be up a bit. The important thing is to keep your eyes on the truly disturbing long-term trends.

Thanks to the nightmarish U.S. trade deficit, far more wealth leaves the United States each month than enters it. That means that the United States is getting significantly poorer each month. As I noted yesterday, the United States spends approximately $3.90 on Chinese goods for every $1 that the Chinese spend on goods from the United States. That is not sustainable and China is going to continue to bleed us dry for as long as we allow it to continue.

In addition, the United States continues to go into more debt every single month. Each month the U.S. national debt gets bigger, state governments go into more debt and local governments go into more debt.

So what we have is a nation that is getting poorer and that is going into more debt month after month after month.

We are on the road to economic hell, and the American people don’t even realize it because things are still relatively good – at least for now.

But as the economy continues to unravel, is there anything that the folks over at the Federal Reserve can do?

Well, yes there is. It is called "quantitative easing" and the Fed has already indicated that they are going to start doing it again. Essentially, quantitative easing is when the Federal Reserve creates money out of thin air and starts buying things like U.S. Treasuries, mortgage-backed securities and corporate debt.

But isn’t there a good chance that this could cause inflation?

Well, yes.

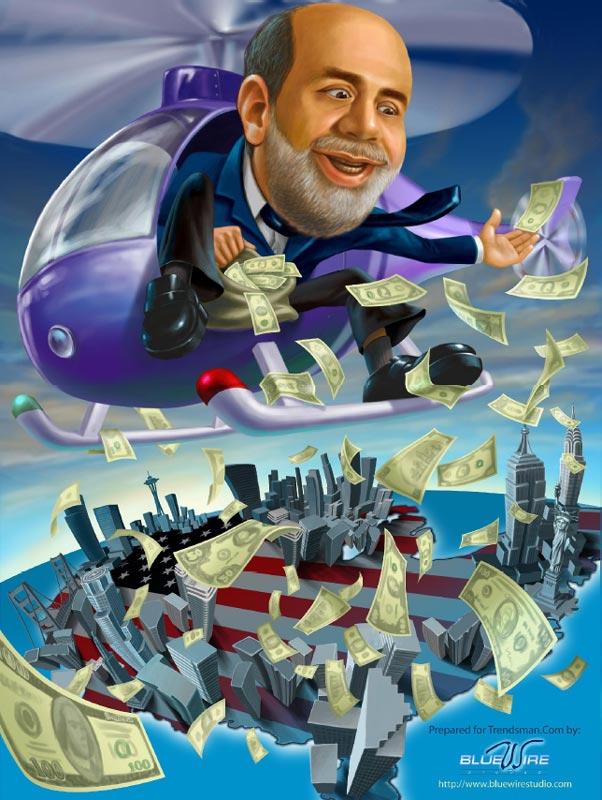

But "Helicopter Ben Bernanke" seems determined to live up to his nickname. Anyone who thinks that Bernanke is going to just sit there and do nothing is delusional. At some point he is going to fire up his helicopter and start showering the economy with money.

And the reality is that feeding massive quantities into the economy will create more economic activity. However, it will also come with a price.

Someday soon, you may wake up to newspaper headlines that declare that our economy is growing at a 10% annual rate, but what they won’t tell you is that the real rate of inflation will be running about 15 or 20 percent at the same time. In fact, the U.S. government will probably try to convince us that the "official" rate of inflation is only about 5 or 6 percent.

The cold, hard truth is that the U.S. economy is going to continue to get worse. Whether it will be a deflationary decline or an inflationary decline depends on the boys over at the Fed. But it is going to be a decline.

Meanwhile, millions of American families are hanging on by their fingernails and are hoping in vain for the great economic recovery which is never going to come.