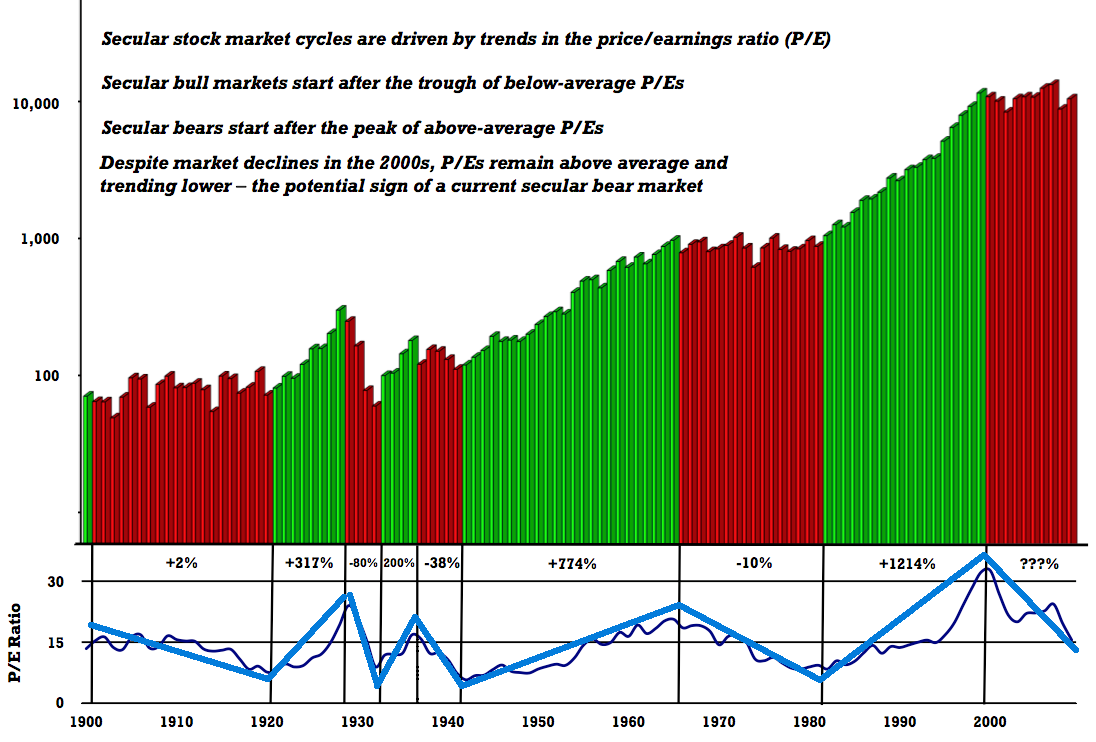

Interesting article on P/E Expansion & Contraction by Barry Ritholtz. Notice in the chart below that P/E ratios now are about aveage – not at the depths seen in previous bear markets. Unless the historical norms are truly moving higher, this suggests there’s further downside in P/E ratios. – Ilene

P/E Expansion & Contraction

By Barry Ritholtz at The Big Picture

Yesterday, Peter Boockvar referenced two WSJ articles on P/E: The Decline of the P/E Ratio and Is It Time to Scrap the Fusty Old P/E Ratio?

I believe these articles are asking the wrong question. Rather than wondering if the value of P/E ratio is fading, the better question is, “What does a falling P/E ratio mean?” The chart below will help answer that question.

We can define Bull and Bear markets over the past 100 years in terms of P/E expansion and contraction. I always show the chart below when I give speeches (from Crestmont Research, my annotations in blue) to emphasize the impact of crowd psychology on valautions.

Consider the message of this chart. It strongly suggests (at least to me) the following:

Bull markets are periods of P/E expansion. During Bulls, investors are willing to pay increasingly more for each dollar of earnings;

Bear markets are periods of P/E contraction. Investors demand more earnings for each dollar of share price they are willing to pay.

via www.ritholtz.com – click here to read more.

Source: Crestmont Research