Sam Antar makes a request to CFOs, Audit Committees, and auditors of public companies’ financial reports: study the SEC’s rules governing the calculation of non-GAAP measures such as EBITDA (earnings before interest, taxes, depreciation and amortization), and follow them. Correct the mistakes before the reports get filed so Sam doesn’t have to write an article and I don’t have to post it.

Sam Antar makes a request to CFOs, Audit Committees, and auditors of public companies’ financial reports: study the SEC’s rules governing the calculation of non-GAAP measures such as EBITDA (earnings before interest, taxes, depreciation and amortization), and follow them. Correct the mistakes before the reports get filed so Sam doesn’t have to write an article and I don’t have to post it.

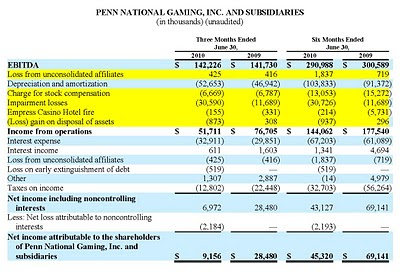

For example, Penn National Gaming (PENN) erroneously reported EBITDA as earnings before interest, taxes, depreciation, amortization AND charges for stock compensation, impairment losses, disposal of assets, losses from unconsolidated affiliates and the Empress Casino Hotel fire–that would be an "Adjusted EBITDA" or in PENN’s case, EBITDASCILDALUAECHFIRE.

To learn how to read a financial report and discover if the company you’ve invested in is calculating EBITDA properly or inflating this number, read Sam’s article. – Ilene

Five More Public Companies Who Need to Learn How to Properly Calculate EBITDA under SEC Rules

Courtesy of Sam Antar

It’s pathetic that so many public companies miscalculate EBITDA (earnings before interest, taxes, depreciation, and amortization) and violate Regulation G governing the calculation of non-GAAP measures such as EBITDA. It seems that too many CFOs, Audit Committees, and auditors don’t take the time to thoroughly review compliance with all appropriate SEC financial reporting rules.

Starting in 2007, I reported improper EBITDA calculations by Overstock.com (NASDAQ: OSTK). After a brutal yearlong public battle, Overstock.com’s embittered CEO Patrick Byrne finally changed his company’s EBITDA calculation to comply with Regulation G. For additional details, please read Lee Webb’s Stockwatch article and Richard Sauer’s book.

Last July, I reported apparently erroneous EBITDA calculations by Penson Worldwide (NASDAQ: PNSN) and Comtech Telecommunications (NASDAQ: CMTL).

In this blog post, I will report erroneous EBITDA calculations by five more public companies: A. H. Belo Corporation (NYSE: AHC), FirstService Corporation (NASDAQ: FSRV), Animal Health International, Inc. (NASDAQ: AHII), Schawk Inc. (NYSE: SGK), and Penn National Gaming Inc. (NASDAQ: PENN).

First, let’s review how EBITDA supposed to be calculated

According to the SEC Compliance & Disclosure Interpretations, EBITDA is defined as under Regulation G as net income (not operating income) before interest, taxes, depreciation, and amortization. See below:

Question 103.01

Question: Exchange Act Release No. 47226 describes EBIT as "earnings before interest and taxes" and EBITDA as "earnings before interest, taxes, depreciation and amortization." What GAAP measure is intended by the term "earnings"? May measures other than those described in the release be characterized as "EBIT" or "EBITDA"? Does the exception for EBIT and EBITDA from the prohibition in Item 10(e)(1)(ii)(A) of Regulation S-K apply to these other measures?

Answer: "Earnings" means net income as presented in the statement of operations under GAAP. Measures that are calculated differently than those described as EBIT and EBITDA in Exchange Act Release No. 47226 should not be characterized as "EBIT" or "EBITDA" and their titles should be distinguished from "EBIT" or "EBITDA," such as "Adjusted EBITDA." These measures are not exempt from the prohibition in Item 10(e)(1)(ii)(A) of Regulation S-K, with the exception of measures addressed in Question 102.09. [Jan. 11, 2010]

In other words, the only way to properly compute EBITDA under Regulation G is by starting the calculation with net income and adding back only interest, taxes, depreciation and amortization. A public company cannot add back other items such as stock-based compensation costs, impairments of fixed assets, or anything else to compute EBITDA. Any different calculation cannot be called EBITDA, but can be called "Adjusted EBITDA."

SEC Division of Corporation Finance review of CGG Veritas EBITDA calculation illustrates that stock-based compensation cannot be included in EBITDA calculation

In 2007, the SEC Division of Corporation Finance told CGG Veritas that its EBITDA calculation erroneously included stock-based compensation:

The acronym EBITDA refers specifically to earnings before interest, tax, depreciation and amortization. However, your measure also adjusts earnings for stock option expense. We will not object to your using such a measure as a liquidity measure but request that you rename it to avoid investor confusion.

CGG Veritas responded to the SEC:

In response to the Staff’s comment, we will in future filings refer to the non-GAAP measure in question as “EBITDAS”, which we will define as “earnings before interest, tax, depreciation, amortization and share-based compensation cost…

Like CGG Veritas, Overstock.com, Penson Worldwide, and Comtech Telecommunications erroneously included stock-based compensation in their EBITDA calculations.

A. H. Belo Corporation, FirstService Corporation, Animal Health International, Inc., Schawk Inc., and Penn National Gaming Inc. all erroneously included asset impairment costs in their EBITDA calculations and some of them also made multiple errors by including other items such as stock-based compensation costs in their calculations.

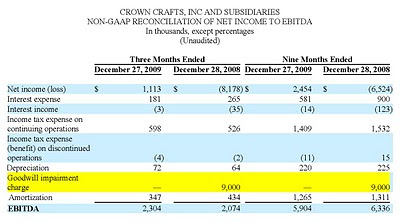

SEC Division of Corporation Finance review of Crown Crafts Financial Report illustrates that asset impairment charges cannot be included in EBITDA calculation

In February 2010, Crown Crafts (NASDAQ: CRWS) erroneously included an adjustment for “goodwill impairment charges" in its EBITDA calculation.

See yellow highlighted item from the company’s 8-K report below. Click on picture to enlarge.

The SEC Division of Corporation Finance reviewed the company’s 8-K report and told them to correct their EBITDA calculation:

We note that your calculation of EBITDA in the press release furnished as an exhibit includes an adjustment for goodwill impairment charges. As such, the non-GAAP measure should not be characterized as EBITDA. When you include an adjustment that is not included in the definition of EBITDA as set forth in Item 10(e) of Regulation S-K, please revise the title of the non-GAAP measure to clearly identify the earnings measure being used and all adjustments. Refer to question 103.01 of the Division’s Compliance & Disclosure Interpretations on the use of non-GAAP measures available on our website at http://sec.gov/divisions/corpfin/guidance/nongaapinterp.htm

Crown Crafts responded:

In future filings, if the Company includes an adjustment to EBITDA, then the Company intends to use the title “Adjusted EBITDA” instead of “EBITDA”; and in such instance, the Company also intends to appropriately define the non-GAAP measure (e.g. “Adjusted EBITDA is defined as earnings before interest, taxes, depreciation, amortization and the goodwill impairment charge.”).

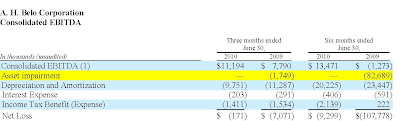

Like Crown Crafts, both A. H. Belo and FirstService erroneously included asset impairment charges, such as goodwill impairment, in their EBITDA calculations.

See yellow highlighted items from A. H. Belo’s recent 8-K report below. Click on picture to enlarge.

See yellow highlighted items from FirstService’s recent 6-K report below. Click on picture to enlarge.

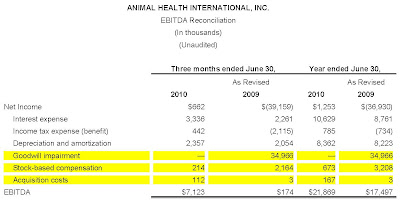

Animal Health erroneously included goodwill impairment, stock-based compensation, and acquisition costs in its EBITDA calculation.

See yellow highlighted items from Animal Health’s recent 8-K report below. Click on picture to enlarge.

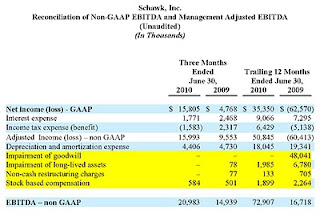

Schawk erroneously included impairment of goodwill, impairment of long-lived assets, non-cash restructuring charges, and stock-based compensation in its EBITDA calculation.

See yellow highlighted items Schawk’s recent 8-K report below. Click on picture to enlarge.

Penn National Gaming was the worst offender in erroneously calculating EBITDA of all the companies discussed so far. The company erroneously defined EBITDA as "income (loss) from operations, excluding charges for stock compensation, impairment losses, Empress Casino Hotel fire, depreciation and amortization, and gain or loss on disposal of assets, and is inclusive of loss from unconsolidated affiliates."

As I detailed above, EBITDA is defined by the SEC as net income (not operating income as used by Penn National Gaming) before interest, taxes, depreciation, and amortization. In addition, stock compensation, impairment losses, Empress Casino Hotel fire, gain or loss on disposal of assets, and loss from unconsolidated affiliates cannot be properly included in an EBITDA calculation.

See yellow highlighted items Penn National’s 8-K report below. Click on picture to enlarge.

Recommendation

The CFOs, Audit Committees, and auditors of all the companies noted above need to study SEC rules governing the calculation of non-GAAP measures such as EBITDA. I will continue tracking their future financial reports to see if they miscalculate EBITDA again and violate Regulation G.

Written by,

Sam E. Antar

Upcoming speaking engagements:

September 28, 2010: Financial Crimes and Digital Evidence Conference in Eugene, Oregon.

…sponsored by the Oregon Department of Justice, the United States Attorney’s Office for the District of Oregon, the Federal Bureau of Investigations, the Oregon Department of Public Safety Standards and Training, and the Southern Oregon Financial Fraud and Security Team.

On October 6, 2010: The Crook and The Crook Catcher: Fraud Elements Post-Madoff in Dallas, Texas.

A new perspective on fraud is required – one that takes into account five elements that are psychologically rooted. Each of these elements is present to some extent in all companies.

Please join Jonathan Marks, partner-in-charge of the Crowe Horwath LLP fraud and ethics practice, in concert with Sam Antar, convicted felon, former CPA, and former CFO of Crazy Eddie Inc., as they address key topics in this area.

Special thanks to the hosting organizations above for seeking my input on white-collar crime.

Disclosure:

I am a convicted felon and a former CPA. As the criminal CFO of Crazy Eddie, I helped my cousin Eddie Antar and other members of our family mastermind one of the largest securities frauds uncovered during the 1980’s. I committed my crimes in cold-blood for fun and profit, and simply because I could.

If it weren’t for the efforts of the FBI, SEC, Postal Inspector’s Office, US Attorney’s Office, and class action plaintiff’s lawyers who investigated, prosecuted, and sued me, I would still be the criminal CFO of Crazy Eddie today.

There is a saying, "It takes one to know one." Today, I work very closely with the FBI, IRS, SEC, Justice Department, and other federal and state law enforcement agencies in training them to identify and catch white-collar criminals.

I do not seek or want forgiveness for my vicious crimes from my victims. I plan on frying in hell with other white-collar criminals for a very long time.

Recently, I exposed GAAP violations by Overstock.com (NASDAQ: OSTK) which caused the company to restate its financial reports for the third time in three years. The SEC is now investigating Overstock.com and its CEO Patrick Byrne for securities law violations (Details here, here, and here).

In addition, the SEC is now investigating possible GAAP violations by Bidz.com (NASDAQ: BIDZ) after I alerted them about the company’s inventory accounting practices. I do not own any securities in the companies cited in this blog post, long or short. My investigation of these companies is a freebie for securities regulators to get me into heaven, though I doubt I will ever get there.

Note: PSW doesn’t endorse Sam Antar’s opinions, we present his views without further research.