Currency Intervention Madness; Japan Intervenes to Weaken the Yen; Selected Quotes

Courtesy of Mish

After months of attempting to talk the Yen down, Japan Intervenes First Time Since ’04 to Rein in Yen.

Japan intervened in the foreign-exchange market for the first time since 2004 after a surge in the yen to the strongest against the dollar in 15 years threatened to stunt the nation’s economic recovery.

Finance Minister Yoshihiko Noda confirmed the intervention, speaking to reporters today in Tokyo. He said Japan contacted other nations about the step, without specifying that today’s measure was taken unilaterally. Chief Cabinet SecretaryYoshito Sengoku said the ministry considers 82 per dollar to be the line of defense, after it reached a high of 82.88 earlier today.

Japan hadn’t intervened to sell yen in the foreign-exchange market since 2004, when the yen was around 109 per dollar. The Bank of Japan, acting on behest of the Ministry of Finance, sold 14.8 trillion yen in the first three months of 2004, after record sales of 20.4 trillion yen in 2003. Noda didn’t say how much was used in today’s action, while that figure will be released at a later date.

U.S. Treasury Secretary Timothy F. Geithner declined to comment about the prospects for currency intervention in an interview last week, instead saying that Japanese officials should do what they can to help their economy grow.

Recent Japanese data have pointed to the expansion losing momentum. The government yesterday revised its July industrial output figures to show that output fell rather than increased from a month earlier. Japan’s economy expanded at a 1.5 percent annual rate in the second quarter, less than half the pace of the previous period, and consumer confidence slid to a four-month low in August.

Is Currency Manipulation OK or Not?

Both China and Japan are intervening in the Forex markets for the same reason, to strengthen exports and stimulate the economy.

Pardon me for asking the obvious question but it needs to be asked: Why does Geithner give the green light for Japan to intervene in the currency markets but China is threatened with a currency manipulator label for doing the same thing?

Boosting the Dollar

Please consider a few select quotes from the New York Times article Japan Moves to Boost the Dollar

JOHN VAIL, CHIEF GLOBAL STRATEGIST, NIKKO ASSET MANAGEMENT

"Clearly the U.S. is not going to be too friendly towards it although they may not argue too much about it in that Japan is a big customer for its Treasury securities."

"I’m not sure we are going to see a major weakening of the macro statistics in Japan, but if we do that would obviously help weaken the yen, but exports were quite strong in July both on a nominal and real basis so it’s a bit of a quandary for Japan."

"But the biggest problem for Japan is not the U.S. cross rates, it’s the Korean won, and the Korean won has just been ridiculously weak. Yet G20 officials have yet to really pressure Korea on this at all, which I think is really to Japan’s detriment."

Bang for the Yen

If Japan’s exports have been strong, why does Japan need to weaken the Yen to boost exports?

If the Problem for Japan is the Korean won, what the heck is Japan doing buying dollars? It certainly would get a lot more bang for the Yen buying Won.

TAKAO HATTORI, SENIOR INVESTMENT STRATEGIST, MITSUBISHI UFJ MORGAN STANLEY SECURITIES

"The size of the currency market is no longer small enough for intervention to change the trend in the yen. I am interested in seeing how the government would announce its stance and its approach to support the economy.

"If they intervened, it was good for the government to show its strong stance but the market is too big for the intervention to change the yen’s trend."

Sheer Madness

Takao Hattori says that the Forex market is too big for intervention to work but "it was good for the government to show its strong stance".

Excuse me for asking but how can it be good policy to take actions that cannot work?

Prior Currency Intervention Madness

Please consider Currency Intervention And Other Conspiracies.

…. Note those numbers. Japan spent hundreds of billions in 2003 starting in August, attempting to prop up the dollar.

Japan halted its currency intervention in March of 2004 according to the International Herald Tribune article EU officials soften stance on yen’s weakness.

Yen vs. Japan’s Intervention 2003-2004

click on chart for sharper image

If ever there was proof of the absurdity of currency interventions there it is. Ironically the Yen started plunging shortly after Japan stopped trying to force down the value of the Yen.

It has been proven time and time again that currency intervention does not work. Yet, somehow it is "good for the government to show its strong stance".

Line of Defense

click on chart for sharper image

Note that the "Line of Defense" is right near the 1995 high.

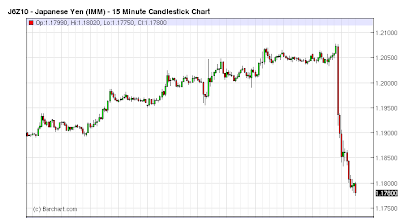

Intraday Intervention in Action

click on chart for sharper image

Some might think the above chart shows that intervention works. It doesn’t except possibly in the very short term.

In 2008 the Fed intervened multiple time to support Fannie Mae. In one such move, the share price doubled from $7 to $15 in less than a week on a short squeeze. A couple months later Fannie Mae collapsed to a buck.

Central banks cannot change the prevailing trend.

Assuming Japan was going to have a "line of defense", one near the 1995 is a spot where there would be technical resistance anyway. If the Yen does drop in a sustained way, it will not be because of the intervention, but rather because the Yen had outrun fundamentals and was simply ready to drop.