Profile: Align Technology Inc. designs, manufactures, and distributes their Invisalign brand medical devices that treat the misalignment of teeth. The company’s clear casings gently move teeth to desired positions. The company offers a line of  ancillary products for cleaning casings and adjusting tools for dental professionals. The company was founded in 1997 and is headquartered in Santa Clara, CA.

ancillary products for cleaning casings and adjusting tools for dental professionals. The company was founded in 1997 and is headquartered in Santa Clara, CA.

Thesis

Recently, Align Technology (ALGN) and their Invisalign brand have been on a roll. The stock has attracted a lot of attention to itself after a record quarter in Q2 2010. Invisalign are the clear aligners that fix misalignment of teeth through casings rather than the typical metal braces. Invisalign gained a lot of popularity after their launch because they made it less obvious that one was wearing braces. They have been especially popular with adults who decide to use braces to fix misalignment.

The company, despite its unique idea and recent success, does not appear that it has a long term potential at its current price levels. The company, for one, is starting to face mounting competition from OrthoCare and the new DENSTPLY International (XRAY). The company offers a similar type of clear casing (MTM Clear Aligner) that fixes misalignment at a much cheaper price. The popularity of the bracket-free orthodontic products is bringing new competition to the playing field and will eat away at Invisalign’s current stranglehold on the industry.

Invisalign really has no economic moat on the industry since the technology is reproducible and it really becomes a matter of cost for consumers. Cost brings about a strong point that the operation is completely elective in nature. During tough economic times, elective operations are often deferred. If not deferred, then a most cost-effective option would be very popular even if quality or brand name is better for Invisalign.

On the positive side, the company should still continue to see growth. The company has grown its revenue every year for the past four years, and it is estimated to increase its revenue by 20% this year and 10% in 2011. The company definitely is still strong and coming out of a recession will be a place that will see strong growth as people start to unload money on more discretionary purchases.

Some of this growth, though, has been negated for Align by the fact that the company has suffered significant lawsuits from their distribution line, which is dentists and orthodontists. A group of orthodontists have started a class action lawsuit against the company based on the fact the company forced orthodontists to take $1000s in forced classes and the costs were never made up by the company. Further, Invisalign required that dentists sell at least ten patients on Invisalign to return a profit on the product. If dentists did not meet this quota, they would then lose their right to sell Invisalign. Therefore, many dentists felt pressured to make unethical choices about who to sell Invisalign to in order to meet the quota.

One of the best rules to live by when investing is to invest in companies that treat their customers and business partners as well as their investors like they are a customer and an investor themselves. Invisalign in Q3 2009 killed their earnings by being forced to shell out nearly $70 million in a lawsuit filing against them. A company that is continually being forced into lawsuits is in no way thinking like an investor and does not have the best interest of its investors in mind. This type of behavior  means that the company has much greater risk and cannot be expected to perform at continuously high levels.

means that the company has much greater risk and cannot be expected to perform at continuously high levels.

Looking at the financial statements of the company, one of the most intriguing aspects of the company is that they have seen significant growth as of late and are moving out of North America. They are seeing growth in Europe, Latin America, China, and Japan. In the last year, the company has seen its sales rise 30% in the past year. At the same time, the company has seen its A/R rise 19%. This is a really positive sign that the company is able to increase sales higher than accounts receivables. One of the main reasons for this is the company’s tremendous movement higher in operating margins and gross margins, which have improved from -10.9 to 5.6 and 74.8 to 76.8, respectively.

Additionally, the company has seen free cash flow increase from $25 million in 2008 to $96 million in the TTM. Positive free cash flow is tremendously important to further growth and allows for a company to improve itself without taking on new debt. Debt is another very positive aspect of Invisalign. The company has only $2 million in short-term debt and no long term debt whatsoever. Additionally, the company has a quick ratio at 3.2, which is tremendous.

One final issue with the company that is abundantly clear is that the company’s P/E ratio is very high. The company’s P/E ratio is over 170 currently. The market average for medical appliances and devices is near 20. The high P/E ratio comes from negative earnings in Q3 2009 that were caused by significant nonrecurring charges for a lawsuit. Even removing that number and replacing it with the quarter before, which was an EPS of 0.07 still leaves the company with an P/E of 21. So, the company at around $19 per share is pretty fairly valued. The company would need significant improvement on EPS in order to become a value investment. For now, it remains growth and growth does appear minimal for this company.

While the financial statement looks very solid, the mounting problems from lawsuits does taint a lot of the positives from this company as well as the fact that the company has no way to produce any economic moat. The company is financially healthy, but it has low appeal in expansive future growth, profitability due to lawsuits and rising costs, and the company has a tremendous P/E ratio that cannot be maintained.

Valuation

The Oxen Group’s fair value estimate for Align Technology is $22 per share based on a discounted cash-flow analysis. The company has seen significant growth in the past year, but the future ability for sustained growth will be challenged by new competitors and a company that is plagued by consistent lawsuits. The risk of the company seem to outweigh speculative nature of the company, and unless the stock can move back significantly from its current levels, it does not present a significantly valuable play. The company should see growth in operating income through 2015, but growth should top out around 10% in operating income in 2011 and dwindle from there. Estimated available cash flow starts at $61 million for this year and ends at $82 million in 2015. The company has a WACC at 8.9%.

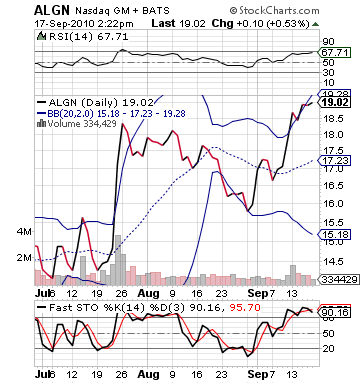

The company is a buy below 15 and a sell above 24.50. Currently, the company, therefore is a hold at $19.

Risk

Risk is medium to medium-high with Align Technology. The company, in the last year, has been able to gain significantly and improve by over 50%. The question and risk comes from the fact that no one knows how a current lawsuit will play out for the company and how much future competition can eat away at the company’s current lead in the market. The company seems quite fairly valued with its current P/E ratio, so a lot more upside will have to come from significant growth, which seems difficult considering current trends.

Good Investing,

David Ristau