It appears that we are going to get away with murder this morning, so TGIF! In after hours, we were staring an 8%+ loss in our Overnight Trade in RIMM in the face. Now, we are looking at getting out for somewhere between 2-3%, which is definitely not as bad as originally thought. RIMM reported some solid earnings, but the market is not buying it. That was our only open position. Let’s get into some morning plays, and look for a new Longterm Rating on Align Technology (ALGN) later today.

Buy Pick of the Day: Alkermes Inc. (ALKS)

Analysis: After such success with Savient (SVNT) on Wednesday, another biotech company caught my eye this morning. Alkermes, in after hours, announced that they had received an FDA panel’s approval for their drug Vivitrol in a  vote of 12-1. This does not mean approval, but typically, a company receiving such approval on panels gets their drug approved by the FDA as a whole.

vote of 12-1. This does not mean approval, but typically, a company receiving such approval on panels gets their drug approved by the FDA as a whole.

The news has sent the shares up around 4.5%, but they were as high as 6% this morning. The biggest news for any biotech company are FDA approvals and panel approvals. Other than that, it is good trial runs. So, hearing this news for ALKS, I think the stock should shoot up this morning. The market is looking like it will open a bit higher but doesn’t have really great legs to move higher. ALKS has the sort of news to get some really great movement.

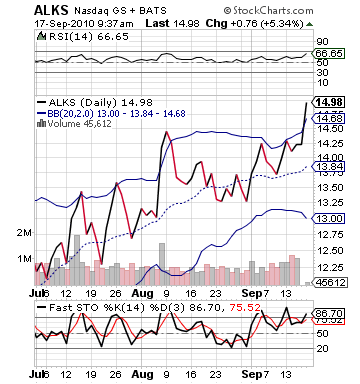

Technically, the stock was trading in a pretty narrow range, and this morning’s news will definitely make the stock move out of its current range and breakout. The bands need to be ignored, but stochastics and RSI are important. The stock was only slightly overbought as of yesterday, and it has a lot of room for more buying to the upside. As well, the stock is only slightly overvalued on RSI, and it has a lot of room to the upside there as well. Additionally, the stock has high short interest, so a stock short squeeze is also an attractive thing about this stock.

Get in right away on this one before it takes off running.

Entry: We are looking to enter ALKS at 14.75 – 14.95.

Exit: We are looking to exit for a 2-3% gain.

Stop Loss: 3% on bottom.

Short Sale of the Day: Oshkosh Corp. (OSK)

Analysis: Oshkosh received an upgrade this morning from Robert W. Baird. They moved the stock from "Neutral" to "Outperform." The stock had jumped up about 3% in pre-market. This is great news for the trucking company Oshkosh. The company believes that Oshkosh is going to do very well in post-war time because the military is going to upgrade everything and replace a lot of trucks and military vehicles now that they have time to refocus on technology.

everything and replace a lot of trucks and military vehicles now that they have time to refocus on technology.

“One critical issue for Oshkosh investors is the shape and slope of the decline in US military spending on demand for Oshkosh products in a post-Iraq world. We believe investors could be overlooking several issues support our apparently more sanguine view,” said Robert McCarthy Jr., an analyst at Robert W. Baird.

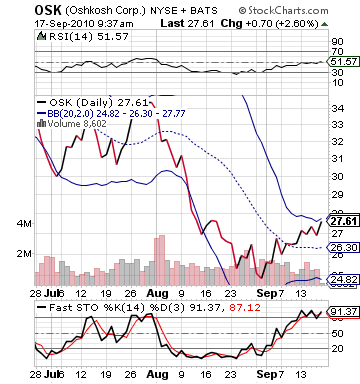

The news was great for OSK, but it comes at a time when the stock has already seen 10% growth in the past week or so, and the market does not look as if it can hold a huge gain today.

I think the upgrade will only help to allow for throughout the day a pullback from a high as traders take some profits. Technically, the stock’s upper band is below 28, so I have the range set a bit to the high side of the band. Further, the stock’s fast stochastics show that it is heavily overbought, meaning that a lot of traders are already in the stock, and it will have a lot of supply coming out as they try to turn the stock.

Entry: We are looking to enter OSK at 27.80 – 28.10.

Exit: We are looking to exit for a 2-3% gain.

Stop Loss: 3% on bottom.

Good Investing,

David Ristau