Thesis

Thesis

Among the companies that has significant future expectations for growth and outstanding “green” potential is Cree Inc. (CREE). The company is the leader in the LED light industry. LED lights are a more efficient lighting source that uses 10-15% of the energy that incandescent lightbulbs use. The company saw significant growth in 2010 thus far and hit its all-time high in the low 80s. The stock since has returned to reality and now faces the question of where now.

The LED light phenomenon has been prompted by the continue growth of green technology and efficiency among tough economic times. Lights are used in automobiles, street lights, home lighting, schools, and more. Cree has been able to etch itself as the leader in the industry due to being the first company as a major player and its highly efficient bulbs. The company continues to produce new LED lights as competitors (GE, Phillips) try to catch up with them.

The company has a number of positive aspects to their investment capabilities. For one, the company is the leader in cost efficiency. The company can produce LED lights cheaper than any of its competitors. The market for LEDs is growing by 50% per year. With an industry that is large and growing, this gives Cree and its competitors a large pie to split between still a small number of players. Additionally, with the industry still young, maintaining significant cash flow for research and development is crucial. The company has over $1 billion in cash on hand, which is outstanding for a young, budding company. This will help the company increase its manufacturing capacity, distribution, and research.

help the company increase its manufacturing capacity, distribution, and research.

In the latest quarter, however, the company for the first time lowered its future guidance. While the company is still expecting large growth, this growth has been baked into the numbers. Therefore, more significant growth numbers must be met in order for the stock to continue to rise. That sort of obtainment may be difficult, however. The company’s main growth has come from the LED-lighted television sets and electronics. That industry has been hit hard by the recession with most families taking big-ticket items off the purchase list. Therefore, the company may struggle to wow in growth until that industry can return to demand. Additionally, the company continues to feel pressure from giants like General Electric and Phillips. These two will continue to cut into the pie, even if it is growing.

Cree’s economic moat is very limited. They currently do have a cost and production edge on its competition, and in a commodities industry, this type of edge is crucial. Yet, as GE and Phillips begin to invest more into this among other alternative revenue options, they will be able to quickly match technology to Cree. If this can be done, the company will have  no economic moat and loses a lot of potential.

no economic moat and loses a lot of potential.

Looking at the financial side of things can help to provide more perspective into where this company is headed in the future. The company’s growth is outstanding, and it should average at least 25% over the next three to four years without a doubt. That growth, though, in many ways is already expected by analysts and investors. When that growth was limited in the latest quarter, the company saw its stock drop by more than 30%. Growth must be maintained, and it can be. As any growing company, being able to maintain its inventory and A/R levels is crucial. The company, in the past year, has seen sales grow 53%. At the same time, it has seen its A/R grow 15%. The fact that sales are outgrowing A/R is a very positive sign for this company. Inventory is outgrowing A/R, which also means that the company is being able to keep up with its growth and is not getting in over its head – another great responsible business practice.

Additionally, the company has been able to strengthen its margins for the past three years to a whopping 47% operating margin. This is a tremendous margin that shows a very solid return on revenue. The company is very well off in financial health. The company’s current ratio is a whopping 11%, while a company under 1.5% is risky. So, the company can cover its assets significantly. This company is at no risk of any financial problems.

On the financial side, one of the very concerning problems for the company, however, is that they are trading at such a significant P/E ratio. Currently, the company’s P/E ratio is over 34, and the company’s five-year P/E is over 80. Both numbers are much greater than competitors and the industry standard, which averages around 16 for the current year. Somewhat of an overvaluation for a growing company like Cree should be expected, but again, the company will need to maintain extremely high growth potential in order to maintain such a P/E rating. The company has some definite risk due to this issue.

high growth potential in order to maintain such a P/E rating. The company has some definite risk due to this issue.

Additionally, the company’s FCF margins are extremely low compared to its industry. While the company has tons of cash on hand, its competitors have a better FCF margin. RF Micro and Avago Tech have 19% and 14%, respectively, compared to Cree’s 9%. The company has less cash flow that is free, yet the company has higher P/E and growth ratings. That sort of comparison does not compute and is another risk for the growth potential of the company.

Three months ago, Cree appeared to be the next best company, but as always, growth has to slow at some point. For now, it appears Cree is at a pretty consistent area. The company is going to maintain great growth, but the growth will not be above what people expect. The company has a strong financial virtual portfolio, but they have overvaluation and trail in key categories to their peers. Therefore, the company once again has some issues. This may be the best it gets for Cree, and the company’s days of $150+ stock valuations may be over. As competition floods the game and Cree slows down, the stock will maintain  current levels.

current levels.

Valuation

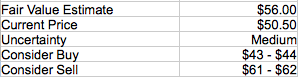

The Oxen Group’s fair value estimate for Cree is $56 per share based on a discounted cash-flow analysis. The company has seen significant growth in the past year, but the future ability for growth that can take the stock back up to atmospheric levels seems unlikely. The company should see growth in operating income through 2015. Growth should slow down to below 20% by 2015. Estimated available cash flow starts at $185 million for this year and ends at $252 million in 2015. The company has a WACC at 8.0%.

The company is a buy below $44 and a sell above $61. Currently, the company, therefore is a hold at $50.50.

Risk

Risk is medium with Cree Inc. The company, in the last year, has been able to gain significantly and improve by over 50%. The question and risk comes from the fact that no one knows if the company can get back to a level where they are surprising individuals with their earnings. If they cannot, then the stock will most likely be stuck in its current fair valuation. Growth diminish threatens the stock significantly givens its high P/E ratio.

Good Investing,

David Ristau