"I’m forever blowing bubbles,

"I’m forever blowing bubbles,

Pretty bubbles in the air,

They fly so high, nearly reach the sky,

Then like my dreams they fade and die.

Fortune’s always hiding,

I’ve looked everywhere,

I’m forever blowing bubbles,

Pretty bubbles in the air."

Gold, Treasuries, Junk Bonds, Netflix (we shorted them yesterday), PCLN (we shorted them Monday), Credit Default Swaps – take your pick of what is going to be the next bubble to burst.

We shorted TLT again yesterday ($105) as I sure wouldn’t lend the US money at those rates and neither, it seems, will the "smart money" guys anymore. The cost to hedge against losses on U.S. government debt rose to the most in six weeks as investors bet the Federal Reserve will put more cash into the economy. Credit-default swaps on U.S. Treasuries climbed 1.7 basis points, the biggest increase in more than three weeks, to 49.4, according to data provider CMA. The Fed said Tuesday that slowing inflation and sluggish growth may require further action. The statement positioned the central bank to expand its near-record $2.3 trillion balance sheet as soon as their November meeting – just in time for a Santa Clause boost for the markets.

So why does this not make us bullish? Well, as I said to Members on Tuesday, it was an anticipated statement with no immediate action and we’re at the top of a 10% run for September so, as I said in yesterday’s post, we anticipate a pullback of 2%, back to our 4% line (see post). Also in yesterday’s post, I mentioned our IWM 9/30 $67 puts ($1.10) and the DIA Oct $105 puts (.89) both of which were good for a reload on yesterday’s silly spike, where I said to Members in the 9:56 Alert:

I like the same IWM and DIA puts as yesterday as we test 10,800 on the Dow – I don’t think it’s going to last. Tomorrow we lose the usual 450,000 jobs for the week and we have Existing Home Sales at 10, which can now disappoint as Building Permits were a big upside surprise yesterday. We also get Leading Economic Indicators at 10 but they are expected up just 0.1% and I doubt they go negative. Friday we have Durable Goods, which should be down 2% and New Home Sales at 10, also now set up to disappoint even the very low 291,000 expected. So caution, caution, caution PLEASE!

I had already mentioned in the morning post that "bear is the word" and this is where the free readers tend to get confused because I was all bullish for the beginning of the month but, as I say often enough and as our Members know very well – I am not bullish, I am RANGEISH – which is a very different thing. 10,700 is the top of our range and with the Russell failing to confirm our 5% line at 666 (they hit it but didn’t hold it) kept us cautious and then we turn to the news flow to see if we’re going to have the gas to get past our major resistance lines and, so far, no – we do not.

Right in yesterday’s morning post I said: "The weak dollar will mask a weak market this morning and that will support commodities and the commodity pushers in early trading but watch that dollar, which will likely get bought up by the BOJ at some point and that will send oil and copper down and those strong sectors will pull back and likely lead us back down to test our 4% levels at Dow 10,608, S&P 1,112, Nas 2,288, NYSE 7,072 and Russell 660." Just to be clear, I don’t MAKE the markets do these things – I can only tell you what the market is going to do and how to make money trading it but I’m not the guy with his hand on the switch, so don’t blame me. We flip-flop when we have to because the market changes every day and whether you are a bull or a bear, you are likely to be wrong soon.

Speaking of being wrong, that’s what we were about gold at the beginning of the week when we looked at GLL for a short position at $1,280. We are scaling in, of course but, as I said about gold in yesterday’s chat:

Speaking of being wrong, that’s what we were about gold at the beginning of the week when we looked at GLL for a short position at $1,280. We are scaling in, of course but, as I said about gold in yesterday’s chat:

"It’s a bubble. The same statements they are making now were made about housing and oil and tulips. Just keep in mind that that doesn’t stop gold from going to $3,000, just like oil went to $147, up 47% in the last Quarter before it crashed and it ended up all the way at $35 yet "that time is was different" and 1,000 experts told me I was wrong for all of ‘07 and ‘08 and, for 75% of that time – THEY WERE RIGHT!"

Even as gold flies up to $1,299 and copper tags $3.594 in overnight trading, commodities under management dropped 2.3% last month from a record $300Bn to $293Bn. This was the first pullback since January as investors withdrew $5Bn from commodity index swaps – the first monthly decline in 5 years! “There was concern about the U.S. and concern about China that spooked the market,” according to Barclays Capital.

There’s even some in-fighting within the Gang of 12 as Morgan Stanley says investors should buy the lowest-rated corporate debt, while Goldman Sachs says stay away. Bonds graded CCC in the U.S. are the “cheapest” high- yield securities with “economic data once again beginning to surprise to the upside,” Morgan Stanley told clients yesterday in a report. Goldman Sachs says higher-rated speculative-grade debt is the way to go as the economy decelerates.

And what should we do when mommy and daddy are fighting like this? Cash out and go stay at a friend’s house is my advice. The September move may not be over but it sure does look fake at this point and making 10% in a month is plenty for most people’s year so I’m leaning towards quitting while we’re ahead and getting prepared to flip aggressively bearish if our 4% levels don’t hold.

And what should we do when mommy and daddy are fighting like this? Cash out and go stay at a friend’s house is my advice. The September move may not be over but it sure does look fake at this point and making 10% in a month is plenty for most people’s year so I’m leaning towards quitting while we’re ahead and getting prepared to flip aggressively bearish if our 4% levels don’t hold.

Of course, this is just the follow-through of the pattern we expected post-Fed (see charts in Tuesday’s chat) so we’re just going to enjoy the ride down and we reserve the right to get bullish again (and this does not affect our long-term, hedged trades, just our directional short-term bets) – pending earnings reports, of course.

8:30 Update: As we expected, jobs are a bust with weekly unemployment up 12K to 465,000, that’s dipping the US futures about 1% and we still have Existing Home Sales and Leading Economic Indicators at 10, which were already reasons we took bearish positions yesterday. The key is going to be what kind of volume we get on the way down and what levels hold up to give us a clue of whether we are still at the top of our 10,200, 1,070 range or whether we indeed can call our former mid-range new floor. Oil broke yesterday, as we expected (very nice for the OIH puts) and today’s natural gas report at 10:30 is not likely to cheer them up and $73.50 would be a shame to fail. We’ve been tracking the barrel counts over at the NYMEX in member chat and there is still quite a stockpile that needs to be worked off – another bearish factor that’s kept us on our toes as we approached our upside goals.

Asia was mixed this morning but mostly closed for holidays with the BSE posting yet another decline. We looked at some BRIC shorts yesterday, including India but I favored BGZ (ultra-short emerging markets) to shorting IFN (India ETF), which gives fantastic bang for the bearish buck.

Asia was mixed this morning but mostly closed for holidays with the BSE posting yet another decline. We looked at some BRIC shorts yesterday, including India but I favored BGZ (ultra-short emerging markets) to shorting IFN (India ETF), which gives fantastic bang for the bearish buck.

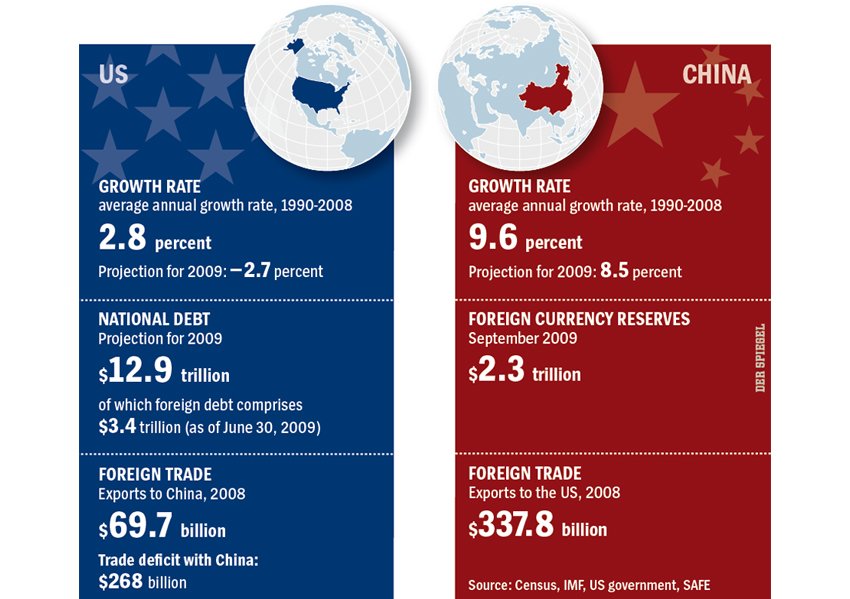

An appreciation of 20 percent in China’s currency would cause widespread bankruptcies in China’s export sector, where firms operate on thin margins, Chinese Premier Wen Jiabao said on Wednesday. "The conditions for a major appreciation of the renminbi do not exist," Wen said in a speech to U.S. businessmen in New York. He said the appreciation of China’s currency demanded by U.S. lawmakers would not bring jobs back to the United States because U.S. firms no longer make such labor-intensive products.

An appreciation of 20 percent in China’s currency would cause widespread bankruptcies in China’s export sector, where firms operate on thin margins, Chinese Premier Wen Jiabao said on Wednesday. "The conditions for a major appreciation of the renminbi do not exist," Wen said in a speech to U.S. businessmen in New York. He said the appreciation of China’s currency demanded by U.S. lawmakers would not bring jobs back to the United States because U.S. firms no longer make such labor-intensive products. The Premier is in New York to get his ass kissed by Obama while we pretend to get tough on Chinese currency. As I mentioned last week, China has stopped bying US Treasuries and, for the moment, Japan is filling the gap – but how long will that last as Japan is pressured to apply more stimulus at home?

We’ll be on our toes as we test each of our levels on the way down. Hopefully those 4% lines will hold, which would be impressive with all this negative noise. Durable Goods is ahead of the bell tomorrow morning and it’s very unlikely that report is good and we also get record-low New Home Sales at 10 so there’s nothing to be bullish about into tomorrow’s open and next week we see our own GDP along with Case-Shiller, Consumer Confidence, Personal Income & Spending, ISM and Auto Sales so busy, busy into earnings.