TGIF! What a great week for us. We close it out today with a solid start to the day with KB Homes. We got involved at an averaged position of 11.84, and we are looking to exit at the open today. The stock is poised for an open around 12.50, which will give us around a 6% gain. Yesterday, we closed out positions in Bed, Bath, and Beyond (BBBY) for a solid 3.5% Overnight gain, Nabor Industries for a 2% gain, and gained 3% on a Buy of Novell (NOVL).

We are looking to continue our streak with a Short Sale this morning…

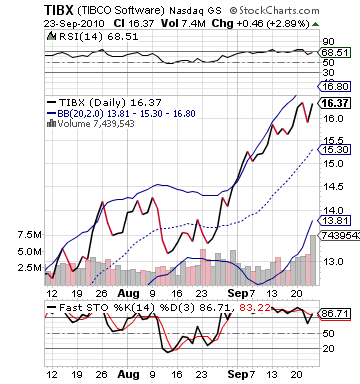

Short Sale of the Day: Tibco Software (TIBX)

Analysis: Tibco is a typical short sale for us in that it is a stock that has moved up way too much in pre-market, and it appears that it is more likely to take a nice dip rather than rise. The company reported very solid earnings this morning with a 22% rise in revenue year-over-year. The company beat earnings estimates by a couple pennies with an EPS of 0.17, and TIBX rose its Q4 estimates. It was a good report, but I am not sure its a report worth a whopping 12% gain in pre-market.

Yet, that gain is what Tibco is fetching this morning. The gains are being helped by a very solid market gain as well that is poised to open up over 100 points. The market is moving up on some expectations of new home sales to be strong to match other home data and appears to be making up losses accrued over the week. I am not sure, however, how much higher the market will go today if home sale aren’t exceptional as it seems priced into the market now.

Tibco appears much more likely to sell off at this point than to move much higher. The stock, technically, was already nearing its upper bollinger band, which was near 16.75. The stock was already overvalued on RSI and overbought on stochastics. This means that the demand for the stock is going to be great, but the supply is also going to be great because a lot of investors and traders will take their gains and bolt. The stock already had a very high P/E ratio, and today’s gains will take that number above 50.

I look for the stock to pop a bit to start the day before falling, so don’t enter at the open.

Entry: We are looking to get involved at 18.40 – 18.70.

Exit: We are looking to cover for a 2-3% gain.

Stop Loss: 3% on bottom.

Good Investing,

David Ristau