At Phil’s Stock World, we have been focused on companies which are sound investments at a reasonable price (SIRP). Buying for a 20% discount, September’s dozen, David R.’s 2-3% daily buys, pure scientific plays (from the truest sense of the word) by myself, and Opts 5d MA methods, there are plenty of ways to capitalize on gains (in both directions) in this choppy market.

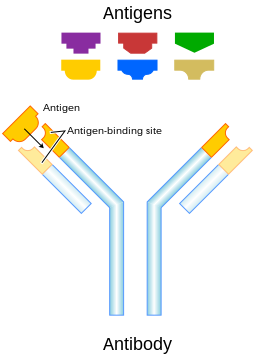

Since science is a first call for me, I thought I would give a little background on an area of research that has exploded in the past 15 years, monoclonal antibodies. Monoclonal antibodies (mAb) are monospecific antibodies that are the same because they are made by identical immune cells that are all clones of a unique parent cell. Given almost any substance (antigen; the antigen is a target that is recognized by the immune system that is ‘foreign’ to the body), it is possible to create monoclonal antibodies that specifically bind to that antigen; they can then serve to detect or purify that antigen. mAbs have become an important tool in biochemistry, molecular biology and medicine.

Figure 1. mAb production and an Antigen.

Figure 2. Antigens.

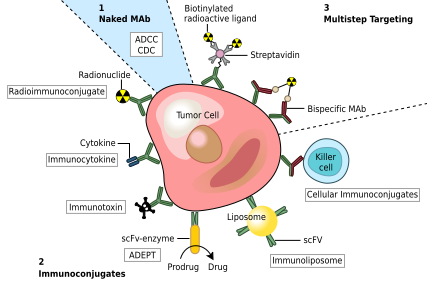

Monoclonal antibodies are typically made by fusing myeloma cells (cancer cells themselves) with the spleen cells from a mouse (or other immune cell type) that has been immunized with the desired antigen. Almost all pharma companies are utilizing this technology now in one way or another. One disadvantage to the older mAbs is that they are made with mouse ‘parts,’ so some individuals develop hypersensitivities (allergic reactions) to the mouse components. As the technology of generating mAbs has progressed, humanized forms are starting to come to market, making these hypersensitivities less common. I am going to discuss Biogen Idec as well as briefly revisit several pharma company picks which utilize this therapy regimen in this review for PSW members to consider in their investment virtual portfolio. mAb’s are additive as well as alternatives to chemotherapy, although for many cancers, chemo remains a front line treatment.

Figure 3. Different Mechanisms That mAbs Attach Cancer or Foreign Bodies.

Biogen Idec Inc. – formed through the 2003 merger of Biogen Inc. and Idec Pharmaceuticals Corporation (Idec), is a biotechnology company focused on developing treatments for cancer, autoimmune and inflammatory diseases. The company’s virtual portfolio of approved drugs includes Rituxan and Zevalin, both of which treat B-cell non-Hodgkin’s lymphoma. Biogen Idec also markets Amevive, a drug to treat psoriasis, and the best-selling treatment for relapsing multiple sclerosis, Avonex.

The path for biotech companies is usually long as the navigation of the FDA regulatory world is often confusing and frustrating. In November 1997, after 12 years of work (and Genetech backing), Idec received welcome news as the FDA approved Rituxan, making it the first monoclonal antibody to be approved as a cancer therapeutic. Rituxan, quickly became the leading treatment for non-Hodgkin’s lymphoma, and Idec gained global recognition as a skillful pioneer in the industry.

Since that first success, Biogen Idec’s product line includes:

- Multiple sclerosis treatments Avonex (interferon beta-1a) and Tysabri (natalizumab). Avonex is not a mAb, but rather a protein that is usually secreted lymphocytes and has beneficial properties in inflammatory diseases. Sales are expected to decline in the coming years, as Avonex will face direct competition from Novartis and Bayer (goes off patent in 2011 (EU)/12 (US)). BIIB is developing a PEGylated interferon beta-1a (Avonex) expected to launch in 2014. The current Phase III candidate has a longer half-life than its parent, and it is those superior dosing requirements that may fend off biosimilar Avonex compounds when they hit the market.

- Tysabri is a mAb against the cellular adhesion molecule α4-integrin (VLA4). Tysabri is used in the treatment of multiple sclerosis and Crohn’s disease. The drug was approved in 2004 (co-mareketed with Elan), withdrawn soon there after as three cases of the rare neurological condition progressive multifocal leukoencephalopathy (PML) arose when it was combined with Avonex. Tysabri was returned to the market in 2006, but the PML risk remains. Its benefits, though, outweigh the risks. Sales of Tysabri are expected to slow and possibly diminish some with the introduction of Merck-Serono/Teva’s Mylinax (oral cladribine) and Novartis’s Gelenia (fingolimod), but it remains to be seen at this point how much market share, if any, these new drugs will take.

- Rituxan (rituximab) is used for the treatment of non-Hodgkin’s lymphoma as well as rheumatoid arthritis; Rituxan is co-marketed with Genentech.

- Panaclar (dimethly fumarate or BG-12) is in Phase III trials and is a orally active small molecule treatment for multiple sclerosis. It is projected to be the company’s second largest product growth driver in the coming years. The company is developing Panaclar as an add-on therapy to other products. The potential launch of Panaclar is not anticipated to cannibalize sales of the company’s leading MS therapies (Avonex and Tysabri).

- Other revenue generators include fumaric acid esters for psoriasis treatment (licensed in Germany), Zevalin (ibritumomab tiuxetan), another treatment for non-Hodgkin’s lymphoma, licensed to Cell Therapeutics, but BIIB continues to produce it for European marketing partner Bayer, Amevive (alefacept) for psoriasis treatment and licensed to Astellas Pharma.

- BIIB and Acorda Therapeutics have a license agreement to develop and commercialize Fampridine-SR, a multiple sclerosis therapy, in markets outside the US. Fampridine-SR is a novel, oral sustained-release compound being developed to improve walking ability in people with MS.

- Three mAbs in late stage development: ocrelizumab (a second generation anti-CD20 mAb) forecast to reach the market late this year, and is predicted to provide a big portion of revenues. ocrelizumab is being co-developed with Genentech/Roche; daclizumab (in-licensed from PDL Biopharma) for the potential treatment of multiple sclerosis; and GA101 (in-licensed and co-developed from Glycart/Roche) for the potential treatment of chronic lymphocytic leukemia.

BIIB has $1B in cash and debt, and a growth rate of almost 10%/yr in revenue. This revenue growth is expected to slow some in the coming years, but should hold steady. With a trailing P/E of 14, the company is fairly valued. The company’s market cap is $13.6B, and with the recent hostile bid for Genzyme, BIIB is right in line for a bit as well for a mid-tier or big pharma purchase. We will look at potential entries on BIIB after the quarter end.

Immunogen (IMGN) – I talked about them in a past post, and I bring them up again for good reason. The stock is still in the range I like to buy them with Phil’s 20% or so discount. Briefly, IMGN out-licenses its TAP technology to other companies (Amgen, Biogen-Idec, Centicor, Genentech, Sanofi, and others) for use with their proprietary antibodies to specific targets. The TAP technology addresses two critical components for companies pursuing monoclonal antibody (mAb) therapeutics: enhancing the yields from development programs by creating new products and/or providing product franchise life extension.

We have discussed other potential cancer companies here, as well as Novartis, Sanofi, and JnJ. Come and join us at Phil’s Stock World and see all there is to offer in one comprehensive place for investors.

Disclosures: Long IMGN. We will initiate an entry on BIIB after 3Q.