Good Tuesday to everyone. The market is looking towards fresh gains today after an unexpected decision by Japan to lower its central interest rate to 0.10% to 0.00%. This decision has put a bit of a hamper in my assessment of getting into Alcoa (AA) as the stock looks to be up around 12.00 this morning. Alcoa was our Play of the Week, but I thought the stock was too overvalued to play at levels above 11.80. The stock never dipped below 11.80, and we have not entered the stock. We will continue to monitor it.

lower its central interest rate to 0.10% to 0.00%. This decision has put a bit of a hamper in my assessment of getting into Alcoa (AA) as the stock looks to be up around 12.00 this morning. Alcoa was our Play of the Week, but I thought the stock was too overvalued to play at levels above 11.80. The stock never dipped below 11.80, and we have not entered the stock. We will continue to monitor it.

In addition to the Play of the Week, yesterday, I finished the September Oxen Report Virtual Portfolio update. The Buy Report Virtual Portfolio is now up 94% for the year and jumped 20% month-over-month. The Short Sale Virtual Portfolio is now up 30% for the year. We have success rates at 75% and 83% for both virtual portfolios, respectively. Check out the update here!

Let’s get into some new plays for this morning…

Buy Pick of the Day: Constellation Brands Inc. (STZ)

Analysis: The market is looking like its ready to make another move higher after Japan made a key interest rate decision that will move its central borrowing rate from 0.10% to 0.00%. The move is an attempt to stimulate the sluggish Japanese economy. The news sent futures up as high as 55 points on the Dow, and futures continue to move higher. One company that could benefit from a strong day in the markets as well as should get extra attention today is Constellation Brands (STZ).

The company is a wine and spirits distributor that sells brands, such as, Robert Mondavi, Corona, Svedka, Arbor Mist, and Modelo. The company operates mostly in the premium wine and beer sector with a seond large bulk business in the $5 – $20 wine area. The company is slated to report its earnings tomorrow morning, and it is looking at an average estimate of an EPS of 0.49 vs. the EPS of 0.45 one year ago.

The company has definitely been hit by the drag in consumer spending, which has meant less premium drinks being sold. However, the company’s Svedka vodka has gained lots of popularity and is expected to see growth around 10%. Additionally, the company should benefit from a retun to luxury spending that has continued to be seen growing in 2010. Those with money are starting to spend more than in 2009, and it should help the company as well.

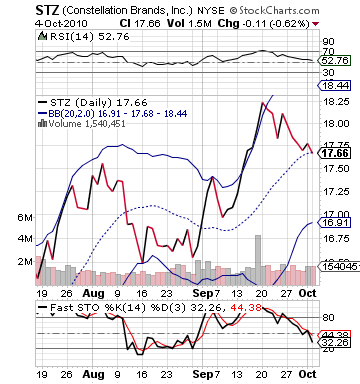

The stock is appealing as a day play because it has a lot of upside technically. The stock is completely oversold on fast stochastics, and after yesterday, moved below its midpoint in the bollinger bands. It is right at its 50-day moving average, and the stock is fair valued on RSI. Compared to most other stocks, this one is quite under the market average. Therefore, with gains expected tomorrow morning, I think investors will plop themselves back into STZ, and it can move 2-3% today.

We want to get involved fairly early, but I would watch for a small pullback to start the day.

Entry: We are looking to get involved from 17.65 – 17.80.

Exit: We are looking to exit for a 2-3% gain.

Stop Loss: 3% on bottom.

Short Sale of the Day: Direxion Daily Energy Bear ETF (ERY)

Analysis: Despite its already too high of levels, oil most likely will continue higher today and up to $85. The market just does not show any signs of stopping. The dollar is dropping this morning, which is helping push oil prices higher. Further, a strong equities market is always a reason to expect gains on oil. One of the reasons for more gains today.png) is also due to port closures that could put a temporary strangle on the supply line.

is also due to port closures that could put a temporary strangle on the supply line.

As supply decreases, the demand will increase. Most analysts are expecting that this week’s crude oil inventories due out tonight and tomorrow will show that oil supply is on its way down, and that demand is growing. I speculative of that sort of firmness, but it should help to boost the price today, which we can take advantage of for sure.

“There is a view that further quantitative easing in the U.S. could help boost the economy,” said Hannes Loacker, an analyst at Raiffeisen Zentralbank Oesterreich in Vienna. “Investment into oil could well be expanded.”

The way to play this is by buying puts or short selling Direxion Daily Energy Bear ETF (ERY). This ETF should decline throughout the day as both the market and oil market improve. It is not in a technical position to move much below 41, so I don’t think huge gains should be expected. I am starting my exit strategy at 1.5% today.

Get in though before this one moves but watch for a slight pullback to start the day.

Entry: We are looking to get involved from 41.80 – 42.10.

Exit: We are looking to cover for a 1.5-3% gain.

Stop Buy: 3% on top.

Good Investing,

David Ristau