Profile: Johnson Controls Inc. is a three-pronged American auto parts maker. The company operates a building efficiency segment, automotive experience segment, and power solutions unit. The efficiency segment that produces air conditioning, controls, and security equipment maker. The automotive experience segment designs and manufactures interior products as well as designs and manufacture cockpit, overhead, and door systems. Finally, the power solutions unit makes car batteries.  The company was founded in 1885 and has its headquarters in Milwaukee, Wisconsin.

The company was founded in 1885 and has its headquarters in Milwaukee, Wisconsin.

Thesis

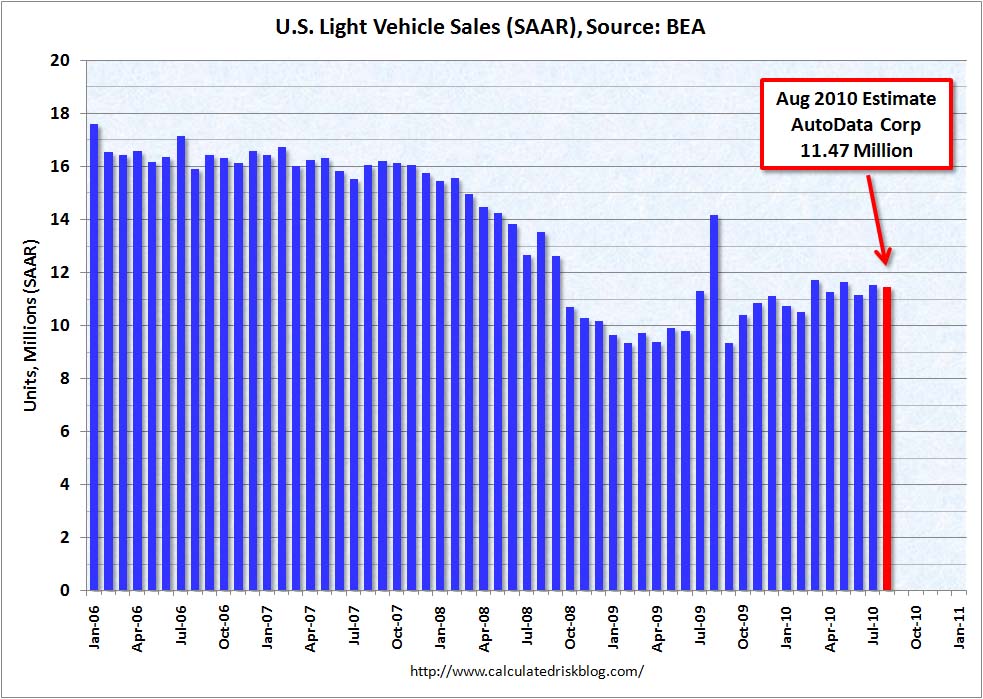

The automotive industry was crippled during the Great Recession. Automobile sales, across the board, were down, and auto parts makers were hit hard by the lack of demand. that hurt automotive sales around the world as consumers avoided big-ticket items. 2010, however, has breathed life back into the automotive industy as sales have risen exceptionally throughout the year. Projected sales this year are over 11 million, while 2009 only saw 4.8 million sales. One auto parts company in the USA looks poised to take advantage of the resurgence in the American market and its positioning in the growing Chinese automotive market.That company is Johnson Controls Inc.

The American auto market has seen great recovery thus far in the USA. August was the first month in 2010 that was not higher year-over-year, but this was caused by the Cash for Clunkers craze that struck last August. In July 2010, GM pulled a 25% increase in sales year-over-year of its four remaining brands. Ford pulled in a 3% rise. The significant year-over-year gains will slow down, but as long as things continue to get better, it is a good sign for the auto industry. Many estimates have US sales increasing to 20 million by 2015, and an auto parts maker like Johnson Controls will be at the forefront of this uptick in sales. This is because JCI supplies auto parts to every American company, and its parts are being used in nearly every  model. Further, the company is dedicating to diversification in two ways: China and electric cars.

model. Further, the company is dedicating to diversification in two ways: China and electric cars.

The Chinese industry became the leader of automotive sales in 2010, and it looks poised to continue to grow throughout the coming years. Chinese auto sales are estimated to grow 55% by 2015, according to JDPower.com, from nearly 9 million to over 13.5 million sales. Johnson Controls has recognized the future and opportunity in China, and the company will build three to four new plants by 2015. The company wants to be able to produce 30 million batteries in China by 2015. Luckily, JCI has great paths to entry into the market with American companies GM and Ford that are already being established in the country.

Johnson Controls, additionally, is pushing itself in the path of the electric car. The company, which, operates mostly as a power train, steering, HVAC, and battery maker is looking at the electric car, which runs on batteries, as a big place for future revenue growth. Recently, the company opened its first electric battery plant in Michigan, which was the first of its kind for the company. As electric cars mount pressure to be an alternative to the combustion engine, JCI can truly prosper with this growing market.

There are still some concerns for JCI from being so heavily dependent on the automotive industry. The continual struggles to get the labor market back to better employment rates and concerns of a slower than expected economy could diminish some of the upside for JCI. In 2009, for example, the compnay saw its ROIC drop to 3.3%. It has already bounced back up in the TTM to over 9% (rising ROIC is one of the best indicators of future growth). The company’s gross margins in 2009 dipped to 12.5% and are back to near 15% in the TTM. Operating margins wen negative to -0.8, and in the TTM, they are back over 3%. The company is completely dependent on the North American automotive industry being successful, which is a large risk. That does diminsh the company’s longterm outlook to some degree.

of the upside for JCI. In 2009, for example, the compnay saw its ROIC drop to 3.3%. It has already bounced back up in the TTM to over 9% (rising ROIC is one of the best indicators of future growth). The company’s gross margins in 2009 dipped to 12.5% and are back to near 15% in the TTM. Operating margins wen negative to -0.8, and in the TTM, they are back over 3%. The company is completely dependent on the North American automotive industry being successful, which is a large risk. That does diminsh the company’s longterm outlook to some degree.

Overall, though, Johnson Controls is a developing company that should continue on its path of growth that it was on prior to the automotive meltdown. The company saw great revenue growth from 2000 – 2008, more than doubling in size from $17 billion to over $38 billion. The company took a dip in 2009 back below $30 billion but has recovered back to a TTM in 2010 of $34 billion. There is no reason to believe that the company cannot make its move back to where it was in 2008 and continue to grow from that level. The company’s growth in China will be able to add more revenues onto the top of the 2008 levels.

Additionally, on the financial side, Johnson Controls has been able to maintain strong free cash flow through 2009 into the TTM. In its past quarter, the company reported $922 million in free cash flow. That number gives the company an 11% FCF margin, which is a good amount. I tend to worry about anything under 10%. Cash flow is important for JCI to be able continually research new products and open new distribution channels throughout China without taking on new debt. The company’s current ratio is 1.12, which is somewhat concering. The company has a lot of liabilities, but they have an improving debt to equity ratio. Financial health may be the only concerning matter for the company. Their quick ratio sits below 1. A  sustained lull in the automotive industry could be very threatening to the company.

sustained lull in the automotive industry could be very threatening to the company.

Competition for Johnson Controls comes from a number of companies in Magna International, BorgWarner, and TRW. Yet, Johnson is very specialized in its three-pronged approach with HVAC, batteries, and steering and has historical standings with the companies its supplies. The competition is there, but the company has proven results with its consumers. Its moat comes from its quality and consistency. Risk continues to exist from the company’s inability to diversify itself, and its dependence on the automotive industry. The company has some bright prospects in the electric battery industry and moving into China.

Valuation

My fair value estimate for Johnson Controls Inc. (JCI) is $35 per share based on a discounted cash-flow analysis. The company had seen incredible growth in its operating income in the eight years leading up to 2006, and there is really no worry that the industry cannot continue to grow as demand continues to grow in Americas, China and other markets. Given the development of new markets, the company’s wide distribution market, and development into new markets, the company is continuing to offer growth in its revenue. However, the stock appears to be pretty fairly valued currently given the stock’s 20% growth of late.

JCI is a buy below $27, and it is a sell above $43.

Risk

Risk is low with Johnson Controls. The company is the leader in auto parts, and the company has a great future as recovery hits the USA. Further, as the company enters into China, the company has terrific avenues with already established companies in which they are involved. The company will need to continue to grow its margins, reduce its short term debt, and continue to operate under its similar recipe for success it has had for the past 125 years.