That's right kids, you now only need 82 Yen to buy a US Dollar!

That's down from 125 Yen in 2007 and down 15% since May alone. That means that, even if your $300,000 home kept 80% of it's value during the last 3 years, it still dropped from 37.5M Yen to 19.7M Yen, almost 50% less – and the Japanese STILL don't want to buy our real estate! Maybe it's because we totally burned them on that in the '80s and, unlike American investors, they have learned their lesson.

The S&P priced in Yen looks similar to this chart of the S&P priced in gold – a very sad downtrend that is unlikely to be broken and, even if it is – so what? Are we so easily fooled that we actually believe that, just because it takes more of our hard-earned dollars to buy a stock, that the market is recovering? Surely we have a better grasp of finance than that, don't we? It's like me giving my daughters Monopoly money for an allowance and selling them various household fixtures. I can tell them they earned $10,000 and that they bought the living room sofa for $10,000 so they can pretend they have an asset but the whole thing kind of falls apart if they try to sell the sofa at a garage sale or if they try to take their fake $10,000 and buy something outside the house.

That's what the US economy is like right now – it's all well and good as long as we're all willing to "extend and pretend" but, whatever you do – do not attempt to leave the boundaries of the game. Banks are looking mighty fine with Bank Bonds back at the best levels since before the EU bailout – even though derivatives (remember those?) are now at an all-time high. All of the banks are doing it so what's the harm if we do it too? Just like all the Central Banks are devaluing their currency – ours just happens to be the best at it and that makes our market LOOK strong at the moment – kudos to Ben!

Not only have I been advocating a cash-out into this nonsense rally but we actually went with UUP at $22.50 yesterday in Member Chat as I simply don't think the dollar can lose that much more ground.

Not only have I been advocating a cash-out into this nonsense rally but we actually went with UUP at $22.50 yesterday in Member Chat as I simply don't think the dollar can lose that much more ground.

If I'm right, then our cash becomes worth more as the market drops and we can get back into bullish positions using our relatively stronger dollars to buy relatively weaker stocks. If I'm wrong, and the dollar keeps declining – we convert everything to gold and leave the country because this thing is going straight to Hell in the proverbial handbasket!

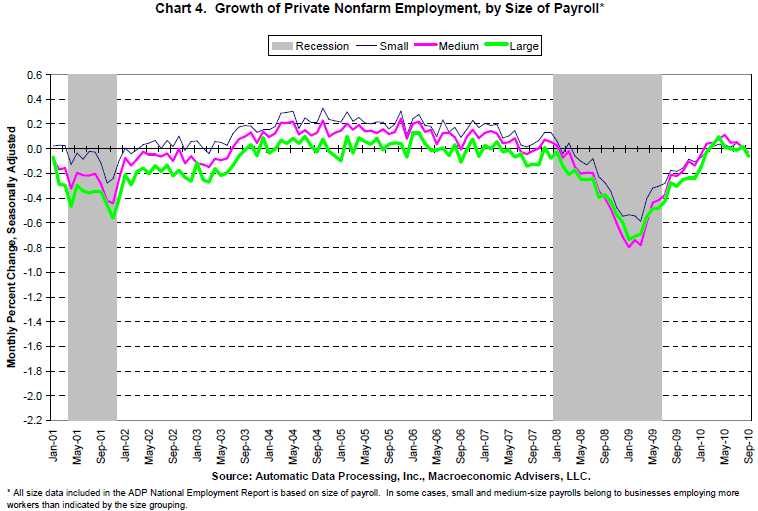

As I said in yesterday's morning post, we have a weak ADP report (us connected people get advanced copies of everything!) with 39,000 jobs lost vs. 20,000 expected and down from up 10,000 last month so pretty much a total disaster but hey, look at the bright side… No, sorry, just kidding – there is no bright side – this number totally sucks. In fact, look at that very scary and ironically green line that represents Big Business hiring:

You would think it has already been proven that Quantitative Easing, absent of Stimulus, is pointless and, in fact, makes things worse but, after already pushing $2Tn into the system in the past 24 months, Bernanke and the boys are now circling the wagons and virtually guaranteeing another massive round of QE for 2011. In remarks Monday, Bernanke said of the possibility of future purchases, "I do think they have the ability to ease financial conditions."

The idea behind asset purchases is to flood the economy with money, which would lower interest rates and spur more lending and spending. But new asset bubbles could form if the Fed doesn't start backing away from its policy of easy money — often thought to be the source of the housing bubble which caused the recession in the first place. Kansas City Fed President Thomas Hoenig has been warning of asset bubbles since early this year, and consistently voting against additional asset purchases and low interest rates. And there are already troubling signs of possible new bubbles, like increases in the values of various assets from Treasurys to gold to other commodities.

"When the Fed buys long-term government debt from the private market, it shifts interest rate risk from bondholders to taxpayers," Minneapolis Fed President Narayana Kocherlakota warned last week. Well, that pretty much sums up the mission of the Federal Reserve, doesn't it? Protect the rich (bondholders with money) and screw the poor (middle class taxpayers). Philly Fed President, Charles Plosser agrees: "Asset purchases in our current economic environment can do little if anything to speed up the return to full employment," Plosser said in a speech last week. "Because I see little gain at this point, and some costs, I would prefer not to engage in further asset purchases at this time."

"We are following policies that unless changed will eventually lead to lots of inflation down the road," said Warren Buffett at Fortune's Most Powerful Women Summit Tuesday. "We have started down a path you don't want to go down."

Chicago Fed's Charlie Evans disagrees (and he's a voting member next year!) and said yesterday that he favors "much more [monetary] accommodation than we've put in place." MUCH MORE than $2Tn – take that Japan and your puny $500Bn pledge!

So happy days are here again and, as we pointed out in this week's Newsletter, bad news is good news in this topsy-turvy, Wonderland economy of ours and the poor jobs numbers means more likely Fed easing which means a less valuable dollar which is….. GOOD FOR THE MARKET! Isn't Economics fun?

Ireland is having fun as Fitch downgrades the country as they are forced to go deeper into debt bailing out their banks. In other news you won't be hearing today, as the MSM is in "happy" mode this week and doesn't want to bother you with bad news: The IMF cut their estimates for US growth as consumer spending trends are disappointing and our friends at Goldman Sachs summed it up by saying the US economy is likely to be “fairly bad” or “very bad” over the next six to nine months. Yeah, let's go out and buy at the top of a 10% rally – we can root for "fairly bad."

“We see two main scenarios,” analysts led by Jan Hatzius, the New York-based chief U.S. economist at the company, wrote in an e-mail to clients. “A fairly bad one in which the economy grows at a 1 1/2 percent to 2 percent rate through the middle of next year and the unemployment rate rises moderately to 10 percent, and a very bad one in which the economy returns to an outright recession.”

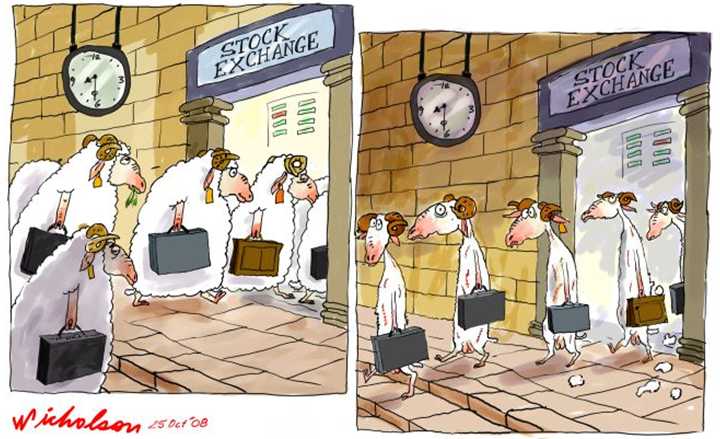

Meanwhile GS alumni Jim Cramer was telling his sheeple to BUYBUYBUY last night – leading a fresh population of lambs right to the slaughter. I tried to listen to the lightning round but it did begin to sound like the callers were just saying "baaah, baaaah, baah" to me and I felt like Jodie Foster, crying for the poor little things and wishing there was a way I could save just one of them from Cramer's advice…

The Nikkei was thrilled with the BOJs QE program and jumped another 1.8% today. The Hang Seng gained 1% and the Shanghai is closed, and was closed all week so they did not gain 1.7% as I had thought. Hong Kong property sales dropped 19% in September but that's what the Government wanted to happen – we'll just have to wait to see if they got it right or if the poked the bubble a bit too hard. Real Estate companies led the Nikkei as inflation expectations (finally) boosted that sector.

Over in Europe, the indexes are up about 0.75% just ahead of the US open and we'll do the multi-charts tomorrow to see where everybody is. UK PM David Cameron says there will be "painful public-spending cuts" and Spain is also facing terrible cutbacks but all of that is forgotten as the markets are in a relief rally as France rounds up 12 terror suspects. This is a neat, new dynamic – commodities fly up on terror threats and boost the markets and then, when the treat is over, the rest of the market rallies and commodities stay high. All they have to do is pull this nonsense once a month and we'll have $100 oil by Christmas!

So enjoy the sham while it lasts – we're bearish but we're also cashish and taking aggressive short-term upside plays to cover on the breakouts. Until this chop gives us a better sense of direction – that's the way to go!