Federal Reserve Officials: Americans Are Saving Too Much Money So We Need To Purposely Generate More Inflation To Get Them Spending Again

Courtesy of Michael Snyder at Economic Collapse

Some top Federal Reserve officials have come up with a really bizarre proposal for stimulating the U.S. economy. As unbelievable as it sounds, what they actually propose to do is to purposely raise the rate of inflation so that Americans will stop saving so much money and will start spending wildly again. The idea behind it is that if inflation rises a couple of percentage points, but consumers are only earning half a percent (or less) on their savings accounts, then there will be an incentive for consumers to spend that money as the value of it deteriorates sitting in the bank.

Some top Federal Reserve officials have come up with a really bizarre proposal for stimulating the U.S. economy. As unbelievable as it sounds, what they actually propose to do is to purposely raise the rate of inflation so that Americans will stop saving so much money and will start spending wildly again. The idea behind it is that if inflation rises a couple of percentage points, but consumers are only earning half a percent (or less) on their savings accounts, then there will be an incentive for consumers to spend that money as the value of it deteriorates sitting in the bank.

Yes, that is how bizarre things have gotten. It is not as if U.S. consumers are even saving that much money. Several decades ago, Americans typically saved between 8 and 12 percent of their incomes, but over this past decade the personal saving rate got down near zero a number of times as Americans were living far beyond their means. Once the recession hit, Americans very wisely started saving more money, and so now the personal saving rate has been hovering around the 5 to 7 percent range. This is well below historical levels, but the folks at the Fed apparently are eager for Americans to pull that money out and start spending it again.

In an article entitled "Fed Officials Mull Inflation as a Fix", Wall Street Journal columnist Sudeep Reddy described this bizarre new economic approach that some over at the Federal Reserve are now advocating….

"But as the U.S. economy struggles and flirts with the prospect of deflation, some central bank officials are publicly broaching a controversial idea: lifting inflation above the Fed’s informal target."

"But as the U.S. economy struggles and flirts with the prospect of deflation, some central bank officials are publicly broaching a controversial idea: lifting inflation above the Fed’s informal target."

Does increasing inflation as a way to stimulate the economy sound like a good idea to any of you?

These are supposed to be some of the brightest economic minds that our nation has produced.

Unfortunately, it is becoming increasingly apparent that the folks running the Federal Reserve do not have a clue about sound economic policy.

Anyone who lived through the "stagflation" days of the 1970s should know that inflation does not spur economic growth.

But now some of the most prominent Fed officials are publicly proposing that we should purposely generate more inflation so that "real interest rates" (interest rates with inflation factored in) will go down.

For example, during a recent interview the president of the Federal Reserve Bank of Chicago, Charles Evans, made the following statement….

"It seems to me if we could somehow get lower real interest rates so that the amount of excess savings that is taking place relative to investment needs is lowered, that would be one channel for stimulating the economy."

If you truly grasp what Evans is proposing here, your jaw should be dropping.

He is basically coming right out and saying, "Hey, let’s go out and crank up the inflation rate so that American consumers will start recklessly spending their money again."

So are Americans really saving too much money?

Of course not.

Just take a look at the chart below.

Americans are actually still saving far, far less than they used to. As you can see from the chart, in the 1960s and 1970s Americans would usually save somewhere between 8 to 12 percent of their incomes.

Today, we are still well below that level. But we have made some progress from the reckless days of five to ten years ago when Americans were living far, far, far beyond their means and basically saving next to nothing….

So now some top Fed officials want to undo all that. They apparently want Americans to grab their credit cards and to run out to the stores and spend wildly like they did a few years ago.

But spending recklessly is not going to repair our economy. In order to have a healthy, balanced economy you need to have a healthy personal saving rate. Encouraging Americans to spend every last nickel they have may boost economic figures in the short-term, but it will make our long-term problems even worse.

But it is not just Federal Reserve officials that are advocating this kind of nonsense. Just a few months ago, IMF chief economist Olivier Blanchard suggested that it might be a good thing if western nations doubled their inflation targets from two percent to four percent.

It seems like almost everyone is in an inflationary mood these days.

The Federal Reserve keep dropping hints that it is ready to print lots more money and unleash another huge round of quantitative easing.

Just this past week, the Bank of Japan shocked world financial marketsby cutting interest rates even closer to zero and by setting up a 5 trillion yen quantitative easing fund.

In fact, nations all over the world have become increasingly eager to devalue their national currencies in an attempt to gain an edge in international trade.

So after years of relatively low inflation, it looks like our leaders are almost eager to tangle with the inflation tiger once again.

But it might not be so easy to tame the next time.

Once a really bad inflation spiral gets going it is really hard to stop.

But in the end, it is not going to be Barack Obama or the U.S. Congress that is going to decide if we pursue these inflationary policies or not.

Ultimately, these decisions are in the hands of the unelected, unaccountable Federal Reserve.

If you don’t like it, too bad. When was the last time a U.S. president or the U.S. Congress really stood up to the Federal Reserve? It just doesn’t seem to happen.

The Federal Reserve is going to do what the Federal Reserve wants to do, and the rest of us are going to have to live with it.

Of course we could all try to elect candidates who would demand more accountability from the Federal Reserve this fall, but unfortunately those kind of candidates are few and far between.

The sad reality is that at this point, the Federal Reserve is pretty much completely and totally out of control. The U.S. dollar has already lost over 95 percent of its value since 1913, and now the Federal Reserve is giving every indication that inflation is going to get even worse in the years to come.

But flooding the system with more paper money is not going to solve anything. Instead, it is just going to make it even harder for average American families to buy milk and bread and to put gas in the car.

Inflation is a hidden tax on every single dollar that we already own. It is a destroyer of wealth and a wrecker of currencies.

But now some of the top officials at the Fed see inflation as a key tool in creating "economic growth".

With such a clueless collection of idiots running our economy (and the Federal Reserve does run our economy) do any of you actually believe that there is hope for the U.S. economic system in the long run?

****

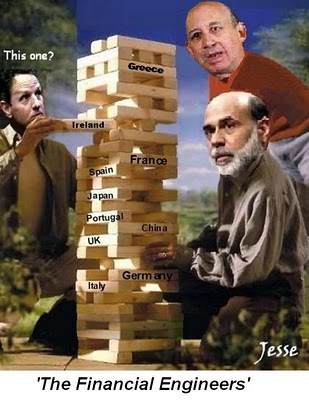

Financial engineers pic credit: JESSE’S CAFÉ AMÉRICAIN