DID WALL STREET SHAFT MAIN STREET?

Courtesy of The Pragmatic Capitalist

I am so torn on the foreclosure debate. On one side, you have homeowners who made bad bets and are now getting kicked out of their homes and onto the streets – that’s a horrible thing no matter how you cut it. On the other side you have the big banks who also made bad bets, but arguably made these bets in good faith. They were essentially building models based on the fact that US housing prices never go down – totally irrational in retrospect of course, but at the time this did not seem so crazy to most people (aside from yours truly who advised his parents not to purchase several houses in 2006 and was ignored).

The homeowners obviously made a bad bet, but I find it hard to believe that the banks were intentionally trying to fleece the American public. After all, if they had known that 2008 would occur they never would have sold all that bad paper to one another. It was more a case of greed run amok. The fees and income generated from this business were too easy, too consistent and too abundant for any greed loving banker to ignore. Likewise, the homeowner wanted to profit from rising home prices and did little due diligence on the most important purchase of their life. The banks were equally ignorant in that they clearly did not do their due diligence either (some of the banks hedged their exposure which seems like a prudent thing to do after the fact. Whether that was legal or not is not for me to decide….)

At the end of the day it seems like a lot of people made bad bets and now they all want a government handout. And the government appears to be willing to give it to them. In other words, it’s more capitalism without losers. And now that the bankers got their bailout Main Street feels entitled to one as well (and rightfully so). I know it’s probably a harsh thing to say, but when you make a bad bet you have to face the consequences of that bad bet. One of the reasons I believe the US economy is such a mess right now is because we’ve attempted to create a marketplace where no one ever loses. It’s a ponzi approach to economics. It doesn’t work.

In the following video Josh Rosner, who foresaw the housing crisis, explains how the whole mortgage fiasco went down and explains why he believes the

Source: CNN

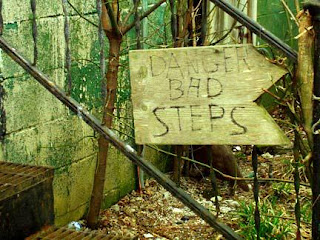

Photo credit: Jr. Deputy Accountant